My mid-week morning train WFH reads:

• What Amazon’s Rise to No. 1 Says About the Stock Market The biggest companies are still the most dominant. The biggest companies today make up less of the overall market than those in the past. And the biggest companies can still be toppled. (Wall Street Journal)

• After Another Great Year for Stocks, Peril Lingers Inflation and the coronavirus did not hold back the stock market last year, but in 2022, investors face new worries. (New York Times) see also Bond and Stock Markets Agree: Interest Rates Are Going Up, Just Not Much Stocks continued their 2022 retreat as the Federal Reserve is widely seen as backing away from its ultra-accommodative monetary policy, after belatedly acknowledging the inflation long apparent to everyone else. (Barron’s)

• The Market is Tightening Cheap money impacts the winners, both individuals, and corporations. It’s hard to say with certainty that low borrowing rates have contributed to stock market inequality, but maybe there’s something there. (Irrelevant Investor)

• Here Today, Gone Tomorrow? Three CIOs Sound Off on Inflation CIO spoke to three chief investment officers about their strategies regarding inflation, each with a different take on how to best protect their assets. We also spoke to an academic economist with a background in Wall Street forecasting and a quantitative analyst at AlphaSimplex to try and paint a best guess of what will happen next. Not everyone is ready to shift their strategies just yet. (CIO)

• China’s looming property crisis threatens economic stability A growing number of Chinese property developers are facing financial strain, while property sales and home prices in China are falling sharply. The Chinese government, worried that an engine of growth is losing steam, is struggling to keep the property sector afloat. Evergrande is a leading indication that China’s model of property-led growth is unsustainable and needs to change. (Peterson Institute for International Economics)

• Microsoft is buying one of the biggest names in games — if Washington lets it Microsoft-Activision is like Disney-Fox. Maybe bigger. (Vox)

• Crypto Enthusiasts Meet Their Match: Angry Gamers Game publishers are offering NFTs, but skeptical gamers smell a moneymaking scheme and are fighting back. (New York Times)

• Why Making Friends in Midlife Is So Hard: I thought I was done dating. But after moving across the country, I had to start again—this time, in search of platonic love. (The Atlantic)

• ‘It’s a tough time’: why is Biden one of the most unpopular US presidents? Puzzle of Biden’s unpopularity has some pieces within his control and some not, experts say, as Covid casts a shadow over his first year in office. (The Guardian)

• Wordle founder Josh Wardle on going viral and what comes next People have an appetite for things that transparently don’t want anything from you. (TechCrunch)

Be sure to check out our Masters in Business interview this weekend with Jim McKelvey, co-founder of Square (with Jack Dorsey), and currently CEO of Invisibly, empowering people to manage the future of their personal data.

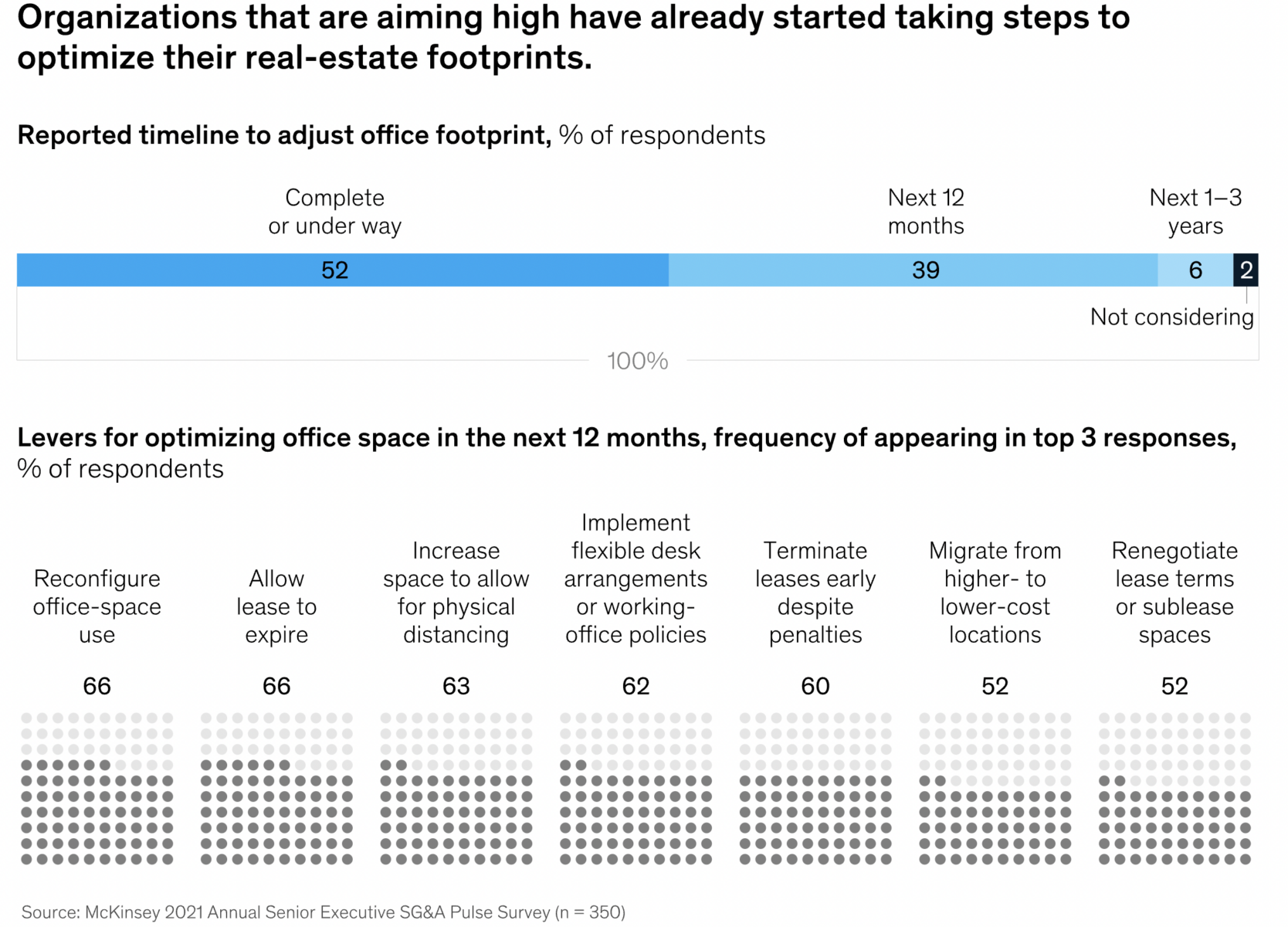

What is Happening with Office Space?

Source: McKinsey

Sign up for our reads-only mailing list here.