My morning train WFH reads:

• Fattest Profits Since 1950 Debunk Wage-Inflation Story of CEOs. In the second year of a pandemic that began by wiping out 20 million jobs, American workers are doing surprisingly well. It’s just that American business is doing even better. In the past two quarters, U.S. corporations outside of the finance industry posted their fattest margins since 1950 — one reason why stock markets keep hitting all-time highs. (Bloomberg)

• The Other Side of a Mania On the other side of every mania lies the reality of the weighing machine. It was always there, lurking in the background, but in the midst of a parabolic, sentiment-driven advance, nothing could seem more irrelevant. Over the past year we’ve seen this story play out in one mania after another. And as long as human beings and their emotions are involved in markets, we’ll see plenty more in the years to come. (Compound Advisors)

• Old Trucks for New Money The hunger for beautiful old trucks is a national phenomenon. Prices for vintage trucks rose more than fifty per cent in the past four years, twenty per cent more than the vintage-vehicle market as a whole, according to data from the collectible-car-insurance company Hagerty. The trend was evident well before the current microchip shortage sent used car prices through the roof. (New Yorker)

• US Shale Patch’s Lackluster Recovery is a Problem for the Post-COVID Oil Market: US tight oil production has materially underperformed the price recovery and that’s worrying for the period after OPEC+ has completed its scheduled COVID-era cut easing (Commodity Context)

• What Uber’s Spies Really Did A former co-worker accused the men of wiretapping their colleagues, hacking foreign governments and stealing trade secrets. It wasn’t true, but the allegations still follow them. (New York Times)

• Twitter Has a New CEO; What About a New Business Model? What makes Twitter such a baffling company to analyze is that the company’s cultural impact so dramatically outweighs its financial results; last quarter Twitter’s $1.3 billion in revenue amounted to 4.4% of Facebook’s $29.0 billion, and yet you can make the case — and I believe it — that Twitter’s overall impact on the world is just as big, if not larger than its drastically larger peer. (Stratechery)

• What’s the Deal With the Corner of Instagram Where Fake Celebrity Accounts Offer Up Motivational Quotes? A number of bizarre accounts have popped up that target wannabe hustlers with pithy, misattributed advice. Is there any making sense of it? (Inside Hook)

• The pros and cons of sleeping with pets Research shows that animals can improve our mental health; for example, studies suggest that human-animal interactions lessen depression while lowering levels of the stress hormone cortisol. But there can be issues… (Washington Post)

• Republicans are quietly rigging election maps to ensure permanent rule The past decade in Ohio shows how bad it can get – and how quickly. Despite the state’s voters often swinging Democratic, 75% of its congressional delegates are Republican (The Guardian)

• Britney Spears, the Newly Liberated Princess of Pop: In November, five months after a June hearing at which Spears said she felt like a prisoner in the court-ordered conservatorship her father oversaw for almost 14 years, a judge dissolved it. (Businessweek)

Be sure to check out our Masters in Business interview this weekend with John Doerr of Kleiner Perkins. Doerrr has backed some of the most successful tech start-ups, including Compaq, Netscape, Symantec, Sun Microsystems, Amazon.com, Intuit, Macromedia, and Google. He is also the author of the best-selling Measure What Matters; his latest book is Speed & Scale: An Action Plan for Solving Our Climate Crisis Now.

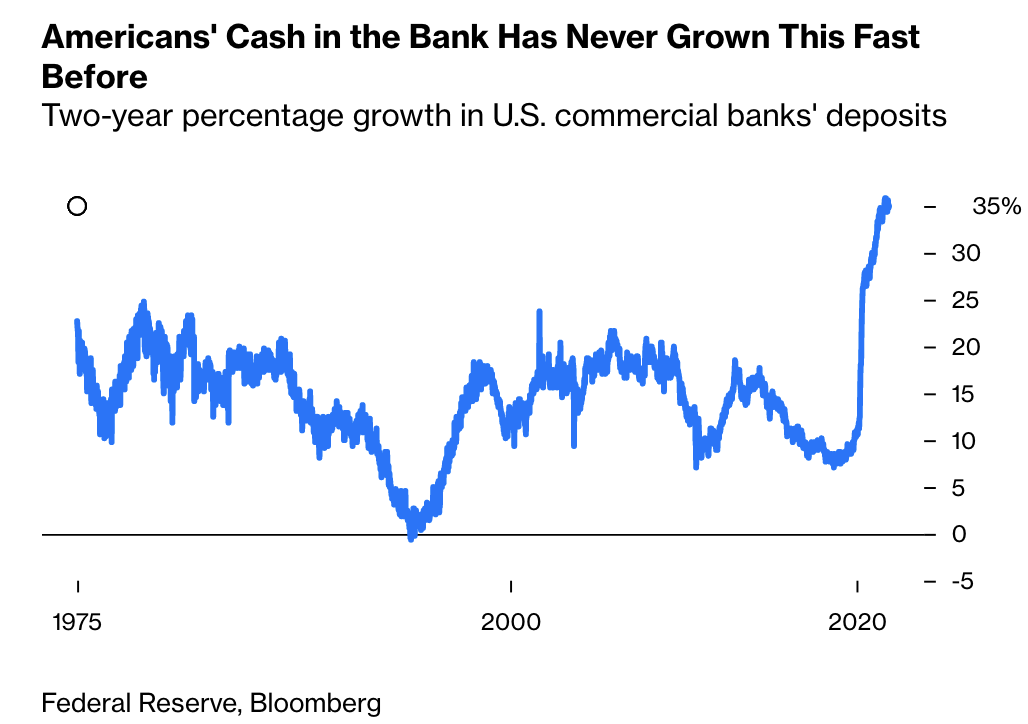

2-year increases in bank savings

Source: Bloomberg

Sign up for our reads-only mailing list here.