To hear an audio spoken word version of this post, click here.

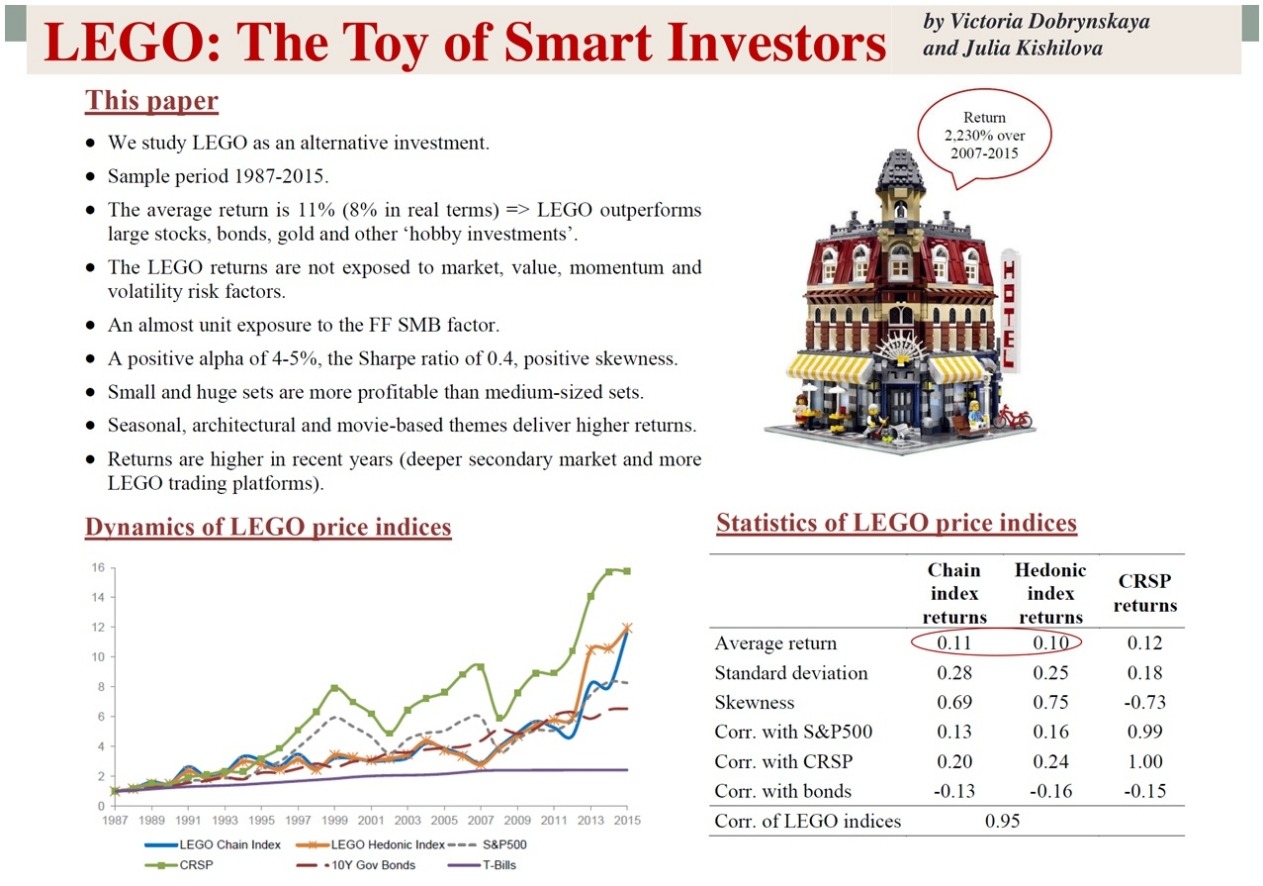

“Study: Toys Prove to Be Better Investment Than Gold, Art, and Financial Securities”

Now do Beanie Babies . . . https://t.co/LQI4F3t5MY

— Barry Ritholtz (@ritholtz) December 13, 2021

“Forget About Gold: Study Says Investing in Lego Sets Will Earn You More Money” . . . Over the years, I have been critical of the gold bug’s blind faith in their favorite shiny yellow metal. I was an early adopter of the Gold ETF (GLD) when Gold’s spot price was about $400 (I sold at 1300 and 1700); I have been mostly skeptical of Gold as a core portfolio holding ever since.

But I have to rise to the defense of Gold in this comparison with Legos as an obvious case of Survivorship bias. Nothing is easier than telling you what has already performed well, but without a time machine, we do not get to invest that way. The after the fact review tells us what has already done well, not what is going to do well. The trick in investing is the ability to do that before the asset runs up in price (Duh!).

This sort of thing is catnip to media outlets: I first came across this in The Guardian, but it spread from there (Gizmodo, The Hill among others). “Investing in Lego more lucrative than gold, study suggests” is at least a bit circumspect, as opposed to the more conclusive nonsense from HSE University regarding the research paper two of their economists published: “Toys Prove to Be Better Investment Than Gold, Art, and Financial Securities.”

The survivorship bias crew has the unfortuante tendency is to over-emphasize big winners while simultaneously excluding big losers. In the investment world, this was first documented with active Mutual funds companies who loved to tout the average returns for their family of funds; somehow, those data tables omitted the funds that had closed primarily because of weak performance.

Why does this matter? Vanguard and DFA (both index shops) found that on average, half of all mutual funds had closed within 15 years. The surviving winners look oh so much better when you back out the long-term returns of the bottom half of all funds, especially when the reason they closed was due to their weak investing results.

But it’s not just toys; we see this with collectible cars, art, and wine, to say nothing of alternatives such as Private Equity, Hedge Funds, and Venture Capital. We all know the names of the biggest winners but we fail to recall those that went down in ignominious defeat.

~~~

Thank you, HSE, for telling us after the fact who won the race, and doing so in a way that confuses investors with innumeracy and bias. This is no way to run a University . . .

Previously:

The Hidden World of Failure (October 23, 2020)

Survivorship Bias (& Compounding) in The Art World (May 22, 2019)

Survivorship Bias on Wheels (August 14, 2018)

Sources:

LEGO: THE TOY OF SMART INVESTORS

Victoria Dobrynskaya, Julia Kishilova

Research in International Business and Finance Volume 59, January 2022

https://doi.org/10.1016/j.ribaf.2021.101539

Investing in Lego more lucrative than gold, study suggests

Mark Sweney

The Guardian, 10 Dec 2021

Toys Prove to Be Better Investment Than Gold, Art, and Financial Securities

HSE University, Dec 3, 2021

https://www.hse.ru/en/news/research/536477053.html

click for audio