To hear an audio spoken word version of this post, click here.

Every discussion I hear about inflation reminds me of the parable of the six blind men and the elephant.1 Having never encountered such a creature before, the sightless men learn about the pachyderm only by touching it: One man feels the trunk, another the tail, the tusks, ears, legs, and sides. They argue over what the beast is, each describing it differently, each mans’ understanding incomplete, limited by his narrow, personal experience.

It feels like the debate over Inflation is a similar experience: One’s analysis and expectations about inflation can be too narrow, highly dependent upon the aspect of CPI data you choose to focus upon, the priors you bring to those observations, and (therefore) what it is you see in various prices.2

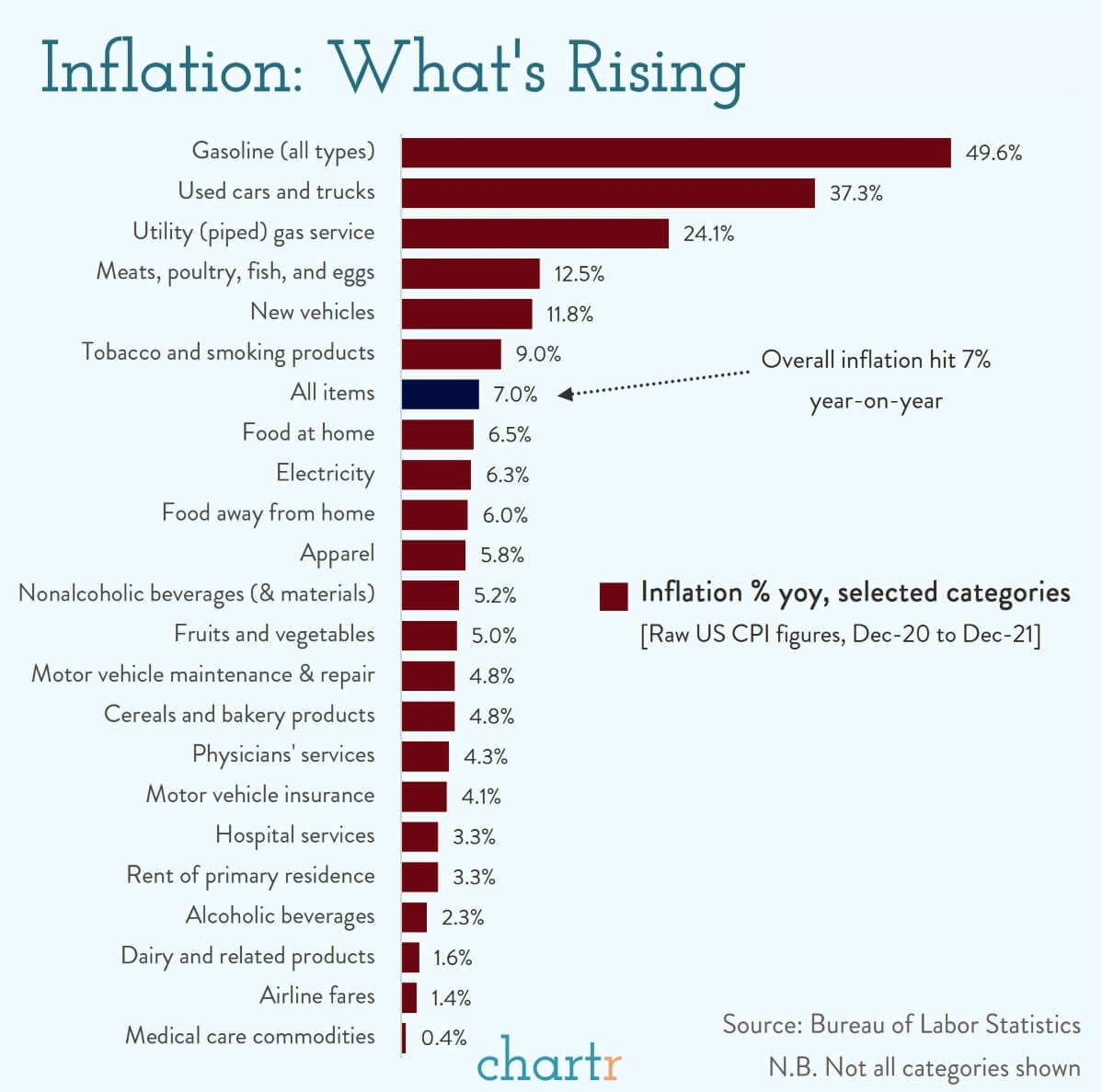

This matters a great deal: Inflation is less than the simple binary question: Is the CPI rising or not? Rather, there are many factors driving the components that make up the Consumer Price Index. When we closely analyze these, we find a broad dispersion across various consumer goods and services. The nature of these inputs will determine how much inflation there is, how long-lasting it might be, and what can be done to combat it.

Consider four components that go into CPI, plus two additional factors impacting consumption, and you get a sense of the complexities involved:

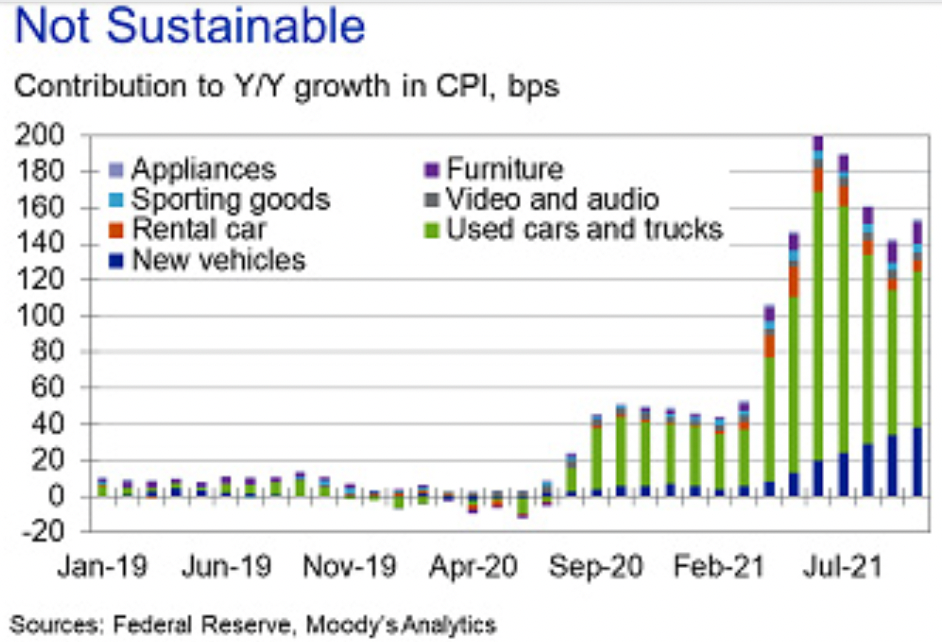

Automobiles: The constraints of reopening chip fabs to produce semiconductors is a long slow process – estimates are for as long as 24-36 months. Which means we might only be halfway to a third of the way to a sufficient supply of chips for new car productions to ramp up.

The shortage of new cars has led to a surge of used car prices — and there are only so many used cars out there. This has had a substantial – and disproportionate – impact on prices (see chart). Without the spike in car prices, that 7% consumer price increase would have been about a third less, closer to 5.5% had car prices been stable.

Housing: The lack of supply of new single-family homes has been over a decade in the making; existing-home sales seems to have been impacted by the pandemic lockdowns from apartments to houses. Housing expert Jonathan Miller of Miller Samuel notes that “sales volume exploded as the pandemic lockdowns ended.” 3 This was especially true among the upper half of homes, where salaries had risen and net worth rose. As more supply comes online, and mortgage rates rise, we should see price increases moderate.

Wages: There are so many crosscurrents in the labor market, but for inflation purposes, I want to draw your attention to three: Minimum wage workers, High-skill workers, and Demographics.

Minimum wage workers, relative to most other metrics, have been underpaid for decades. The pandemic gave them two things – CARES act cash, which afforded an opportunity to improve their skills, and negotiating power. It is obvious (to me at least) that rising minimum wages is a belated generational reset.

Demographics are partly to blame: Decreased immigration, new business launches, a lack of childcare, covid deaths, early retirement have dramatically reduced the number of people in the Labor Force.

