My mid-week morning train WFH reads:

• Andy Warhol, Clay Christensen, and Vitalik Buterin walk into a bar The idea that crypto is simply a bubble may miss something important that this suite of technologies has to teach us about the economy. Anne Goldgar’s 2007 book “Tulipmania” made the case that the tulip mania was far less widespread and damaging than outlined in Charles Mackay’s 1841 book “Extraordinary Popular Delusions and the Madness of Crowds,” which had made it so notorious. But even in minimizing its impact, she agreed that the tulip bubble called into question the very nature of what constitutes value. (O’Reilly)

• Neil Young vs. Joe Rogan vs. Spotify Spotify joins Facebook and Twitter in the misinformation wars. (Grid) see also Spotify’s Joe Rogan Problem Isn’t Going Away The controversy is different, in many ways, from the other conflicts between online stars and the companies that give them a platform. (New York Times)

• 6 Investing Lessons From the TV Show Billions The shenanigans of its scheming characters may seem absurd, but they have real-world applications. (Chief Investment Officer)

• Why It Could Be Years Until We See a Normal Housing Market We’re in a housing market where we have record high demand and record low supply. If you want to know why prices are 20% higher than they were a year ago this is the simplest explanation. But there’s more going on here… (Wealth of Common Sense)

• How the Industry’s Fastest Growing Sector Is Pushing Managers To Change Their Behavior Wellington, Schroders and others are taking a more activist approach to managing their environmentally-sustainable funds. (Institutional Investor)

• The great LIBOR Divide The findings of the US court of appeal suggest that, what was a massive crime in the UK leading to initial sentences of 14 years for Tom Hayes, was not a crime in the US. (Clyde & Co)

• The paradox that leads professionals into temptation High-minded managers may be more prone to bias because they think they know how to ignore gift-givers (Financial Times)

• Musk: Robots to be bigger business than Tesla cars Musk told investors on a Tesla earnings call his nascent robot plans had “the potential to be more significant than the vehicle business, over time.” And they would be the most important things Tesla worked on this year. (BBC)

• The science behind the omicron wave’s sharp peak and rapid decline Why do Covid-19 surges seem to end as suddenly as they begin? (Vox)

• Tom Brady Vanquished Father Time Brady is retiring after 22 seasons and seven Super Bowl wins. He’s ending his illustrious career at the peak of his powers.. (The Ringer) see also How Tom Brady, the Person and the Process, Made Greatness Seem Routine Before many athletes and teams followed his lead, Tom Brady was redefining what it took to be the best, on and off the field. (Sports Illustrated)

Be sure to check out our Masters in Business interview this weekend with David Conrod, Co-Founder CEO at FocusPoint Private Capital Group. Previously, he was at Guggenheim Partners, where he established the Private Fund Group, with more than $7 billion of fund allocations for general partnerships external to the firm.

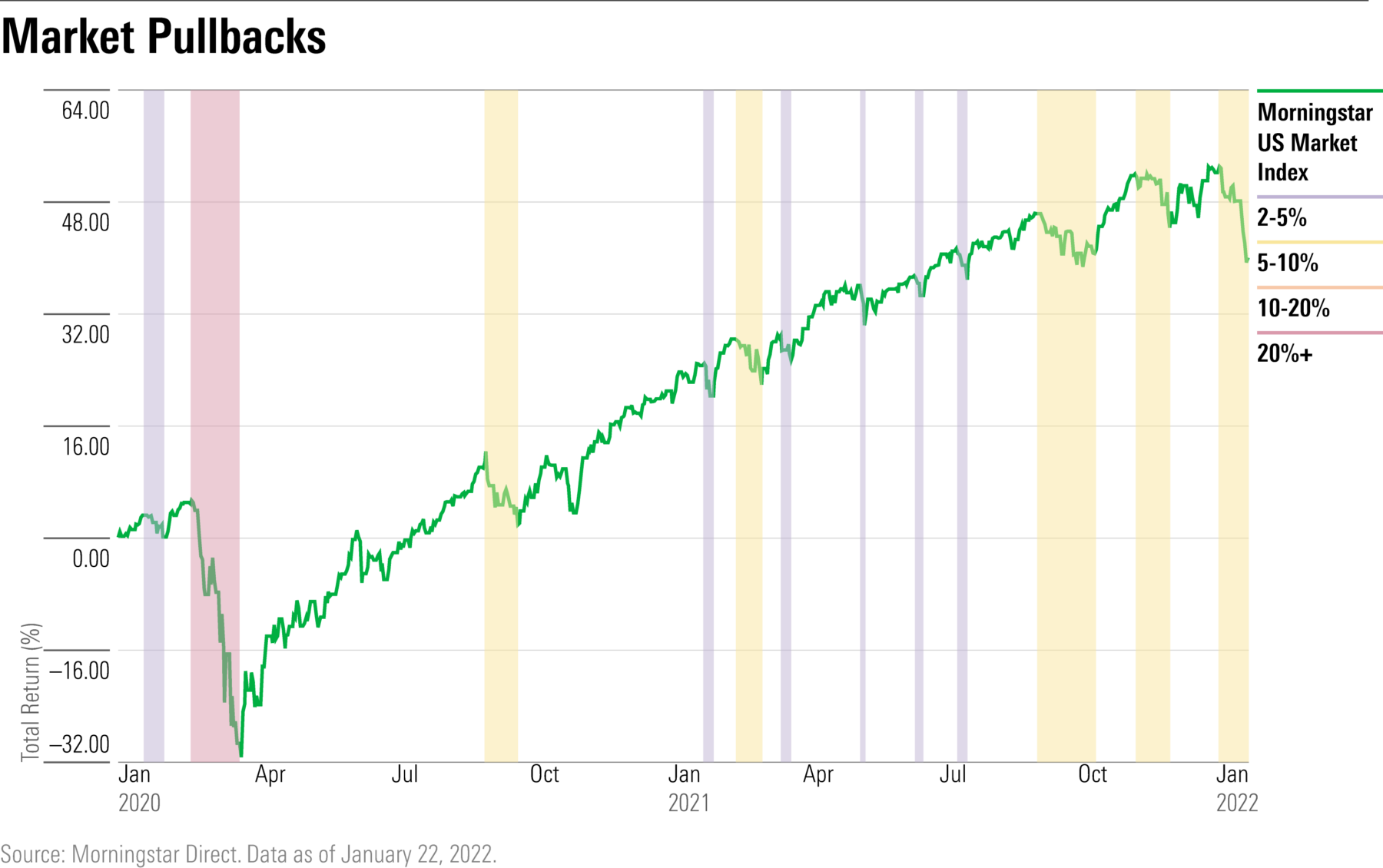

The changing outlook for the Fed continues to spark volatility

Source: Morningstar

Sign up for our reads-only mailing list here.