Source: Bloomberg, New York Times, Visual Capitalist

My favorite questions from clients often contain a bit of a puzzle: “Why is the market doing this seemingly crazy thing?”

We saw this during the March 2020 collapse, when our prior experience during the great financial crisis led us to expect a multi-year downturn. If you looked at it from the right perspective, you could see where those assumptions were off-base. A few months later, the markets had fully recovered from their 34% plunge (and then some). The most common refrain was Mr. Market had become completely unhinged and irrational. (Narrator: They had not).

Now, we see the markets screaming higher after January’s volatility. The temptation to offer an after-the-fact explanation is powerful. Rather than go too far down that road, I am going to offer a few possible ideas:

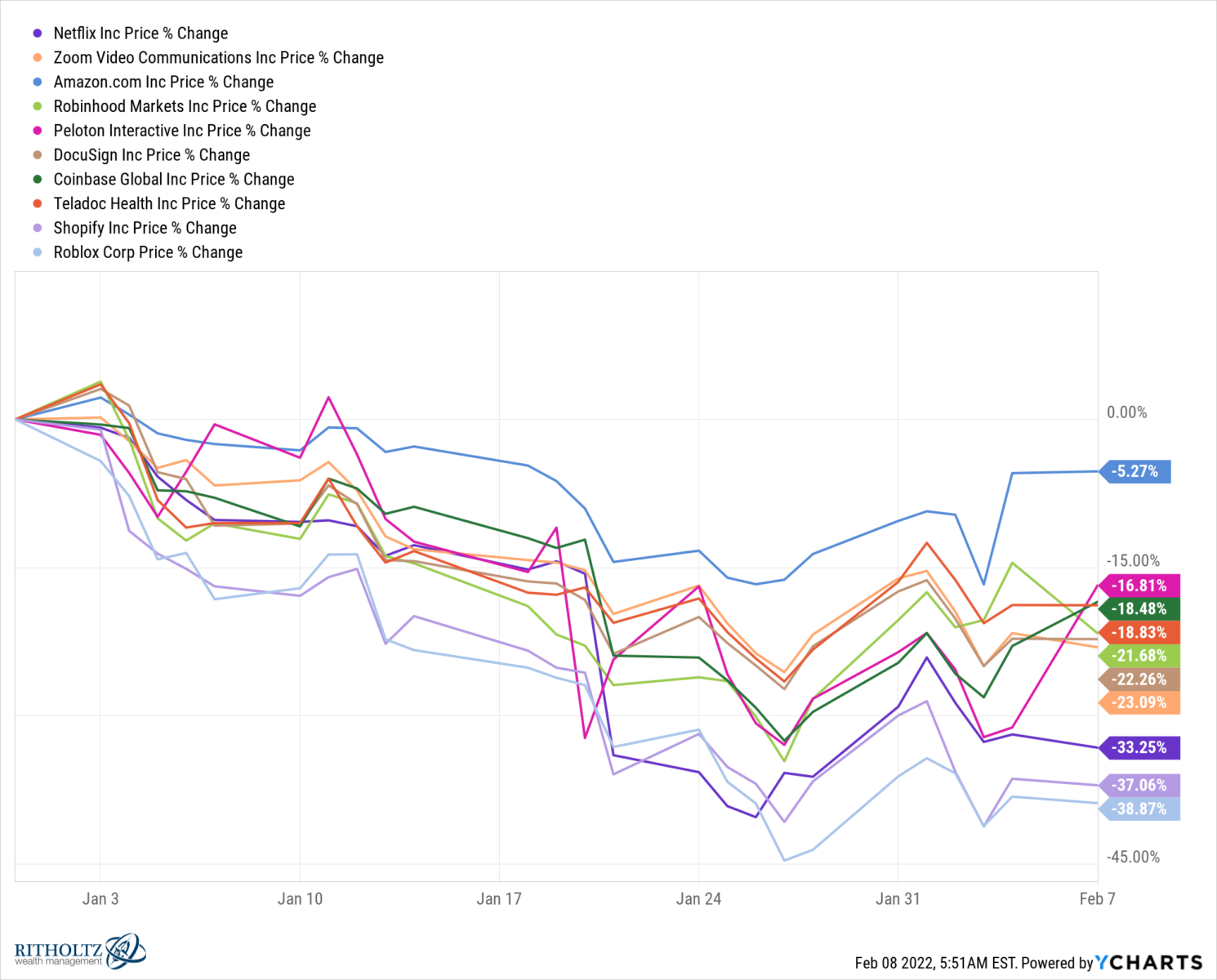

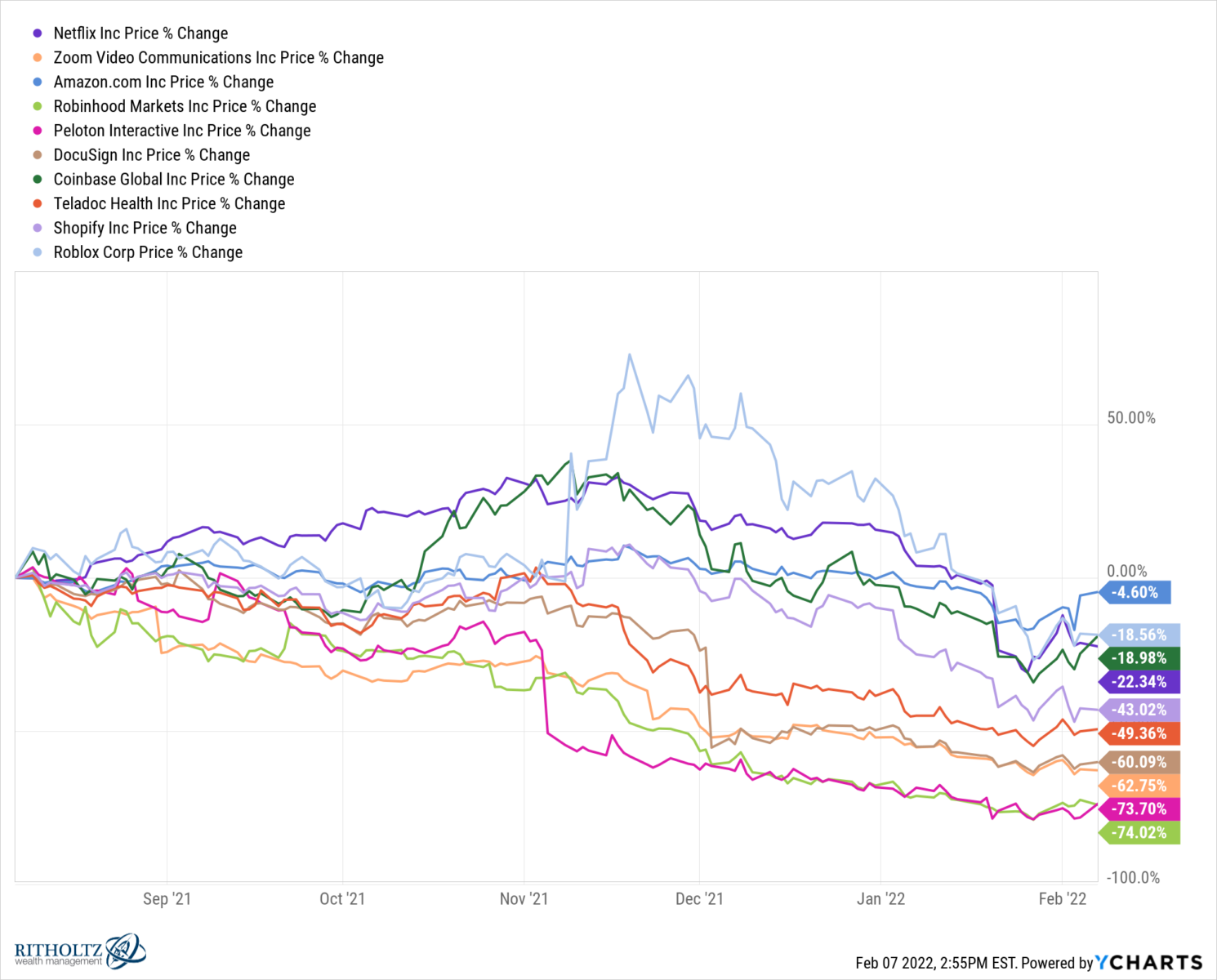

1. The WFH stocks (see chart above) began selling off 6 months ago;

2. Initial response to CPI data/Inflation and Fed tightening cycle may have been overreactions;

3. The Omicron wave is Receding; economic reopening/recovery appears to be nearer than thought a month ago.

Too often, a combination of hindsight bias and narrative fallacy combine to create a comforting but untrue or incomplete version of what just happened. I cannot tell you for sure that any of