Enjoy Pi day (3.14) with our back to work morning train WFH reads:

• When You Think About Investing, Don’t Think About the News “I was interviewed by one of the financial news networks on one of their morning shows, and they asked me, ‘What should people do the next time the markets are getting very volatile?’ I said my advice would be to turn off this channel and switch to ESPN.” That’s not a great thing to say to financial journalists, I said. “Right,” Thaler said. “They switched immediately to a commercial.” (New York Times)

• A Mysteriously Large Chunk of Gen Z Isn’t Working A decline in labor force participation for people 65 and older is easy enough to understand, but why is it still so low for those in their early 20s? (Bloomberg)

• Some Thoughts on Bear Markets: Going back to 1950, the average peak-to-trough drawdown in a given year is -13.6%: So we’re right around average. No year is ever average when it comes to the stock market and this year is obviously far from over but I like to put these things into perspective when things seem scary. It’s always something. There is also more to the stock market than the S&P 500. At their lows in recent weeks, the Nasdaq 100, Russell 2000 and MSCI All World ex-USA were down 20%, 21% and 16%, respectively. (A Wealth of Common Sense)

• Crypto may be too big to fail. Biden’s executive order recognizes that. There didn’t have to be an executive order on crypto. The fact there was is a big deal. (Grid)

• The New Financial Supermarkets: Private-equity firms were once niche players serving big clients. Now they’re trying to be everything to everyone. (New York Times)

• Dr. Sanjay Gupta: Is America ready to take the next step in its Covid-19 recovery? We appear to be standing on the edge of the endemic phase of this global health crisis. For many, that’s the moment when we hope we can get back to our regular lives. Several times during this pandemic, I have written essays about America as if the country was my patient. The current situation has me thinking along those lines again. (CNN)

• Murdoch hounded by lawsuits that could cost Fox News billions Rupert Murdoch for years has enjoyed a Trump-like ability to avoid responsibility for the avalanche of lies he promotes. That all may be changing thanks to a pair of billion-dollar defamation lawsuits surrounding Trump’s Big Lie campaign — Murdoch appears powerless to stop the looming legal reckoning. (Press Run)

• Could Putin actually fall? What history teaches us about how autocrats lose power — and how Putin might hang on. (Vox)

• Putin proves my point. Whatever it is: While Ukrainians fight for their lives, battalions of keyboard warriors are explaining how this validates their other opinions. (Financial Times)

• Woolly Mammoth Revival Raises $75 Million From VC Firms, Paris Hilton Resurrecting the extinct creatures could slow climate change, according to a bioscience startup, but investors are keen to see human applications for the genetic research. (Bloomberg Green)

Be sure to check out our Masters in Business interview this past weekend with Michelle Seitz, Chairman and Chief Executive Officer of Russell Investments, the 6th largest manager in the world. The firm manages over $331. billion in assets and advises on another $2.8 trillion.

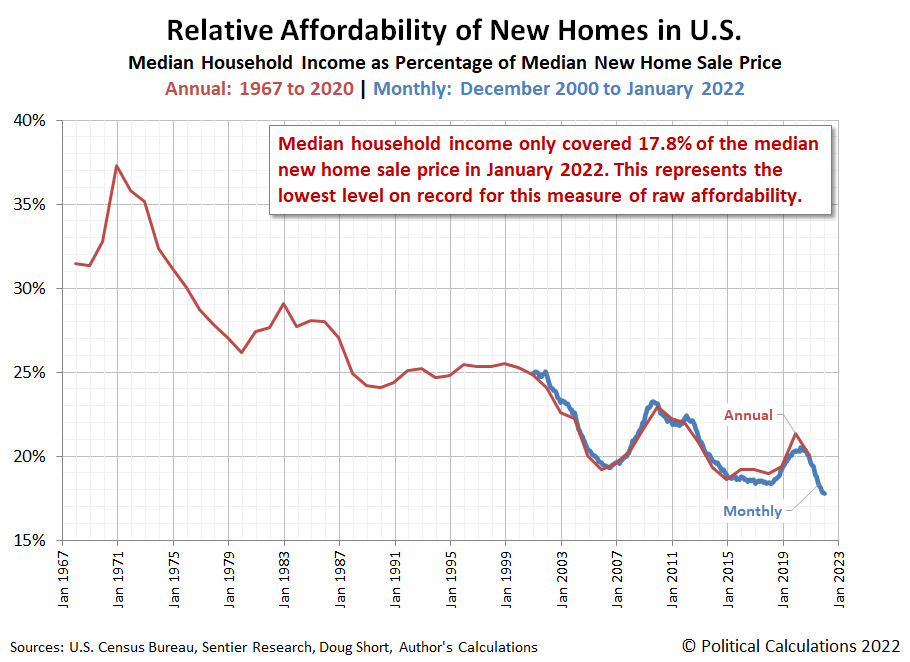

Affordability of New Homes in U.S. Resumes Decline in 2022

Source: Political Calculations

Sign up for our reads-only mailing list here.