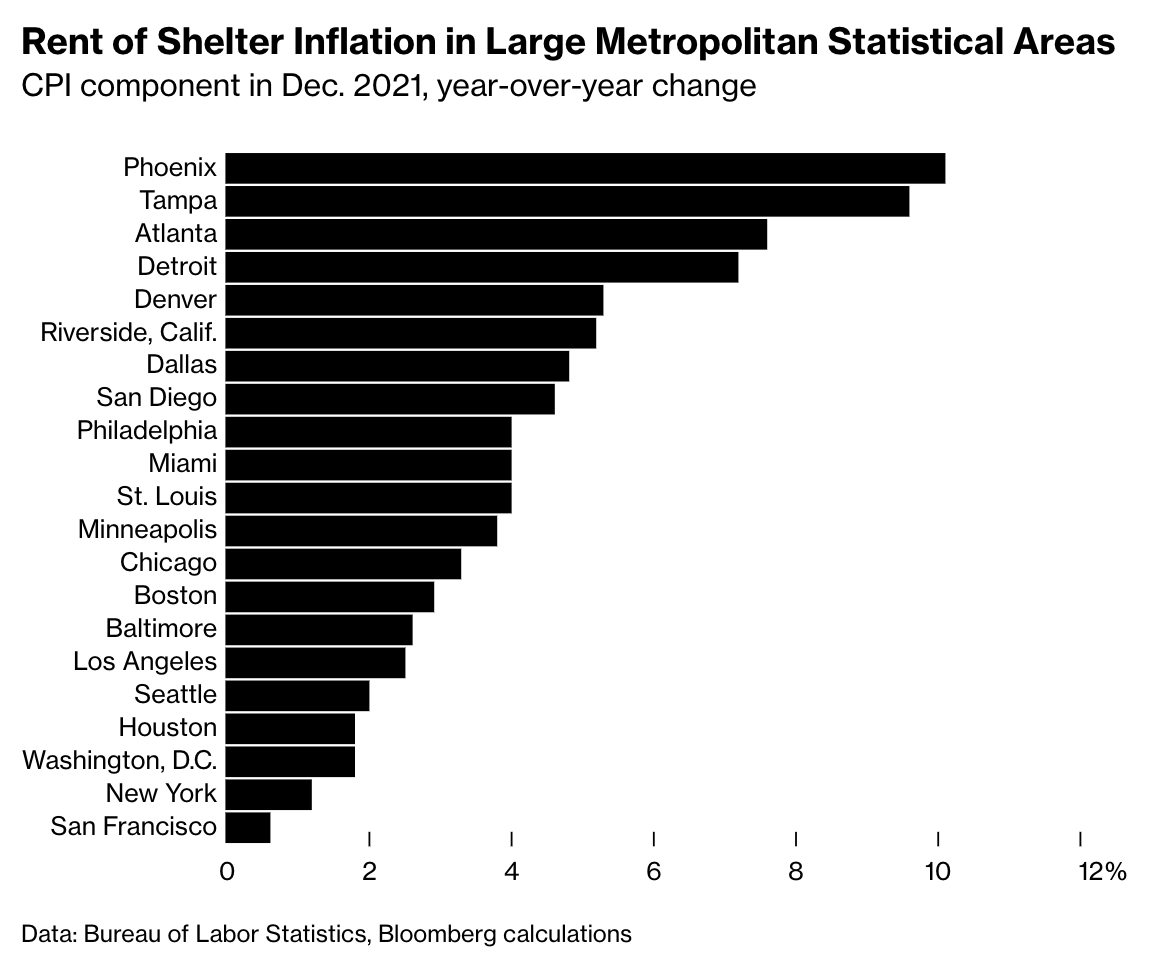

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post headline. It cited a Jan 21 Redfin rental market report. The table (right) was included.

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post headline. It cited a Jan 21 Redfin rental market report. The table (right) was included.

It showed massive rent surges in cities like Austin +40%, lots of tri-state area increases running +35% (Nassau, Manhattan, New Brunswick, Newark) and then three Florida cities — Miami, West Palm Beach, and Jacksonville at +34%.

Color me skeptical about those rent numbers.

There is no doubt that prices have risen in most places for rents. And, it is worth recalling that a nearly 2-year eviction moratorium just ended. That created a lower turnover in apartments, putting a cap on many rental unit increases. A modest surge in prices would have been expected once that ended, as apartment owners were once again able to raise rentals unit prices to market rates.

But that should not lead to high double-digit increases. I suspect Redin’s methodology is amiss; to their credit, they caveat the numbers,1 but even that is another reason to be skeptical of this assessment.

