My 2.22.22 Tuesday morning train WFH reads:

• Everyone Thinks Rising Interest Rates Are Bad for Tech Stocks. But Are They? A closer look at the numbers shows that the relationship may not be as clear-cut as many investors believe. (Institutional Investor) see also How Do Stocks Perform When the Fed Raises Rates? There have been 8 longer-term rate hiking cycles since 1970 Surprisingly, stocks have held up relatively well on average, with a total return in these periods of 23%. (Wealth of Common Sense)

• Putin’s New Age of Conquest In today’s world, borders are almost never redrawn at the point of a gun. Could the Ukraine crisis change that? (Grid)

• Big Tech Makes a Big Bet: Offices Are Still the Future Even as they allow some employees to change how often they come into the office, tech companies are rapidly buying and leasing properties around the country. (New York Times) see also What We Lose When Work Gets Too Casual The loss of workplace formalities like fixed start and stop times, managerial hierarchies with clear pathways for advancement and professional norms that create boundaries between personal and professionally acceptable behavior only hurt workers. We should not be deceived: Many of these changes mostly benefit employers. (New York Times)

• Move over, crypto. A record number of workers are becoming millionaires with their boring 401(k)s and IRAs. Fidelity Investments reported that its number of IRA (individual retirement account) and 401(k) millionaires hit an all-time high. Likewise, the number of millionaires investing in the Thrift Savings Plan (TSP), the federal government’s version of a 401(k), also spiked significantly. (Washington Post)

• The logical mystic Ludwig Wittgenstein’s ‘Tractatus’ is as brilliant and baffling today as it was on its publication a century ago.(New Humanist) see also Knightian Uncertainty What makes Knight’s distinction between “Risk” and “Uncertainty” so astute is the recognition that Risk is measurable: It can be objectively assessed, and it can be hedged. (The Big Picture)

• The $250 billion question: Apple broke Facebook’s ad machine. Who’s going to fix it? And of those stories have a degree of truth. But the idea that Apple has hurt Facebook’s revenue in a direct and meaningful way seems the truest: Facebook says changes Apple made that affect how ads work on iOS apps — namely, that it’s now much harder for app-makers and advertisers to track user behavior — will cost it $10 billion in revenue this year. (Recode)

• How the IBM 7094 Gave NASA and the Air Force Computing Superiority in the 1960s The early mainframe model, powerful in its day, helped NASA control spacecraft for the Gemini and Apollo programs, and the Air Force used it for its Ballistic Missile Early Warning System. (FedTech) see also The Money Printing Press That Is Chipmaker TSMC TSMC is itself a money making machine. If you double its capital expenses over three years it doubles its revenues and profits over five years. (Next Platform)

• A Progressive Real Estate Firm Faces Accusations of Discrimination Redfin has staked its reputation on making a racist industry more equitable. Critics say it has been denying services to Black homebuyers and sellers. (Businessweek)

• Don’t blame the IRS for its lousy service. Blame Congress But those who suggest that the IRS is responsible for its own problems are blowing a thick cloud of smoke. That’s because finding the reason for the agency’s underperformance in customer terms requires looking elsewhere — specifically, on Capitol Hill. (Los Angeles Times) see also Don’t Like USPS Losses? Blame Congress Congress, not Amazon, messed up the Post Office when legislators passed a law that made the USPS less competitive with the private sector (The Big Picture)

• How Winter Olympians who hate the cold compete in freezing weather As the Beijing Games carry on through frigid temperatures and frosty conditions, athletes reveal the cold hard truth about competing in a polar climate. (Sports Illustrated)

Be sure to check out our Masters in Business this week with Samantha McLemore, Miller Value Partners. She is the co-portfolio manager of the Miller Opportunity Trust and related strategies, and founder/CIO of Patient Capital Management. For the 10 years ending 1/31/22, LMNOX returned 16.42% annually and was in the top 1% of its Mid-Cap category.

