Good news! The days are already getting longer! Kick off the next 6 months of more sunlight with our mid-week morning train WFH reads:

• How to Navigate the New Pandemic Business Cycle The pandemic has shaken up the very foundation of macroeconomic theory—the business cycle. And that could have big consequences for investors. If we are in fact in a new expansion cycle, investors can rest easy knowing that it will likely continue for at least another few years. CIO Sean Bill says, ‘It’s going to get a lot trickier.’ (CIO)

• The Pandemic Has Made Everyone Richer The net worth of American households has gone from $110 trillion to $137 trillion since the pandemic disrupted our lives in the first quarter of 2020. That’s from new Federal Reserve data through the end of the third quarter 2021, which was released last week: This may surprise you — the bottom 50% have also seen their wealth soar: (A Wealth of Common Sense)

• How the 2020s Economy Could Resemble the 1980s It depends on whether Jerome Powell at the Fed can pull a reverse Paul Volcker. (Upshot)

• Bitcoin’s ‘One Percent’ Controls Lion’s Share of the Cryptocurrency’s Wealth New research shows that just 0.01% of bitcoin holders controls 27% of the currency in circulation (Wall Street Journal)

• A Quant Investor Uses A.I. to Track Down Corporate Greenwashing By analyzing how executives talk about their sustainability efforts, Acadian’s Andy Moniz hopes to figure out who’s full of hot air. (Businessweek)

• Delivery Failed: How an EV startup and its charismatic CEO nearly cornered the market for electric delivery vans — until it all fell apart (The Verge)

• The internet runs on free open-source software. Who pays to fix it? Volunteer-run projects like Log4J keep the internet running. The result is unsustainable burnout, and a national security risk when they go wrong. (MIT Technology Review)

• Scientists Create ‘Living Machines’ With Algorithms, Frog Cells Darpa-funded research is focused on “biobots” with potential environmental and health applications. (Businessweek)

• Highly vaccinated countries thought they were over the worst. Denmark says the pandemic’s toughest month is just beginning. Omicron positives are doubling nearly every two days. The country is setting one daily case record after another. The lab analyzing positive tests recently added an overnight shift just to keep up. And scientists say the surge is just beginning. (Washington Post) see also How omicron broke Covid-19 testing Rapid tests are sold out everywhere, and help might not come until next year. (Vox)

• Best of 2021: Top 50 Photographs From Around the World As the end of yet another year amidst a pandemic (that just won’t go away) quickly approaches, we’re all inclined to take pause and reflect on all that’s passed—good and bad. Many photographers, who had previously lost a lot of work due to travel restrictions and social distancing mandates, found new ways to document the world and continue to capture striking images. Despite the questionable state of the world in 2021, they have managed to photograph beauty, despair, and everything in between to great effect. (My Modern Met)

Be sure to check out our Masters in Business interview this weekend with Michael Mauboussin, who runs consilient research at Morgan Stanley’s buyside firm, Counterpoint Global. Mauboussin (and his co-author, Alfred Rappaport ) revise and update their book Expectations Investing: Reading Stock Prices for Better Returns.

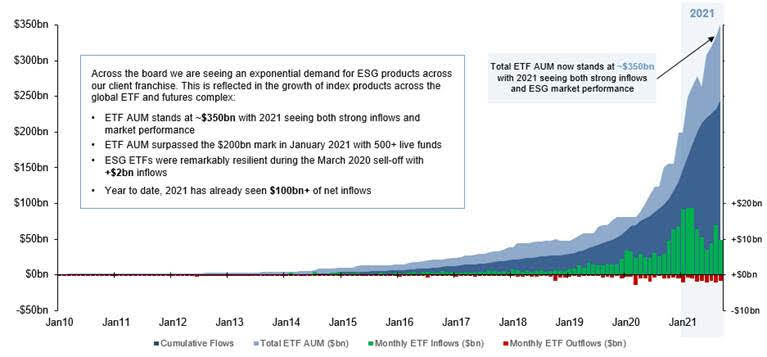

Total AUM across ETFs tracking ESG Indices

Source: Goldman Sachs Global Markets

Sign up for our reads-only mailing list here.