This week, I attended my first industry conference in two years. I met some interesting folk, my presentation went well, sat in on other interesting panels, and learned a few genuinely new things. All told, it was a successful trip.

The most interesting thing discussed was not during a panel or presentation. As it turned out, several speakers – folks who have been in the industry for a long time and are very senior positions at major institutions – had canceled their appearances.

The reason why? They were unvaccinated.

Proof of vaccination was required by airlines, the venue, and the conference event itself. There may be plenty of vaccine-hesitant people in other industries, but in investing? I did not think of finance as one of those sectors.1 I was wrong about that, and this was a surprise.

There are many parallels between the work that people in our industry do, and the decision-making process that eventually leads to a decision to get vaccinated. Consider this definition, variations of which have been my go-to definition:

“Investing is the art of using imperfect information to make probabilistic assessments about an inherently unknowable future.”

Making good investment decisions and making good health care decisions are not all that different.

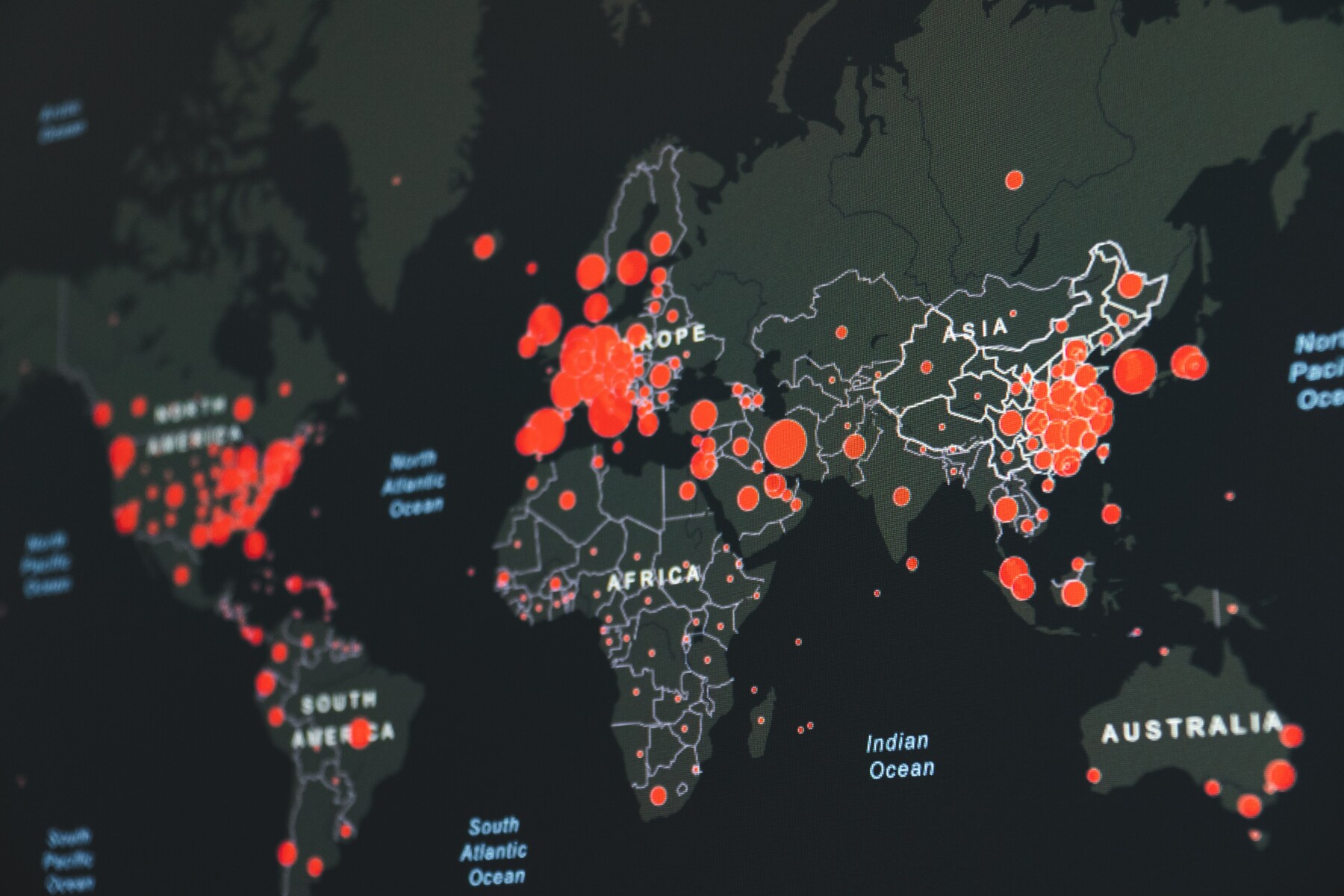

When the pandemic first began, very little was known about Covid-19; when mRNA vaccines came out, we had very little experience with them; the data on infection rates, mortality, side effects, etc., have been ambiguous and potentially confusing.

It seems that the skill set required to successfully navigate each of these challenges is similar.

Especially given how much we have learned about “Judgment under uncertainty” from the field of behavioral economics: Do you know what you don’t know? Is your decision-making driven by cognitive errors? Are you engaging in partisan politics? Are you being tribal and unthinking?

We have discussed in these pages the problematic ways explaining behavioral economics and our cognitive issues these issues manifest, from confirmation bias to mixing politics with investing.

It is one thing to worry about the safety of a new emergency vaccine approval in December 2020; it is something else entirely after more than 11 billion shots have been administered 16 months later. Failing to objectively evaluate new data because of cognitive dissonance is a classic behavioral error.

An exec from a large asset manager was discussing just this issue with me. Part of a firm’s new products team includes a salesperson for the group – he is the client-facing lead for the firm. It’s literally his job to meet face-to-face with the firm’s biggest institutional investors to discuss, explain, and sell this firm’s offerings. Unvaccinated during the entire lockdown (then Delta, then Omicron), no one knew he was unvaxxed. Now, with 75% of U.S. adults vaccinated and everyone else suffering from Zoom fatigue, it’s time to go out into the world. This employee cannot come into the office, should not meet with clients, and will soon face an important decision: Get vaccinated or get another job.

Maybe I shouldn’t be surprised that at this late date, there are still holdouts; that within an industry that demands rationality and probabilistic thinking, there are still people who make decisions that seem increasingly difficult to defend.

Presented differently: If you are charged with managing people’s wealth, maintaining their long-term investments for their retirements, generational wealth transfer, and philanthropy, what should your clients expect from you?

If it isn’t rationality and clear, level-headed thinking, then what is it?

Previously:

Investing is a Problem-Solving Exercise (January 31, 2022)

DELTA is Coming For Your Economic Recovery (August 13, 2021)

How F*cked Is Business Travel? (August 11, 2021)

The Economic Risks from Anti-Vaxxers (July 15, 2021)

Oblivious (February 3, 2021)

___________

1. In New York City frontline emergency workers such as police, EMT, and firefighters, were threatened with being fired if they remained unvaccinated. After a lot of noise, all but a tiny handful got fully vaccinated.