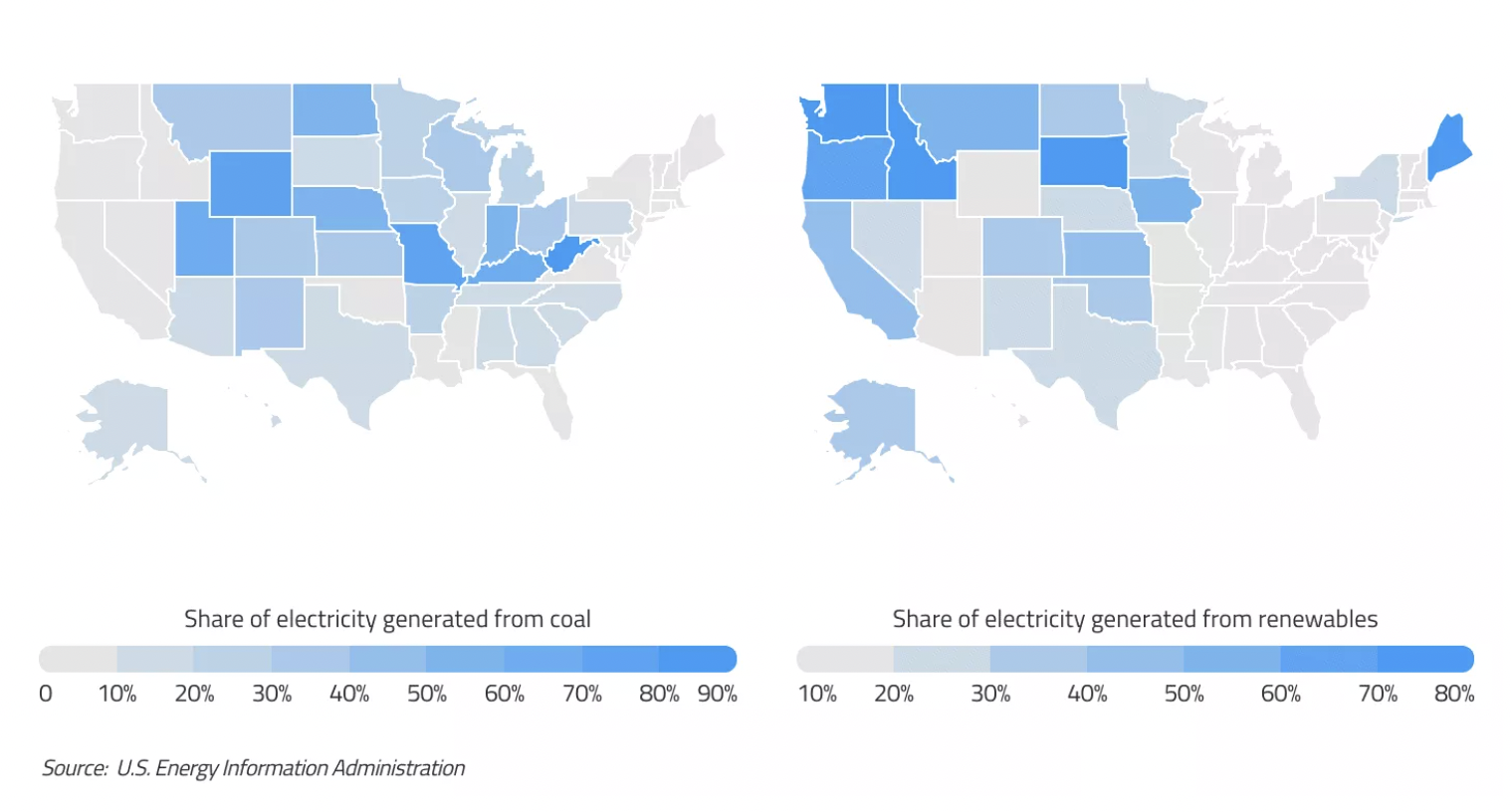

Which US States are Still Dependent on Coal for Electricity?

Source: Commodity.com