My end of week morning train WFH reads (extra salary/employment edition):

• Yield Curve Almost Flashes Recession, Maybe, but Who Knows When Whisper it quietly, but maybe the yield curve isn’t quite as useful as many think as a recession alert (Wall Street Journal)

• Say hello to Russian gold and Chinese petroyuan: The Russia-led Eurasia Economic Union and China just agreed to design the mechanism for an independent financial and monetary system that would bypass dollar transactions. (The Cradle)

• The Entirely Predictable Impact of Salary Transparency Europe is about to decide whether to make everyone’s salaries public, a move that could dramatically narrow the gender pay gap. (Wired)

• That big tech exodus out of California turns out to be a bust That’s the conclusion of some new studies, most recently by Mark Muro and Yang You of the Brookings Institution. They found that although the pandemic brought about some changes in the trend toward the concentration of tech jobs in a handful of metropolitan areas, the largest established hubs as a group “slightly increased their share” of national high-tech employment from 2019 through 2020. (Los Angeles Times)

• Food Prices Keep Going Up. The Impact May Be Felt Far Beyond the Supermarket. The 7.9% surge in total consumer prices last month from a year earlier marked a new 40-year high at a time when inflation-adjusted household incomes are falling at the fastest pace since the government began the data series in 1959. But the reality is much worse, and it is probably going to worsen still as the economic effects of Russia’s invasion of Ukraine play out. (Barron’s)

• How Should Real-Estate Agents Be Paid? Many researchers and consumer advocates believe it’s time to change the commissions that home sellers pay. But how? Three researchers discuss some alternatives. (Wall Street Journal)

• Is Russia’s Largest Tech Company Too Big to Fail? It took 20 years for Arkady Volozh to build Yandex into Russia’s Google, Uber, Spotify, and Amazon combined. It took 20 days for everything to crumble. (Wired) see also Russian Asset Tracker: Introducing a project to track down and catalogue the vast wealth held outside Russia by oligarchs and key figures close to Russian President Vladimir Putin. (OCCRP)

• Hong Kong’s Completely Avoidable Covid Catastrophe: The city kept the pandemic at bay for two years. Why didn’t it take measures that would help in an inevitable outbreak—like an all-out campaign to vaccinate the elderly? (Businessweek)

• How a Book Is Made: Have you ever wondered how a book becomes a book? Join us as we follow Marlon James’s “Moon Witch, Spider King” through the printing process. (New York Times)

• Nicolas Cage Can Explain It All He is one of our great actors. Also one of our most inscrutable, most eccentric, and most misunderstood. But as Cage makes his case here, every extraordinary thing about his wild work and life actually makes perfect ordinary sense. (GQ)

Be sure to check out our Masters in Business interview this weekend with Samara Cohen, BlackRock’s Chief Investment Officer for ETFs & Index Investments. BlackRock manages over $10 trillion in assets, and Cohen’s Index / ETF group is responsible for $6 trillion of it.

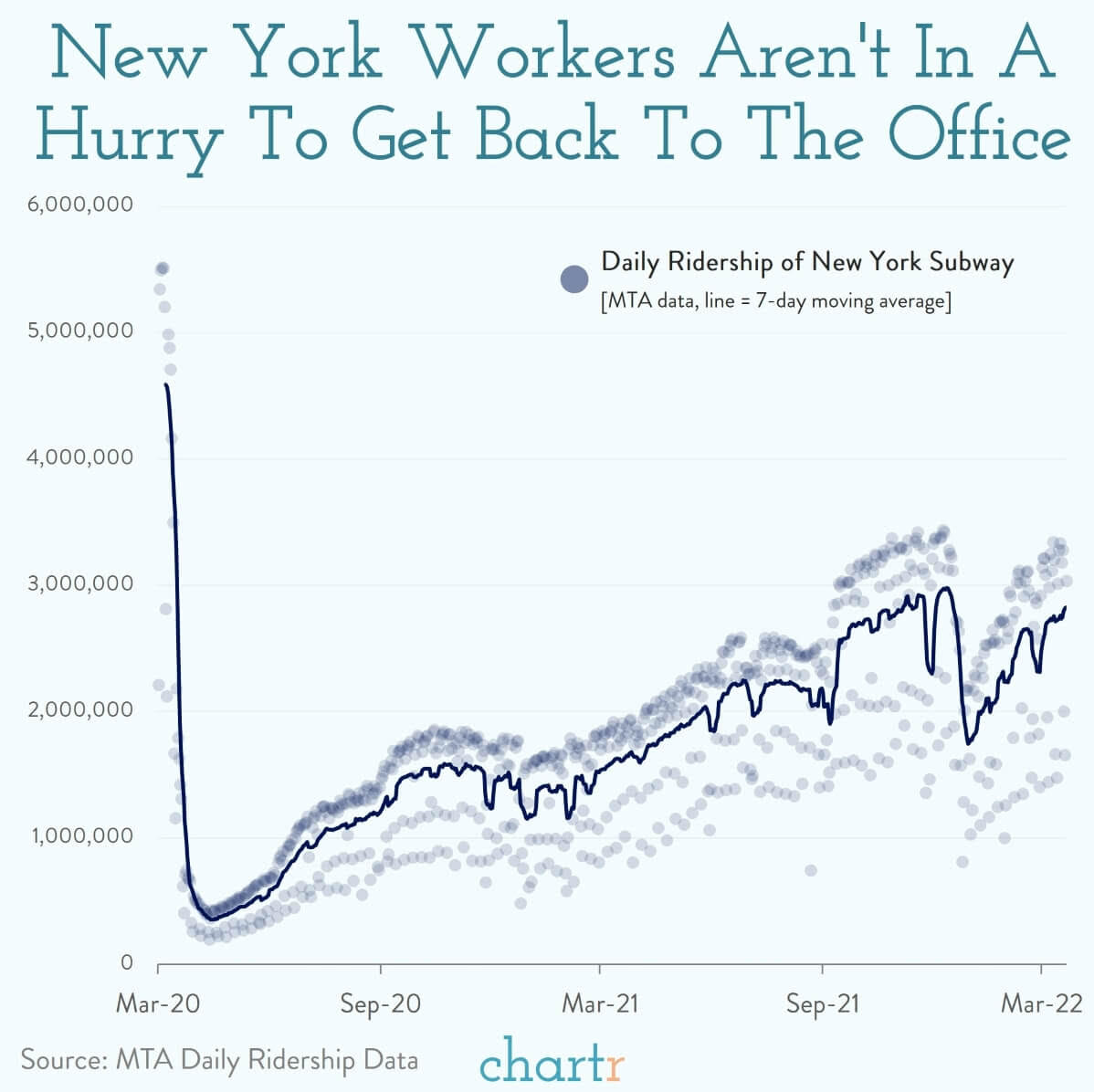

New York, new way of work. Subway usage is still way down in the big apple

Source: Chartr

Sign up for our reads-only mailing list here.