My mid-week morning train WFH reads:

• What Does the Bond Market Rout Mean for the Stock Market? For the longest time it felt like tech stocks were the only ones worth owning. That dynamic has now completely shifted. It makes sense the biggest winners in the upswing would end up the biggest losers in the downswing but there’s a lot more going on right now. Perhaps the strangest development for investors right now is what’s happening in the bond market… (A Wealth of Common Sense)

• McKinsey Opened a Door in Its Firewall Between Pharma Clients and Regulators The firm let consultants advise both drugmakers and their government overseers, internal records show. “Who we know and what we know” was part of their pitch. (New York Times) see also Is McKinsey & Co. the Root of All Evil ? The global consulting firm has created dubious strategies for all manners of companies ranging from Enron to General Electric. Where ever there has been a financial disaster in the world, if you look around, somewhere in the background, McKinsey & Co. is nearby. (The Big Picture)

• How Jon Glidden Resurrected a Forsaken Strategy and Revived a Dying Pension. Over the course of a decade, Institutional Investor’s 2022 Allocator Lifetime Achievement honoree engineered a triumphant turnaround for the Delta Air Lines retirement fund. Here’s how he did it. (Institutional Investor)

• Affordable Prices Drive Home-Buyer Activity: The hottest places to live now are often the most affordable: Fast-rising housing prices have pushed buyers from expensive coastal cities into cheaper housing markets in recent years. Expanded remote-work opportunities and a search for different lifestyles during the Covid-19 pandemic have accelerated the trend. Less expensive cities with strong local economies climbed in the first quarter. (Wall Street Journal)

• Global Supply Chain Crisis Flares Up Again Where It All Began Ports are already snarled, with the $22 trillion trade in global goods facing months of severe disruption. (Bloomberg)

• Why Netflix is a victim of its own success: The streaming giant’s stock plunged after it announced its subscriber numbers took a hit, signaling a problem many companies face when rapid growth slows. (Grid)

• The surprising afterlife of used hotel soap Hotel guests leave behind millions of half-used bars of soap every day. A nonprofit is on a mission to repurpose them. (The Hustle)

• The list of foods banned during pregnancy is absurd. Humans are horrible at assessing risk. No OB has ever been sued for recommending a woman with child follow strict dietary guidelines that forbid almost every soft cheese worth eating, including feta, blue and brie (listeria risk); deli meats, a category I assume contains every species of corned and smoked brisket (more listeria risk); and organic health food store staples such as fresh-squeezed juice and raw alfalfa sprouts (bacteria risk). And yet riding in a car doesn’t make any list of pregnancy dangers. (Los Angeles Times)

• Sweet and Squishy as Ever, the Gummy Universe Keeps Expanding On its 100th anniversary, the colorful candy has evolved from dancing bears to a booming industry — and for some, a bountiful obsession. (New York Times)

• In “Russian Doll,” Natasha Lyonne Barrels Into the Past How the actress turned showrunner took on inherited trauma through time travel. (New Yorker)

Be sure to check out our Masters in Business interview this weekend with Mark Jenkins, Head of Global Credit, at Carlyle. The firm manages over $300 billion in assets. Carlyle’s Global Credit platform manages over $73 billion in assets in liquid, illiquid, and real asset strategies.

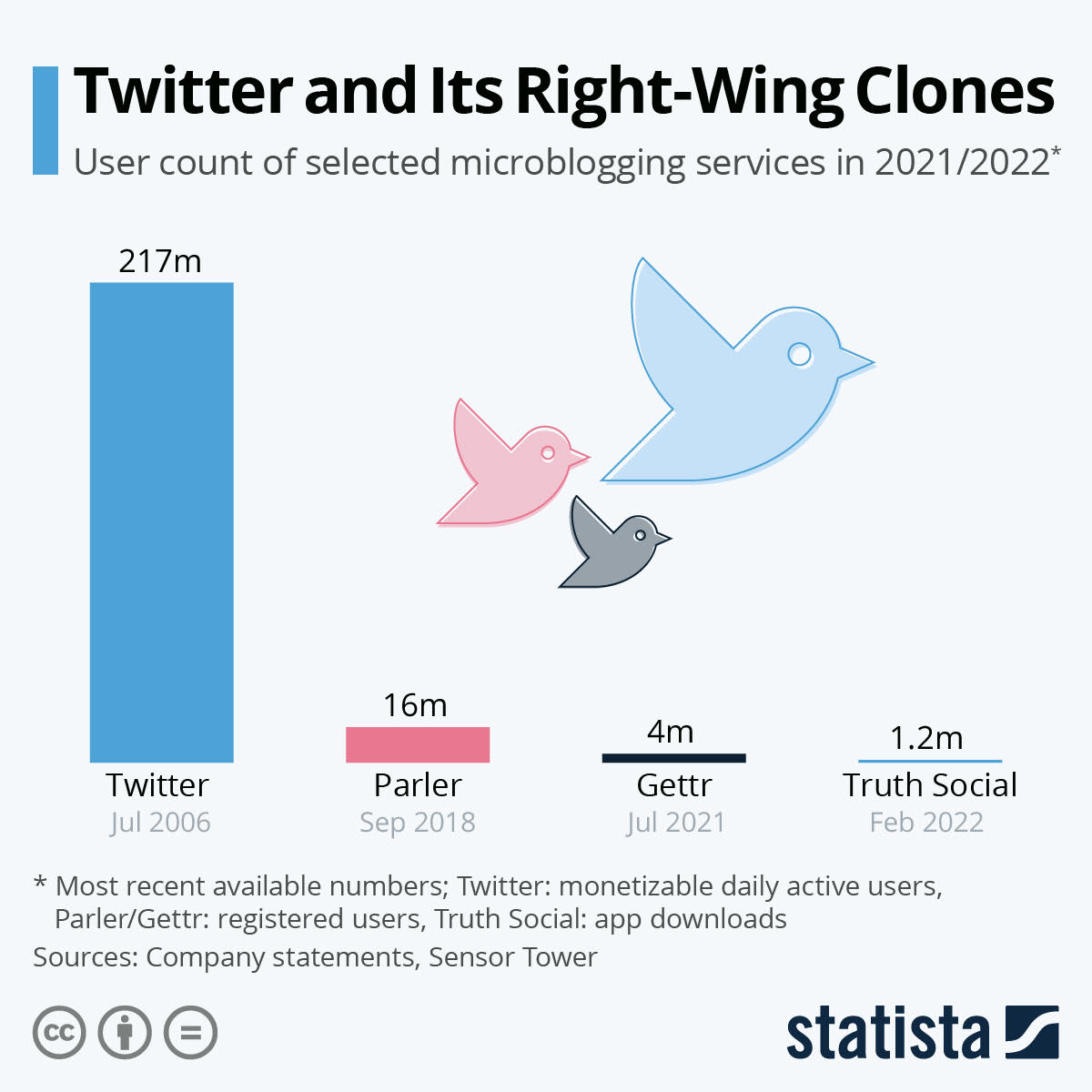

Social Media/Microblogging subscriber counts

Source: Statista

Sign up for our reads-only mailing list here.