I am prepping some charts for our quarterly conference call for clients, but really, the only questions on anybody’s mind now are “What is the Market Up To?” and “Why?”

Don’t look to Television for your answers: This morning, the chyron read “Ukraine, Fed Hikes, Uncertainty drive stock rout” when markets were down 3%; after the losses were recovered, the chyron read “Stocks close higher in wild day.”

TV chyrons know everything and nothing…

My charge is to answer the question “What is the Market Up To?” without relying on the usual clichés. Consider a few media favorites we are all guilty of falling prey to from time to time as part of this challenge:

“Repricing Risk” — which in truth is what the market does every day, every hour, every tick. Another purposeless cliché: “Digesting Gains,” shorthand for saying, “Gee, I have no idea why that run-up in price suddenly stopped.” How much new is in the news headlines of Geopolitical fallout from Ukraine?” when the potential for a destabilizing Russia/Ukraine war has been in the headlines for several months now. And I must avoid “Looking to the end of the pandemic” because, really, isn’t that what the market has been doing since March 2020?

Thinking about the confusion surrounding the current market action, while trying hard to avoid hindsight bias and the recency effect is not easy. But there are a few explanations that do a better job explaining 2022 market action than the clichés above:

• Economic Disruption: Economically, we are managing through an excess of office space, as some but not all of us return to a 9-5 office. The excess might get converted to residential, or — like Retail before it — slowly bleed out over decades. Where we work and live, how much of the country will go virtual, will have an unknown impact on real estate values. That is before we figure out when we return the balance between goods and services back to pre-pandemic levels and how to unsnarl the supply chain.

The pandemic unleashed forces that went far beyond fighting Covid-19. We are in the midst of many substantial realignments — economic, political, technolgocial, philosophical — and there is little clarity as to how they play out. These are fundamental questions about major sectors of the economy. Market consensus may be forming around the idea that underlying changes could be even more disruptive to the status quo than previously expected.

• Shift from “Free” to merely “Cheap” Money: For the past decade, the cost of Capital has been essentially free. This has stimulated the economy, encouraged more debt-based consumption, and enhanced corporate profits. This period is ending. The Fed is winding down quantitative easing (QE) and moving off of its Zero Interest Rate Policy (ZIRP). Markets are pricing in quite a few unknowns: When will the Fed hike? How much, to what Fed Funds Rate? How will this impact the economy? Will it cool off inflation? How will this impact corporate profits?

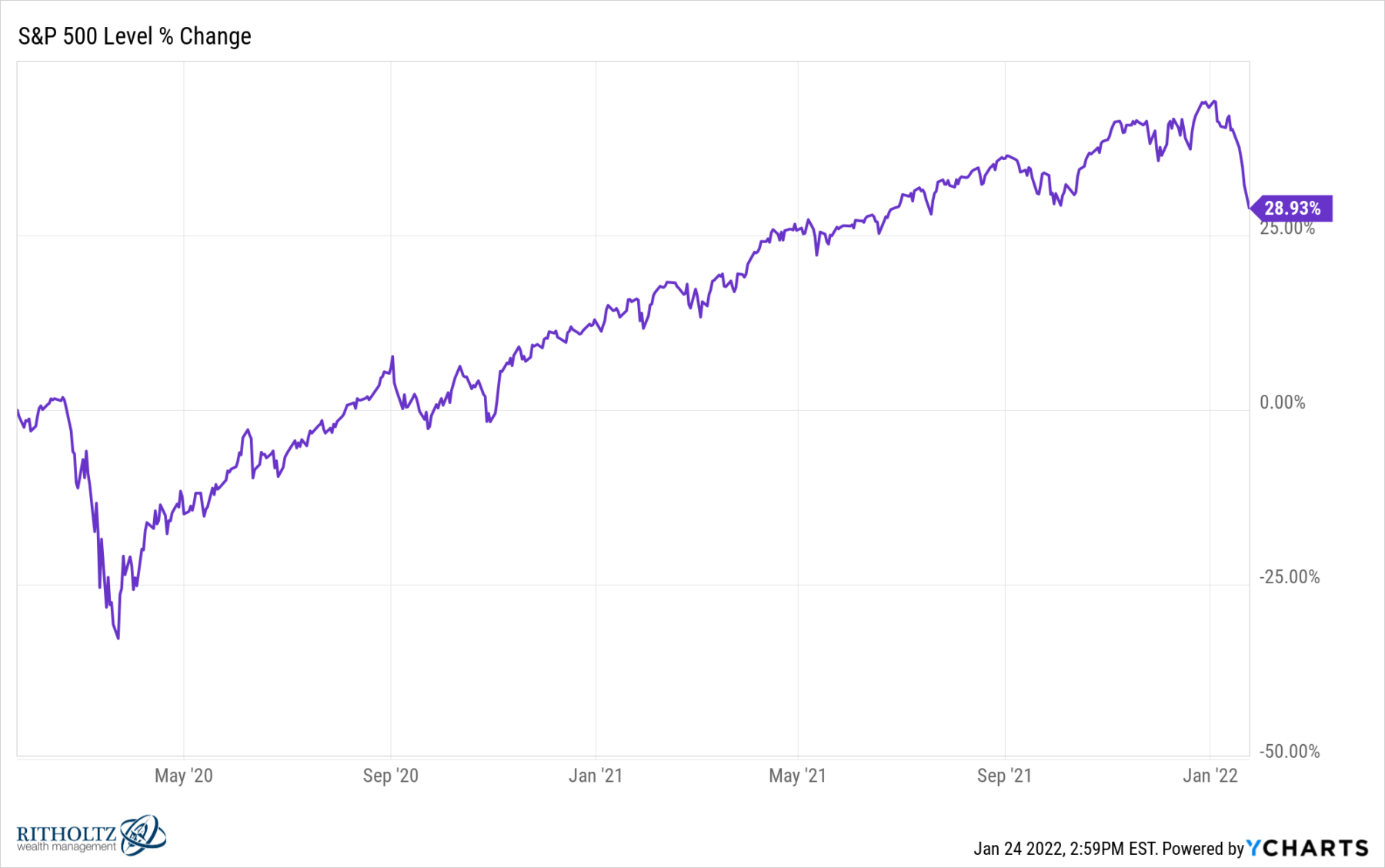

• Return to Normal: We have been lulled into complacency by the 2021 market that went straight up with little volatility and almost no pullbacks. Volatility is a feature, not a bug of markets. This is what it’s supposed to be like — a 10% correction once every 2 years, a 20% bear market once every 7 years, and a 30% crash once every 12 years. After a year where markets did essentially just one thing — they went up — a bidirectional market feels wrong. In reality, 2021 was the outlier.

We have no idea what the answers to these questions are, but most of the time, we can effectively fool ourselves into believing we have a handle on it. True uncertainty arises when we are forced to admit we have no idea what comes next. That scares investors and leads to increased market volatility.

Previously:

Corrections, Retracements, Crashes & Dips (November 29, 2021)

Living Through a Crash (January 14, 2022)

Cyclical Bear or Secular Bull Market? (March 20, 2015)

Lose the News (June 16, 2005)