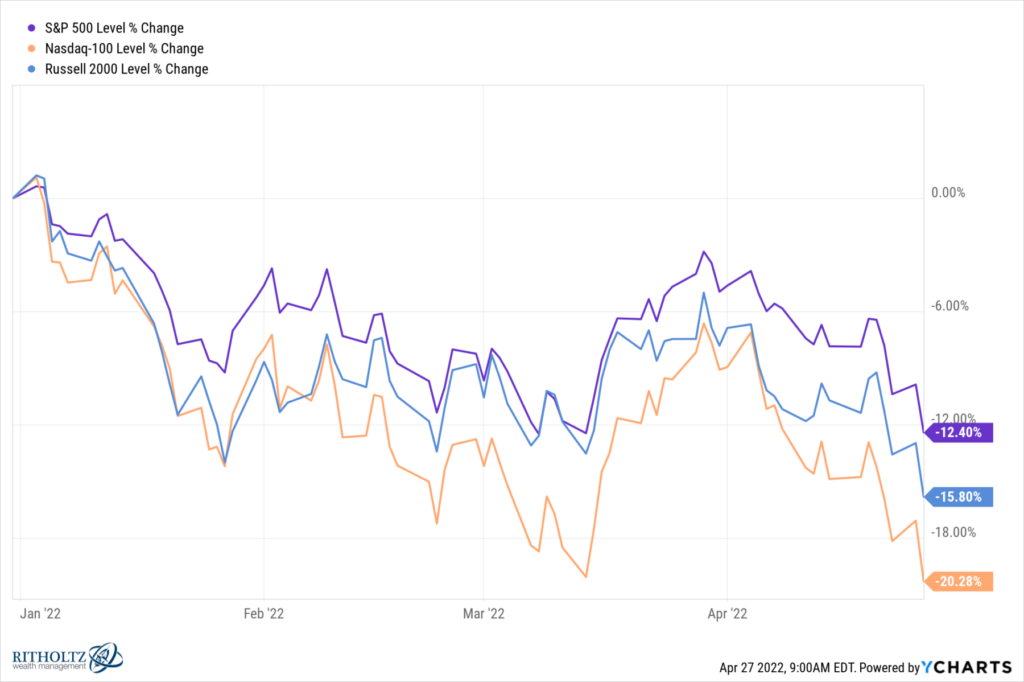

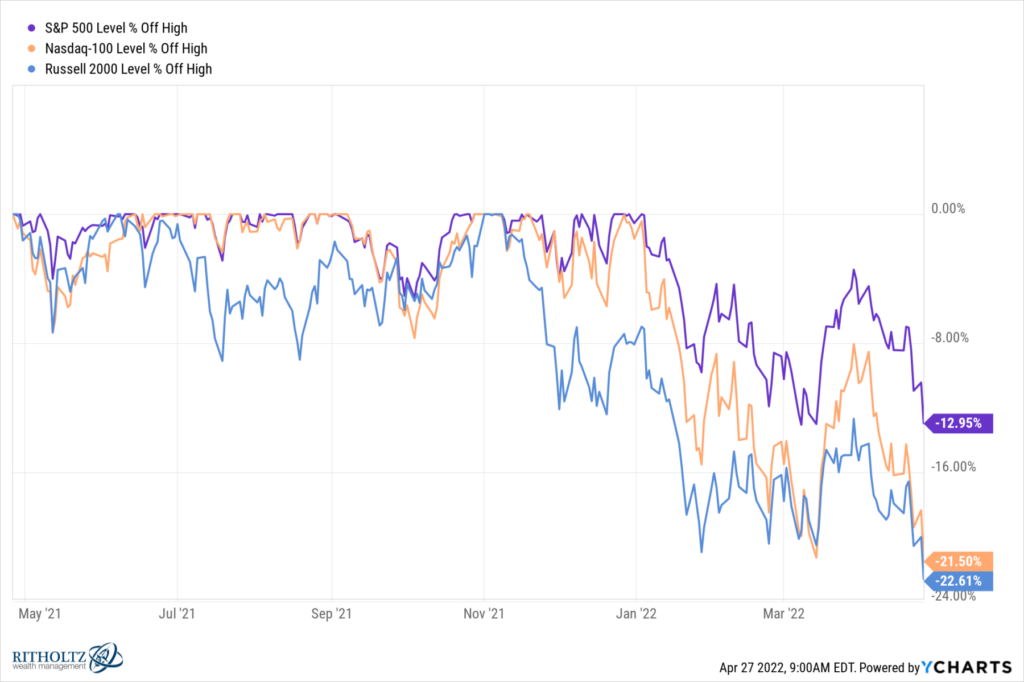

After a tremendous decade of above-average returns, and a spectacular two-year period of even stronger gains, the markets have entered a 6-month period of weakness and volatility.

Specifically, the sell-off yesterday brought the S&P500 down 12.4% year-to-date; the small-cap Russell 2000 is off 15.8%; the Nasdaq 100 tech index is down 20.3%.1 Those are comparable to each indices’ drawdown from all-time highs: 12.9%, 22.6%, and 21.5% respectively.