The Redfin data measure something — I am not sure what — but it appears it is not the average rate of rent increase in these metro areas.

That did not stop the Washington Post — and dozens of syndicators — from running that screaming headline. Someone must have noticed something was amiss because subsequently the headline was changed to the still dubious “Rents are up more than 30 percent in some cities…”

Maybe someone in Austin’s rent went up 40%, or something related to college housing affected the print, but I need to see more hard data before believing the average rent in Austin is up by that much.

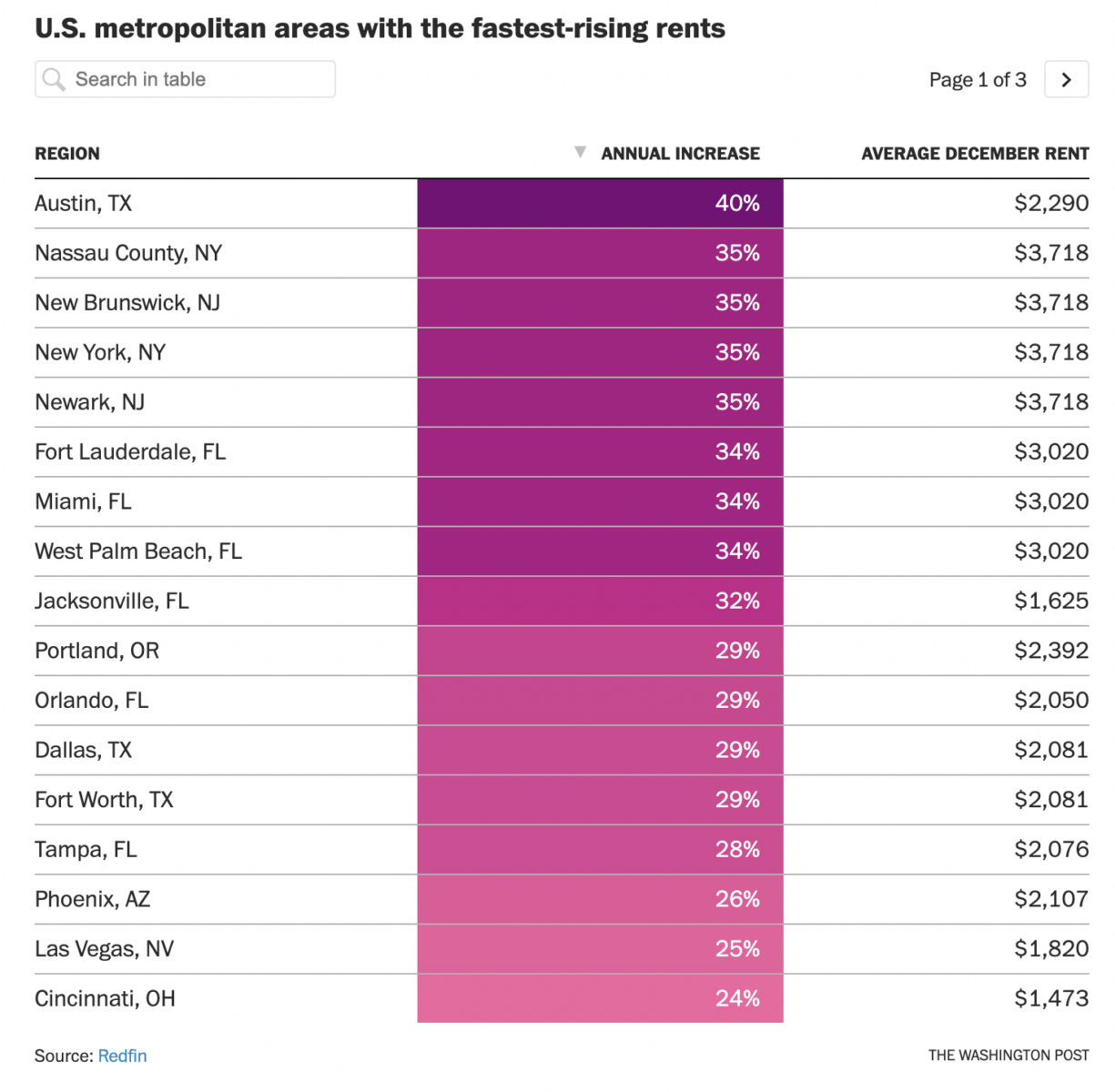

Perhaps this is merely me confirming my priors but this chart of CPI Rents via Bloomberg this AM looks more rational than the data from Redfin:

The reporter noted:

“Outsize residential rent increases spreading from new leases to existing ones has been a distinct pattern in places like the Atlanta and Detroit metro areas, where rents rose in 2021 at the fastest pace in decades, according to Labor Department data, propelled in part by an influx of new arrivals fleeing higher-cost cities. In 2022, the pattern is set to become a nationwide phenomenon, as landlords recoup bargaining power they lost in the early part of the pandemic, when unemployment surged and governments responded by enacting eviction bans.”

