My end of week morning train WFH reads:

• When Everything Is a Growth Stock And All Money Is Venture Funds. What do you get a credit market that has everything? How about billions of dollars of loans at ultra-low interest rates to companies with no income? Having spent years chasing shrinking returns in the booming institutional loan market, yield-hungry lenders are taking a leaf out of the venture capitalist playbook and extending cash to companies that aren’t yet profitable but which might be expected to become so in the future (Bloomberg)

• The Scramble for EV Battery Metals Is Just Beginning Global miners have an opportunity to sell ESG-friendly natural resources to the automotive and energy industries, but it will require investment (Wall Street Journal) see also Could Roads Recharge Electric Cars? The Technology May Be Close. Magnetizable concrete technology — developed by the German company Magment — is enabling wireless charging of electric vehicles as they drive. (New York Times)

• New People Are Coming to Crypto — And They May Not Like Bitcoin. Specifically often associated with right-wing, anti-Fed, gold-bug types, and the fact that Bitcoin uses a lot of electricity to secure the network has helped cement the perception of “crypto” as a kind of antithesis of popular, liberal, ESG-ish ideals. But things are changing on that front, and mainstream commenters who previously turned up their noses at the space are capitulating. (Bloomberg)

• Alternative Assets Hit $9 Trillion This Year. Here’s What Investors Should Be Worried About. As capital continues to flood into the industry, Moody’s raises concerns about leverage and illiquidity. (Institutional Investor)

• Patrick & John Collison, the Irish Brothers Embraced by Silicon Valley: With internet sales soaring and interest rates low during the pandemic, Stripe raised $600 million in March, giving it a market value of $95 billion and making it the most valuable Silicon Valley startup of all time. (Businessweek)

• Top Bosses at Goldman Are Finding New, Creative Ways to Juice Their Own Pay The notion that top bankers reeling in more than $20 million a year are underpaid is yet another exclamation point on this era of turbocharged wealth. At a time when Elon Musk is worth $300 billion — and each day seems to bring news of another fortune in technology, crypto and private equity — the old yardsticks of success are being tossed out. (Bloomberg)

• How Morale at Facebook Tumbled After Trump’s “Looting and Shooting” Post After optimism in the company peaked at 82% in mid-May 2020, it plummeted in early June to about 60% and further sank throughout July. It dropped sharply after November, hitting 50% in December—just before the Jan. 6 Capitol insurrection, which, as the Washington Post reported as part of its own examination of the Facebook Papers, the platform played no small part in fomenting. (Slate)

• Winter is coming. But with these tips, you don’t have to fear it. Like with many difficult things, the first step is acceptance: Accept winter for what it is — colder and darker. Many of us try to pretend nothing has changed when daylight ends earlier. We stick to the same schedules and feel annoyed when we’re more tired, despite how daylight influences our circadian rhythms and sleep patterns. Recognize and accept the darkness. (Washington Post)

• What I learned eating at 8,000 Chinese restaurants Many people in America love Chinese food, but David R Chan, a 72-year-old former tax lawyer based in Los Angeles, dined at nearly 8,000 Chinese restaurants across the US (and counting). Over the years it has become itself a chronicle of the rise of Chinese food and changing dynamics of Chinese culture in America. (BBC)

• How Steph Curry Is the New Roger Federer The basketball great is the most popular player in every arena he’s in, even allegedly hostile ones (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with John Doerr of Kleiner Perkins. Doerrr has backed some of the most successful tech start-ups, including Compaq, Netscape, Symantec, Sun Microsystems, Amazon.com, Intuit, Macromedia, and Google. He is also the author of the best-selling Measure What Matters; his latest book is Speed & Scale: An Action Plan for Solving Our Climate Crisis Now.