We do not know exactly what this is: Mere consolidation after those gains? Pricing in of higher rates and inflation? Perhaps even the end of the bull market that began in 2013?

One thing I do know from my past experience is that right around these levels, everyone becomes an expert in what you should have done to avoid the drawdowns and capture the opportunities that are so perfectly obvious today. It is the cyclical moment of glory for “Hindsight Capital, LLC.” 2

Managers of this enterprise succeed by making substantial buys and sells with perfect insight and infallible timing. They know which sector to embrace and which to avoid; what stocks to own and which to short. Of course, real estate is part of their portfolio, as are collectible automobiles, art, NFTs, and even rare wine.

Hindsight Capital sends out its employees – authorized or otherwise – to speak to the press, fund managers, RIAs, VCs, and family offices. They share their wit and wisdom, explain precisely what you got wrong, and tell you exactly what you should have done instead.

They never mention “process,” do not discuss what skills they possess, or how repeatable any approach must be. Intellectually defendable philosophies are not on the agenda, nor are any unknowns, luck, or random events. Rather, they always give specific and actionable advice, albeit too late to act upon.

Regardless, I am always grateful to receive their bountiful wisdom. Over the past few months, I have spoken to a variety of employees of Hindsight Capital. I am pleased to let you know they have shared the following insights:

Bonds: The 30-year bull market in bonds that began in 1982 is dead! Any professional money manager who could not see this coming must be blind and/or dumb.

Real Estate: Whoever sold a house or land in 2018 and 2019 was a fool, given the obvious post-pandemic rise in prices. Suburban rental demand is off the charts and the purchase demand from locked-down apartment dwellers was obvious to see (even in 2019).

Tech: Of course, Tech was going to come in! It had gone too far, and for too long to not suffer a major pullback. And all of the lockdown stocks like Peleton and Netflix were toast even before the pandemic ended.

Energy: It was obvious that energy demand was going much higher, and that those prices would lead the majors to have a huge rally. The Russian invasion of Ukraine was coming, if you only knew where to look.

Those criticisms are dead on, with two minor issues that are hardly worth mentioning. They are included here only for the sake of completeness.

The first:

All of the above critiques are years old. The 30-year bond bull dating back to 1982 only gets you to 2012; we have been hearing about the death of the bull market in bonds for much longer than a full decade. All of the gains since then – both yield and principal – don’t count if you sold your Treasuries, TIPS, and high-grade Corporates a decade ago and sat in money market funds for that whole time earning 10 bps.

As to real estate – if you were a leveraged (mortgaged) buyer renting out properties, you had to survive 2 years of eviction moratoriums. This means you might have been receiving little or no rental income without legal recourse to recover unpaid receivables (but you still had all of those mortgage and maintenance costs to cover).

And that tech valuation criticism? It’s been consistent since (checks notes) 2010 forward. As to the WFH/lockdown stocks like Peleton – it began falling in January 2021; Netflix has been mostly flat since July 2020 before its collapse began in October.

The second critique:

In investing, we don’t get to operate backward, we must invest forwards. Without the benefit of knowing what already happened. We do not know what random geopolitical events will occur, what shifts will take place in sentiment, and how revenues and margins and profits will change.

ALL WE HAVE IS PROCESS.

If you do not have a defendable process, you are just spit-balling, speculating, guessing, dart-throwing. Rather than tell people what they should have done 6 months ago, how about sharing your brilliance with us about what we should be doing for the next 6 months?

To all of the employees of Hindsight Capital, I pose the following questions:

– Are you a buyer or seller of Real Estate today? Single-family homes or multi-family apartments? Which parts of the country? Rural, Suburban, or Cities?

– What tech stocks are you short now? Which ones are you long? Which specific areas of tech do you like?

– Cash: Do you go to cash now? For how long? When and where will you redeploy that into risk assets?

– Bonds: Buyer or seller? Which ones? What duration? What credit quality?

– Equity: What sectors are you buyers of? Sellers? Which stocks?

– Alts/Privates: How much of this investment strategy should be part of your portfolio here? When do you get in or out? Which asset types?

– Energy: How much higher is oil going? How long does the war last? When do prices come down?

– Lastly, what is your basis for all of the above determinations?

As much as we may all want to work with the folks at Hindsight Capital, it is not likely they will do business with you. Part of their allure is that won’t take your money, but they are all too happy to tell you how you should have invested it . . .

Previously:

Judgment Under Uncertainty (March 25, 2022)

Hindsight Bias Free for All (May 27, 2020)

Explaining the Correction, with Perfect Hindsight (October 15, 2018)

Investors and Political Pundits Fooled by Randomness (November 11, 2016)

_______

1. I no longer understand why anyone cites the more or less irrelevant 30 stock Dow Industrials anymore. Somehow, inertia keeps us discussing this meaningless concentrated mutual fund as if it matters anymore; it doesn’t. Perhaps this is fodder for a future discussion.

2. The earliest published version of the phrase “Hindsight Capital” I could find was via my colleague John Authers, who published the phrase in a Financial Times column in 2008: “Hindsight Capital LLC had a great 2008. It has always been successful because it uses the strategy that year in and year out is better than any other: hindsight.” Authers has revisited the topic annually ever since.