My mid-week morning train WFH reads:

• 4 Bed, 3 Bath, No Garage Door: The Unlikely Woes Holding Up Home Building Supply-chain complications are giving the industry and buyers fits. (New York Times) see also The Next Affordable City Is Already Too Expensive In Spokane, Wash., home prices jumped 60 percent in the past two years. The increase is fueled by buyers fleeing the boom in cities like Austin. Who will have to flee next? (New York Times)

• An Obscure Corner of Wall Street Is Making Billions Trading Inflation Small teams have been making the most of global price shocks with trades that can be just as volatile. (Bloomberg)

• A Hedge Fund Manager Reluctantly Challenged — Then Collaborated With — Harry Markowitz The Gerber statistic assesses the level of risk and diversification in a portfolio by determining whether securities move in tandem, in opposition to one another, or have no relationship at all. The stat uses certain thresholds to filter out noisy data that may signal that relationships exist, even when, in reality, they do not. (Institutional Investor)

• Is There a Way Out of America’s Impossible Housing Mess? The first step, according to economist Jenny Schuetz, is recognizing there is more than one housing crisis. (Slate)

• The Great Resignation is also the Great Retirement of the Baby Boomers. That’s a Problem. Employers are dependent on the outsize baby boomer cohort, whose exit is contributing to growing shortages of workers everywhere, from nursing to school bus drivers to the service industry. It’s not just 22-year-old baristas who have had it with working conditions. Those understaffed stores? Retailers became increasingly reliant on older workers in the wake of the Great Recession. Many are now making an exit. (Washington Post)

• Why Spotify bought Chartable & Podsights Both these acquisitions add up to a smart move by Spotify. The company is trying hard to become the most significant player in the “hearing” attention economy and build a sizeable advertising business. Podcasts are a vital part of this business as they cost less and allow the company to keep a significant chunk of its revenues. In comparison, it has to share the money with record labels, who continue to have a draconian hold over the company. (Om)

• One year after Texas cold spell, study shows renewable energy could avoid blackouts Electricity blackouts could be avoided across the nation by switching to solar, wind and water energy sources. (Washington Post)

• The Rare Gift of Seeing Extra Colors: Research on colorblindness has led to a new understanding of tetrachromacy, an inherited ability to perceive subtle shades (Wall Street Journal)

• COVID-19 Isn’t Going Anywhere — And Americans Know It Most Americans believe COVID-19 will persist into the near (or distant) future, but what that means to people’s daily lives is the subject of much more dissent. That’s because understanding COVID-19 as an ongoing reality means something different to everyone. (FiveThirtyEight) but see COVID Won’t End Up Like the Flu. It Will Be Like Smoking. Hundreds of thousands of deaths, from either tobacco or the pandemic, could be prevented with a single behavioral change. (The Atlantic)

• The Biggest Galaxy Ever Found Has Just Been Discovered, And It Will Break Your Brain 16.3 million light-years vs 52,850 light years for the Milky Way (Science Alert)

Be sure to check out our Masters in Business this week with Samantha McLemore, Miller Value Partners. She is the co-portfolio manager of the Miller Opportunity Trust and related strategies, and founder/CIO of Patient Capital Management. For the 10 years ending 1/31/22, LMNOX returned 16.42% and was in the top 1% of its Mid-Cap category.

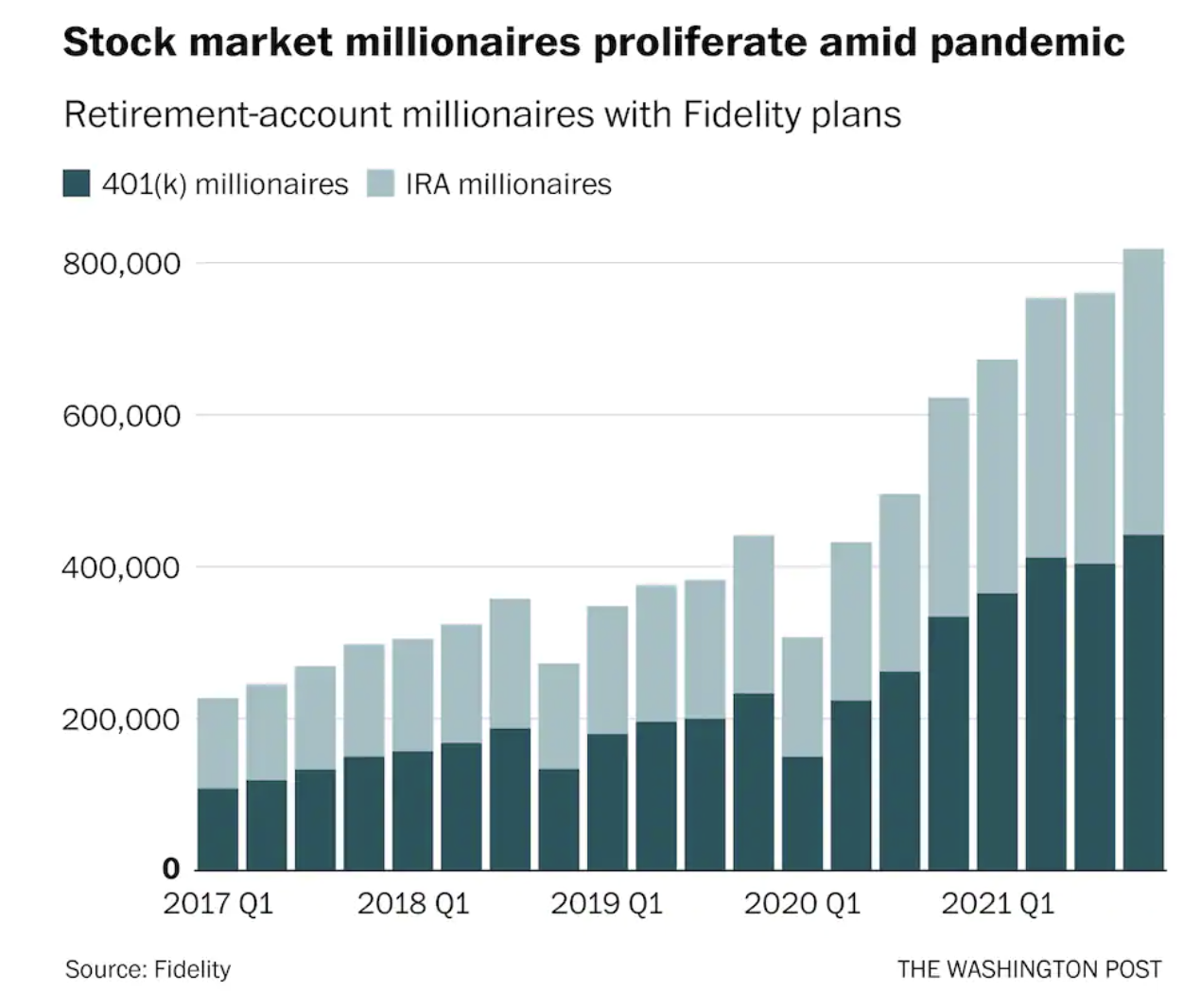

A record number of workers are becoming millionaires with their boring 401(k)s and IRAs

Source: Washington Post

Sign up for our reads-only mailing list here.