My mid-week morning train reads:

• The Mutual Fund That Ate Wall Street—Based on an Index Few People Know About Vanguard’s Total Stock Market Fund, at $1.3 trillion in assets, is a market unto itself—powered by an unassuming index called CRSP (Wall Street Journal)

• Is the Correction Over? Was that it? It feels ridiculous to ask, given that at the lows of last week, the peak-to-trough decline in the S&P 500 was just 5.2%. It feels ridiculous to ask, given that at the lows of last week, the market was still up 21% YTD. But it is a reasonable question, given that stocks have aggressively bounced, with S&P 500 futures currently sitting less than 2% below all-time highs. (Irrelevant Investor)

• Let’s get real: the American Rescue Plan was the best economic policy in forty years Nearly a year and a half into the recovery from the Covid recession, it’s indisputable that fiscal relief was a success. Not so, after the Great Financial Crisis — it fell far short. Blame Larry Summers. (Stay-At-Home Macro)

• Cities Where the Most Homes Are Selling Above Asking Price While the red-hot real estate market has shown some recent signs of cooling in the transition to the traditionally slower fall and winter seasons, the market remains highly competitive for homebuyers. (Porch)

• Branding the Billion-Dollar Dark Stores Instant grocery delivery is a sector on steroids. But how can brands stand out in a super-saturated market? (Bloomberg)

• The Amazon Empire Strikes Back: Amazon is one of the best ways to get your goods to customers. The key thing is that this capacity is not due to last minute ship charters or airplane leases, but rather investments and initiatives Amazon undertook years ago. (Stratechery)

• One of the Most Unusual Cybersecurity Stories of the Year Is Getting More Complicated The FBI announced in June that it had created its own company, called ANOM, to sell devices with a pre-installed encrypted messaging app to criminals. The ANOM app was marketed as providing end-to-end encrypted messaging, comparable to the security protections offered by services like Signal, WhatsApp, and iMessage, but in fact the messages could be intercepted by law enforcement, which had designed the app for precisely that purpose. (Slate)

• The 43rd Lesson Karma is a very just law which, like the law of gravity, treats everyone the same. The law of karma puts a person at the centre of responsibility for everything he or she does and everything that is done to him or her. And like the Brihadaranyaka Upanishad sums up so beautifully, it all starts with our desires and ends with our actions, which come back to us, sometimes instantly but often with a time lag. (Safal Niveshak)

• Why insects are more sensitive than they seem: For decades, the idea that insects have feelings was considered a heretical joke – but as the evidence piles up, scientists are rapidly reconsidering. (BBC)

• ‘I spontaneously burst into tears’: How 13 songwriters felt watching the new Beatles documentary We spoke to more than a dozen songwriters about their reactions to the series about the iconic quartet, the viral moment when McCartney writes the backbone of “Get Back” in minutes, and the sometimes smooth, sometimes arduous process of how to craft a song in the first place. Here’s what they had to say. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with John Doerr of Kleiner Perkins. Doerrr has backed some of the most successful tech start-ups, including Compaq, Netscape, Symantec, Sun Microsystems, Amazon.com, Intuit, Macromedia, and Google. He is also the author of the best-selling Measure What Matters; his latest book is Speed & Scale: An Action Plan for Solving Our Climate Crisis Now.

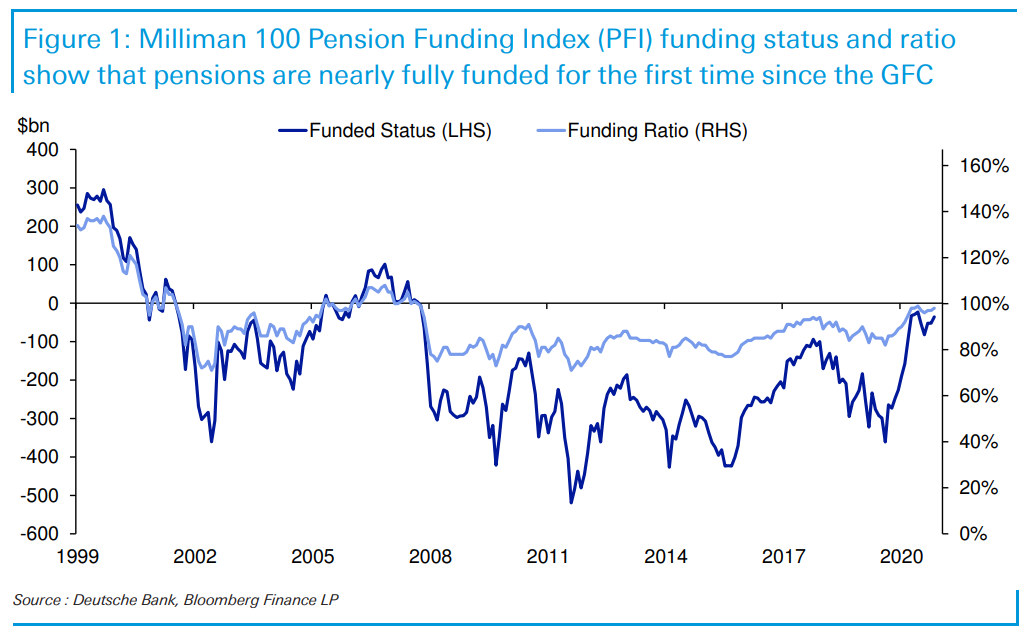

US pension funds went from 72% funded in 2012 to ~100% today. Credit annual return of 16.5%

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.