But by “outsized,” the reference is to 5-10% increases, which follow two years of flat or falling rents. The research firm Inflation Insights is seeing “rental inflation hitting multidecade highs of 5% or more later this year as rent increases spread to existing leases across the country,” but expects more supply to lower rent increases back towards the pre-pandemic range of 3% to 4%.

It’s worth noting that Redfin is hardly an unbiased source of data: They are a full-service real estate brokerage and are publicly traded under the ticker RDFN. I have no idea why the Washington Post headline writer on this was not more skeptical of rent inflation claims that were such obvious outliers.

UPDATE: Feb 1, 2022 3:45pm

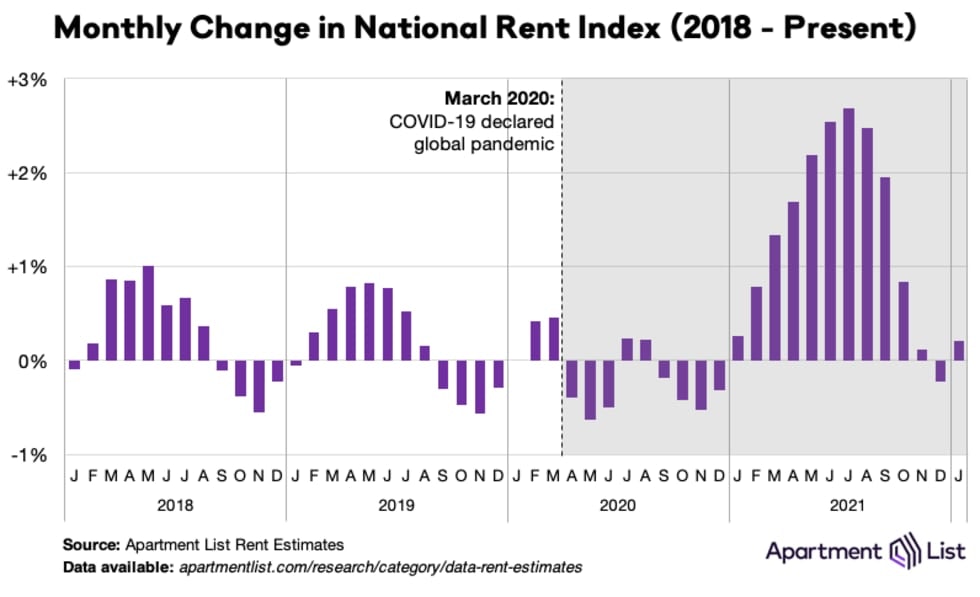

I see others have looked at the data and reached conclusions similar to mine: See this Apartment List National Rent Report from January 26, 2022:

That is the national data; when we look at specific cities, we find some more nuance: New York City median price for an apartment increased a massive 33.5%, but this has only offset the sharp decline in rents during the first year of the pandemic. “Rents in NYC now are just 4.4% higher than they were in March 2020.”

The same cannot be said for lockdown destinations like Tampa, FL, and Phoenix, AZ as those cities never experienced meaningful declines in rents once the pandemic began. Rents there are now appreciably higher than they were in March 2020. Full details at Apartment List. Note the caveat about their methodology — it is based on “Asking” prices (not actual rental prices). Even still, this approach has Austin Texas up 24%, not 40%.

Sources:

Rents are up more than 30 percent in some cities, forcing millions to find another place to live

Abha Bhattarai

Washington Post January 30, 2022

https://wapo.st/346r4c1

Rent Inflation Shows That Landlords Have the Upper Hand Again

Matthew Boesler

Bloomberg, February 1, 2022

https://bloom.bg/3uhUbDP

__________

1. The Redfin methodology reads as follows:

“It is also important to note that the prices in this report reflect the current costs of new leases and new mortgages during each time period. In other words, the amount shown as the average rent is not the average of what all renters are paying, but the average cost of apartments that were available for new renters during the report month. Likewise, the median monthly mortgage payment shown is only for homes that sold during the report month, not for all homeowners.”

Which, to be generous, measures something — just not the average rate of rent increase in each metro area.

I have to work really hard not to title these things “Today in Stupid” but trust me I think about it…