My back to work morning train reads:

• It’s the Worst Bond Market Since 1842. That’s the Good News. The four-decade-long bull market in bonds is over, but that doesn’t mean you should dump them (Wall Street Journal)

• Five reasons the Fed is playing catch-up They took too long to fight inflation. Here are their best excuses. (Full Stack Economics) but see Normalization vs Inflation Fighting inflation the past decade was easy in part because of the lack of a robust fiscal response post-GFC. The massive fiscal response during the pandemic has made the task of fighting inflation much harder. (The Big Picture)

• Stock Market Bottom-Fishers Are Trawling Risky Waters The S&P 500 is down 10% this year, but there’s no way to know if this is a good time to buy. (Bloomberg)

• It’s Not Just Tesla. 8 Other Stocks to Play the Future of Transportation. One might think, from the stock market or Twitter, that Tesla and electrification are the only things that matter today in the world of transportation. But there’s a lot more to the story, including autonomous driving, ride-sharing, robotics, and mobility technology, to name just a few salient trends. Plus, there are 300 million vehicles already on the road in the U.S. alone that still need care and repair. (Barron’s)

• Too rich and too thin? Welcome to Manhattan’s newest ‘skinnyscraper’ This ‘deposit of unimaginable wealth in the sky’ is also an exquisite feat of architecture (Financial Times)

• Steve Cohen’s Secret Weapon for the Mets: His Hedge Fund Some employees from the billionaire’s firm, Point72 Asset Management, are moonlighting in crucial roles for his baseball team. Many are tasked with improving data analysis and technology. (Wall Street Journal)

• America is trying to fix the chip shortage one factory at a time A billion-dollar chip factory just opened in upstate New York. The Biden administration wants more. (Vox)

• This Chinese EV Sells At Just Over $5,000. So We Tried It Wuling’s Mini EV, made in partnership with General Motors, outsells Tesla’s Model 3 in China and costs less than adding CarPlay to a Ferrari. (Wired)

• A pulsar is firing a 7-light-year-long antimatter stream into space: What we’re seeing here is a pulsar-driven galactic-magnetic-field-focused beam of matter and antimatter stretching for 70 trillion kilometers and is big enough that we could see it by the naked eye — if only our eyes could see X-rays. And that’s just cool. (Syfy Wire)

• Rich Strike’s Derby Win Has Given Horse Racing a Welcome Reboot The colt’s jockey, trainer and owner are anything but racing royalty, but they are the kind of story the sport needs right now. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Alex Guervich of Hon Te Advisors, a discretionary global macro hedge fund. Previously, Guervich ran JP Morgans’s macro book. In 2020, Hon Te was ranked 2nd in net return, and a top 10 emerging manager. He is the author of The Next Perfect Trade and most recently, The Trades of March 2020.

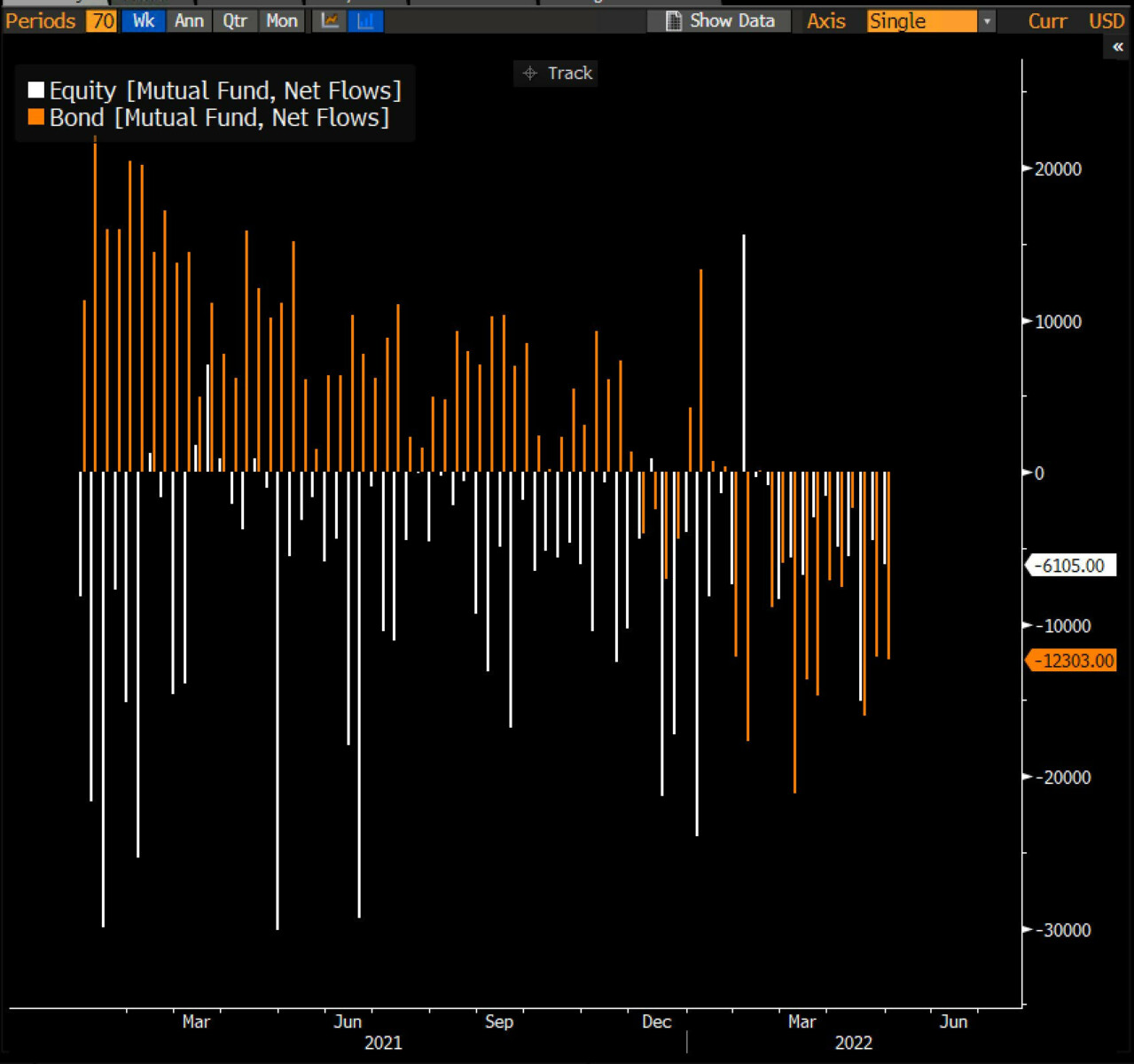

Bond mutual funds YTD have seen -$137b in outflows, worse than equity MFs at -$88b.

Source: @EricBalchunas

Sign up for our reads-only mailing list here.