My morning train WFH reads:

• The Bloomberg 50: The People Who Changed Global Business in 2021 Our annual look at those in business, entertainment, finance, politics, and science and technology whose accomplishments deserve recognition. Did we put the Popeyes Chicken Sandwich on the list in 2019? Yes, and we stand by it. Our 2021 version is less tasty, perhaps, but no less culturally significant: Behold, the meme stock. (Businessweek)

• This Bull Market Hasn’t Always Been Easy Every new generation of investors has to learn the same lessons as the previous generation. But experience alone isn’t always enough to make you a successful investor. Experienced investors panic all the time. Who do you think holds all of the money that actually moves the markets? They also miss big trends, hold onto legacy positions for too long, become overconfident in their assertions and can’t see how the world is changing around them. (A Wealth of Common Sense)

• Everyone Is Talking About Data Science. Here’s How J.P. Morgan Is Putting It Into Practice. J.P. Morgan Asset Management is building machine learning and predictive analytics tools for its fundamental portfolio managers. Just don’t call them quants. (Institutional Investor)

• This Inflation Defies the Old Models It’s becoming clear that neither demand nor supply by itself is to blame. Rather, this inflation was made possible only by strong demand interacting with restricted supply. The U.S. hasn’t seen anything like this combination except, perhaps, in the aftermath of World War II, when pent up demand coincided with war-induced shortages. (Wall Street Journal)

• Without Dorsey, Can Twitter Finally Flourish? There was only one little idea that there was Jack’s. But today, you look at it, and even in his resignation letter, he is the “inventor.” One of the greatest quotes I ever heard about him was someone said, “The greatest product that Jack Dorsey ever made was Jack Dorsey.” (Slate)

• BuzzFeed’s a public company. Now what? “The fate of BuzzFeed is going to determine the fortunes of a lot of other companies.” (Recode)

• The Dark Side of 15-Minute Grocery Delivery: Mini-warehouses dubbed “dark stores” are quietly taking over urban retail space. Left unregulated, the insatiable demand for faster delivery will only hasten the erosion of community life. (Bloomberg)

• Can Apple Take Down the World’s Most Notorious Spyware Company? Pegasus was used to target Al Arab editor Abdulaziz Alkami eight years ago. The same spyware was also employed to surveil Emirati human rights advocate Ahmed Mansoor and Saudi-American dissident Jamal Khashoggi. On Friday reports even emerged that at least nine State Department officials working on East Africa-related issues were hacked using Pegasus over the past few months, representing the widest known hacks of American officials using NSO technology to date. (Slate)

• Want to help animals? Here’s where to donate your money. If you care about animals and want to reduce their suffering, but aren’t sure exactly how, Animal Charity Evaluators (ACE) is an organization that might be able to help. The California-based nonprofit puts out an annual guide for recommended animal charities, and it just released its list for this year. (Vox)

• The story of the Beatles rooftop concert at the heart of ‘Get Back’ The rooftop show and the associated “Let It Be” album are at the heart of Peter Jackson’s three-part documentary series “Get Back,” which has earned a strong critical reception and catapulted the album into the UK Top 40, more than a half century after its release.(Washington Post)

Be sure to check out our Masters in Business interview this weekend with Maureen Farrell, former Wall Street Journal reporter (now with the New York Times), and co-author (with Elliot Brown) of the book “The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion.”

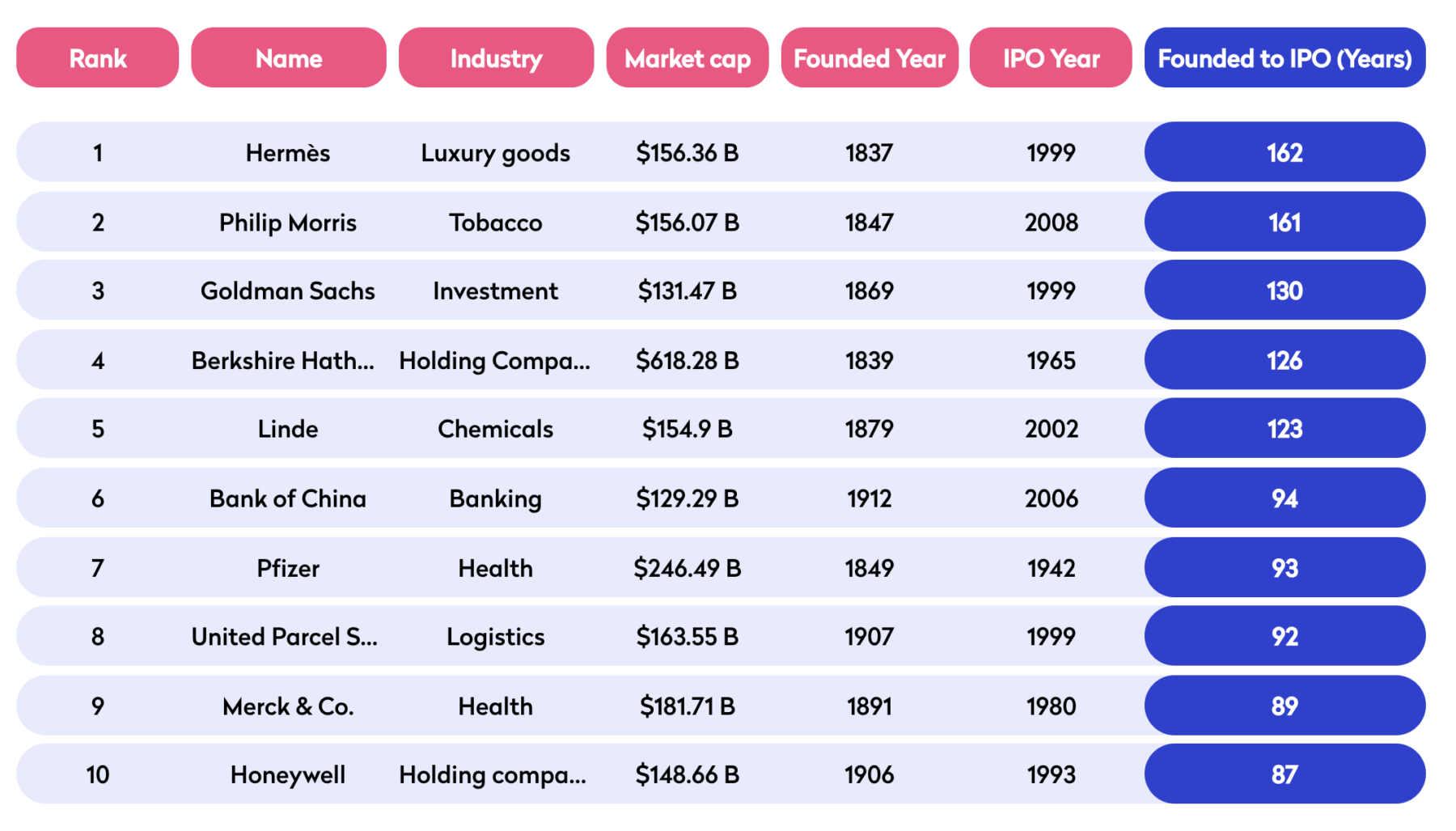

Companies with the longest time period from founding to IPO

Source: Tide

Sign up for our reads-only mailing list here.