My end of week morning train WFH reads:

• The internet turned “money” into a hobby Why (mostly) 20- and 30-something dudes made crypto and sports betting their personality. (Vox)

• ‘They’ll have to carry me out in a box’: inside the apartments of the luckiest renters: They scored beautiful New York City homes for far below market rate – and no, they’re never leaving (The Guardian) see also Keeping an Eye on the Middle Real estate prices have been rising wildly across the region. What will the current median price buy in the borough where you want to live? (New York Times)

• The Bond Market Can Finally Do Its Job Again: Its behavior is supposed to warn about inflation but the function was smothered by a decade of QE bond buying (Bloomberg)

• The SEC Unveils Its Plan to Bring Private Funds in Check: Several common practices disliked by investors would be outlawed under new rules proposed Wednesday. (Institutional Investor)

• Sign This Agreement and Your Bank Account Might Be Frozen: Predatory lenders are turning to Connecticut to help collect their debts, using a legal trick to bypass judicial review. (Businessweek)

• Why Your Car Might Be Worth More Today Than When You Bought It The surge in used-car prices is undoing years of depreciation on some models, leaving some car owners with vehicles worth more now than when bought. (Wall Street Journal)

• Digital Advertising in 2022 Google Search has a built-in advantage over Facebook: Google doesn’t have to figure out what you are interested in because you do the company the favor of telling it by searching for it. The odds that you want a hotel in San Francisco are rather high if you search for “San Francisco hotels”; it’s the same thing with life insurance or car mechanics or e-commerce. And Apple’s app rule changes do not affect it;Facebook, on the other hand… (Stratechery)

• It’s Your Friends Who Break Your Heart: The older we get, the more we need our friends—and the harder it is to keep them (The Atlantic)

• Covid longhaulers are still fighting for recognition. People with long Covid face an uphill battle convincing skeptics their malady is real – but discrediting uncommon conditions is hardly a new phenomenon (The Guardian) see also The New Clues About Who Will Develop Long Covid: Research is homing in on risk factors for developing long Covid, offering clues for potential treatments (Wall Street Journal)

• Out-of-This-World Winners of the ASTRO2021 Photo Contest If these winning images from the photo contest do nothing else, they certainly are a good motivation to join the cause so that the stars always remain visible for all to enjoy. (My Modern Met)

Be sure to check out our Masters in Business interview this weekend with James Anderson, partner at Baillie Gifford, the Edinburgh, Scotland investing giant that manages $470 billion in client assets. He runs FTSE-100-listed Scottish Mortgage Investment Trust, a $23.5 billion fund, where since 2001, he has generated returns of 1,700%.

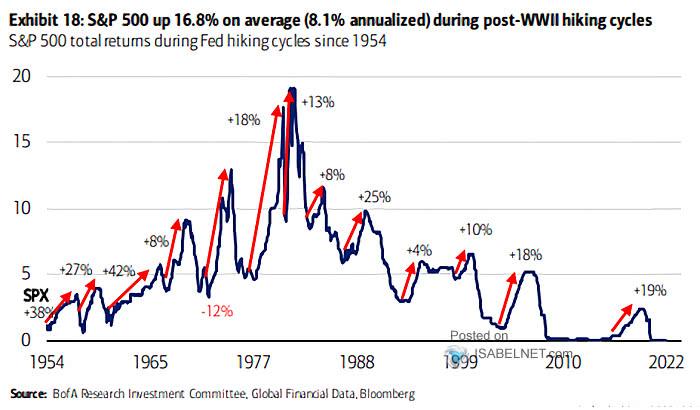

Historically, the S&P 500 tends to do well during Fed hiking cycles

Source: BofA via Isabel.net

Sign up for our reads-only mailing list here.

~~~

RRs will be on vacation next week; No AM Reads Monday 2/14 to Friday 2/18