High-skill workers have always been in high demand, but the pandemic turned local labor markets like New York, San Francisco, Boston, etc., into national ones. There has been lots of disruption as the market adjusts, but valuable employees have figured out they can earn a substantial raise by switching employers. The great resignation at least among this group, is more like a huge job exchange.

Energy: There is a duality among energy sources: On the one hand, oil and natural gas prices have risen so much that electricity producers are consuming more coal (!) than they have in years. On the other hand, gasoline prices have been flat for 13 years, and are only back to where they were in 2015. Of all the inputs we are discussing into rising prices,

Energy seems to have the fastest ability to respond to rising demand with more supply. As every commodity trader knows, the cure for high prices is high prices.

Goods versus Services: We discussed in November how the balance of Goods (38.7%) versus Services (61.3%) was altered by the pandemic. CPI Goods are up over 8%, while CPI Services have recovered back to where they were pre covid — at about ~3% price increases. That will eventually revert to pre-pandemic levels. The move towards goods and away from services may be temporary, but it is still inflationary.

Logistics: Rebecca Patterson, Bridgewater Associates’ Director of Investment Research, observes that the “biggest monetary stimulus outside of wartime” plus a massive fiscal stimulus has led to a “Demand Shock” driving inflation. Globally, the production of goods is now 5% over 2019 pre-pandemic levels, but Patterson notes that demand has risen 20%. We have more ships on the seas than ever, but it isn’t enough. Increased shipping containers and ports working 24/7 are still insufficient.

How will these five factors play out over time?

Some are likely to be transitory. Of all of these rising prices, energy prices tend to be the most responsive to rising prices. On the other hand, it takes 4 to 6 months to construct a new home; an adequate supply of semiconductors is estimated to be at least 6 months, or as much as 24 months away; wages have reset higher – $15 is the new unofficial minimum wage – but the rate of increase could very well moderate towards late 2022. To build one of the giant container transport ships is a 3-year process. Last, the balance between goods and services will be determined by how long it takes us to get the pandemic under control.

How much the prices of these goods and services respond to rising Federal Reserve rate increases is another question entirely. I am very much in favor of the Fed normalizing rates, but I am less sanguine that rate increases are the cure for what we describe above.

Pricing in the global economy is dynamic, ever-changing, with lots of cross currents each responding to different inputs: Supply, demand, interest rates, fiscal stimulus, geopolitics, consumer sentiment, etc. This is the nature of a complex system. Investors should not engage in gross oversimplification, single variable analysis, or even thinking about inflation as a binary outcome. Instead, an awareness of the many factors affecting prices, and how they might play out is a rational approach.

Is the worst of U.S. inflation behind us? Maybe, but since we cannot accurately predict the future, we should at least do our best to understand the present. That means doing more than focusing on any one single part of the elephant . . .

Previously:

Generational Reset of Minimum Wage (November 30, 2021)

Structural or Transitory? (November 23, 2021)

How Everybody Miscalculated Housing Demand (July 29, 2021)

The Inflation Reset (June 1, 2021)

Shifting Balance of Power? (April 16, 2021)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)

______________

1. It was made famous by John Godfrey Saxe’ 19th century poem. I find it so illustrative I keep returning to it again and again. See e.g., Nation of Rentiers? (February 23, 2018) and Is the Market Still a Future Indicator? (August 11, 2008)

2. It was not my intention to suggest that all economists are blind to the full picture of data that lay before them, but if the shoe fits . . .

3. Interesting side note: Miller adds that, “this is a bit simplistic but land appreciates and buildings depreciate so most of the recent price surges are carried by the land.”

click for audio

The shortage of new cars has led to a surge of used car prices — and there are only so many used cars out there. This has had a substantial – and disproportionate – impact on prices (see chart). Without the spike in car prices, that 7% consumer price increase would have been about a third less, closer to 5.5% had car prices been stable.

The shortage of new cars has led to a surge of used car prices — and there are only so many used cars out there. This has had a substantial – and disproportionate – impact on prices (see chart). Without the spike in car prices, that 7% consumer price increase would have been about a third less, closer to 5.5% had car prices been stable.