the above is what is going on, but some combination of these three above is as good an answer as any I have heard the past few weeks.

~~~

What is your favorite explanation for 2022? Hit me up here with your best rationale…

See also:

Was the Pandemic Actually Bad for Companies Like Peloton & Netflix? (Ben Carlson, February 8, 2022)

There’s Blood in the Streets (Michael Batnick, January 27, 2022)

Previously:

End of the Secular Bull? Not So Fast (April 3, 2020)

Maybe Mr. Market Is Rational After All… (August 7, 2020)

How Externalities Affect Systems (August 14, 2020)

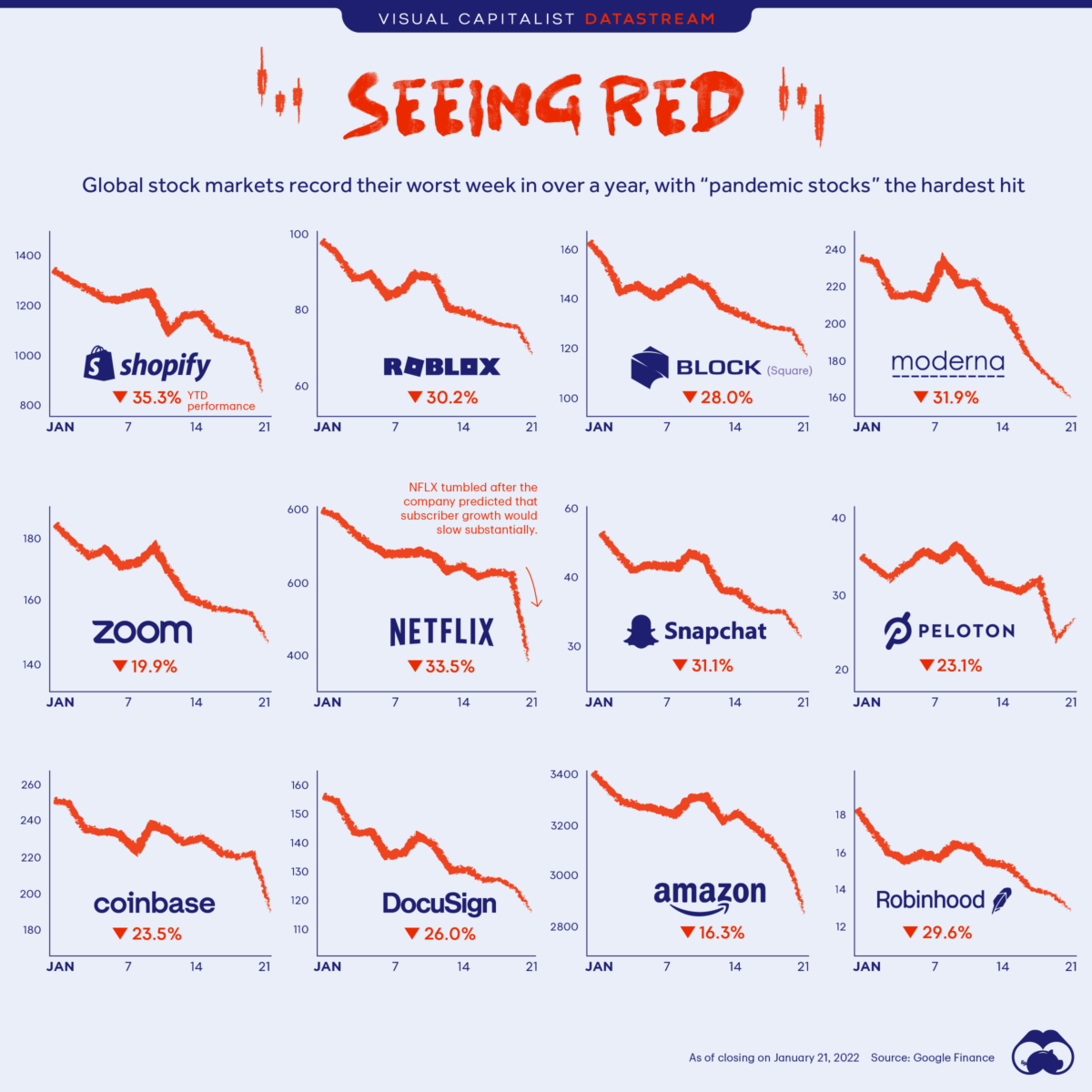

Seeing Red: Is the Heydey of Pandemic Stocks Over?

Source: Visual Capitalist