My Two-for-Tuesday morning train WFH reads:

• Will Outdoor Terraces and Chefs Lure You Back to the Office? These Buildings Hope So. Developers and big tenants in the largest cities are betting that expensive property perks will convince reluctant employees to work under the same roof again (Wall Street Journal) see also Future of Work: Requiring workers to return to the office is a ‘doomed approach’ Slack’s CEO Stewart Butterfield says the future of work is being dictated by workers who want more flexibility and better tech tools. (Washington Post)

• Bond Traders Stare at Worst Real Returns Since Volcker Era Treasury returns trail CPI by most since the early 1980s; Negative real yields help government at expense of savers. (Bloomberg)

• Can We Trust What’s Happening to Money? All over the world, people are abandoning old forms of money and adopting new ones, like cryptocurrency, faster than our brains and customs can process. “We are at an interesting juncture.” (New York Times) see also SEC case against Ripple Labs for XRP crypto sale a ‘Bit’ of a double standard This is where things get nonsensical on the part of the SEC. The commission is now arguing that whatever Hinman said, his speech meant nothing. It’s simply his opinion, nothing more. In court, the SEC is telling the crypto world it really hasn’t made an official ruling whether Bitcoin or Ethereum’s Ether comport with securities laws. (New York Post)

• How Fear of Disruption, ‘Free Money,’ and the Lure of Alts Profits Drove Record M&A: Alternatives firms are outperforming their traditional peers, giving them more resources to reinvest in their businesses and spend on growth. (Institutional Investor)

• The Urgency There’s been an increase in urgency in the wealth management business. A noticeable pickup in estate planning and an acceleration in people’s desire to spend now, enjoy now, give gifts now. Why wait? Stock market returns have been supportive of this activity. (TRB) see also Purposeless Capital There are many lessons to be learned from the debacle that has befallen Bill Hwang and Archegos Capital Management, but at its most basic, there is this simple question: What purpose does your capital serve? (TBP)

• Larry Summers Was Only Half-Right About Inflation: The economist is being treated like the prophet of the Biden economy. Not so fast. (Slate)

• First U.S. vaccine mandate in 1809 launched 200 years of court battles “It doesn’t seem to have triggered widespread opposition at the time. People were terrified of smallpox, and people’s own experience with vaccination reassured them. When smallpox outbreaks struck their area, people could see that those in their community who had been vaccinated didn’t get sick.” (Washington Post) see also Ben Franklin’s bitter regret that he didn’t immunize his 4-year-old son against smallpox Five weeks had passed since the death of Benjamin Franklin’s son, and rumors were swirling. Four-year-old Francis “Franky” Franklin had died after being inoculated for smallpox, the rumor went, and now his pro-inoculation father was trying to hide it. “I do hereby sincerely declare, that he was not inoculated, but receiv’d the Distemper in the common Way of Infection.” (Washington Post)

• The Scramble for EV Battery Metals Is Just Beginning Global miners have an opportunity to sell ESG-friendly natural resources to the automotive and energy industries, but it will require investment (Wall Street Journal)

• Trump’s White House Emailed About a PowerPoint on How to End American Democracy: Former Trump chief of staff Mark Meadows handed over a trove of pre-Jan. 6 documentation. It’s damning stuff (Rolling Stone) see also Meadows Was Deeply Involved in Fighting Election Outcome, Jan. 6 Panel Says The House committee laid out its case for a contempt of Congress charge against Mark Meadows, the chief of staff to former President Donald J. Trump. (New York Times)

• Meet the real NASA scientist behind Netflix’s Don’t Look Up. All in a day’s work: discovering comets, saving the planet, and smashing the patriarchy (The Verge)

Be sure to check out our Masters in Business interview this weekend with Maureen Farrell, former Wall Street Journal reporter (now with the New York Times), and co-author (with Elliot Brown) of the book “The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion.”

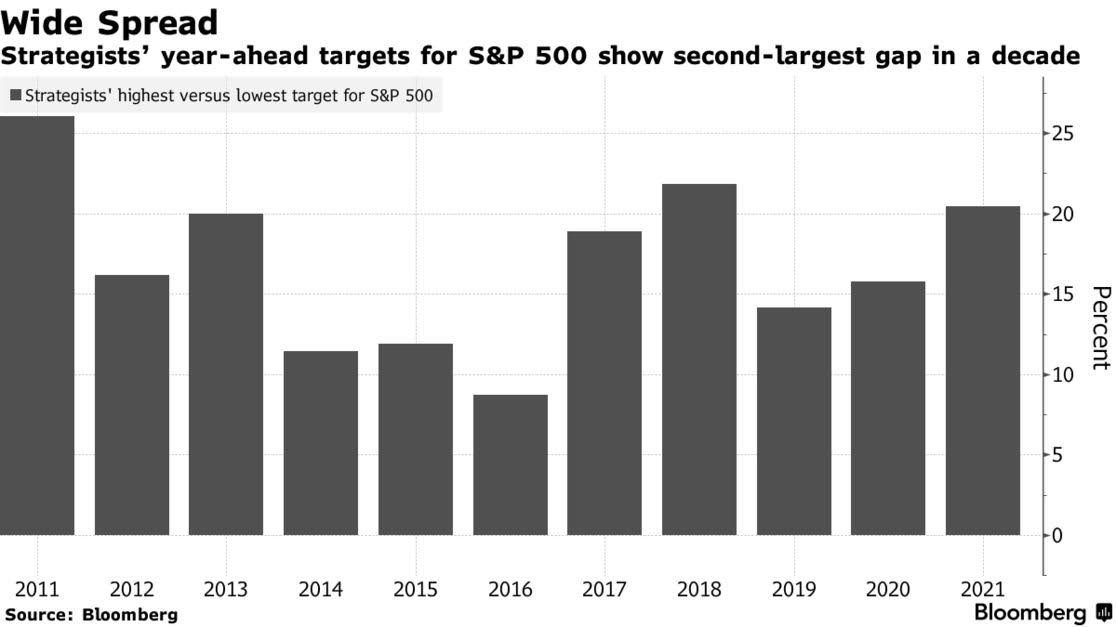

Wall Street Strategist Forecasts for 2022 Differ by Second-Most in a Decade

Source: Bloomberg