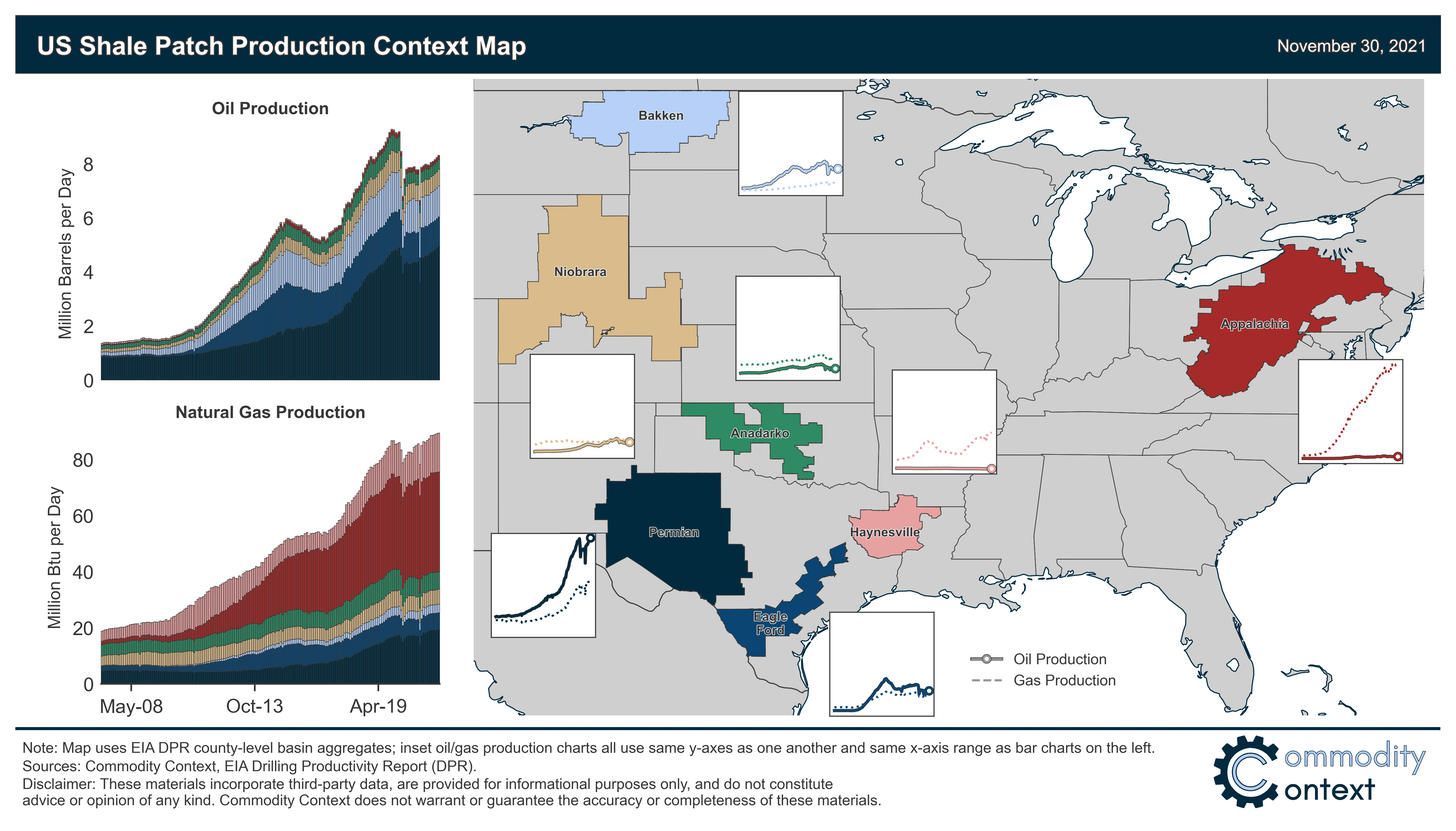

US Shale Patch’s Lackluster Recovery is a Problem for the Post-COVID Oil Market

Source: Commodity Context

Sign up for our reads-only mailing list here.