My mid-week morning train WFH reads:

• How to Not Panic: Studying history, we come to realize that a lot of what we experience isn’t as unique as we think it is. The U.S. stock market typically declines by at least: 10% every other year 30% every 4-5 years 50%+ once a generation (Of Dollars And Data)

• The bull market minted millions of day traders. They’re in for a rough ride In early 2021, in the midst of speculative stock market euphoria, a pair of day traders went viral on TikTok with a video explaining their winning strategy. “I see a stock going up and I buy it. And I just watch it until it stops going up, and I sell it,” says the user known as Chad. “I do it over and over and it pays for our whole lifestyle.” (CNN) see also One-Sided Markets: Relax, it’s easy! “How do we make money day trading from, home? We only buy stocks that are going up; if they don’t go up, we won’t buy them!” The Dunning Kruger effect makes it oh-so-easy to confuse luck and skill. Easy gains combined with an extended lack of pullbacks led people to engage in poor decision-making. (The Big Picture)

• Earnings Math Catches Up With the Tech Highflyers The sector’s stock selloff signals investors have finally realized that future growth can’t justify ludicrous valuations. (Bloomberg)

• ‘The haves and have-yachts’: on the trail of London’s super-rich We join sociologist Caroline Knowles on a walk across the economic and class divide of the capital to discover how extreme wealth has reshaped our streets. (The Guardian)

• A major shift in the economic narrative could be underway: Signs emerge that inventories are correcting and labor shortages are easing. (TKer) see also Is Recession Inevitable? Consider the Data The idea the next recession will be caused by a Federal Reserve that does too much, hikes rates too far, is not credible. Inflation will end when aggregate supply and aggregate demand balance but we’ll reach that state despite what the Fed does, not because. Recession? Maybe, maybe not. (AlHambra Investments)

• Oil Windfall Brings Free College and Day Care to One of the Poorest States New Mexico this year became the first US state to offer free college to its residents and free child care to most families, all on the back of soaring revenue from royalties and taxes on oil and gas production, which are booming on its patch of the Permian Basin. The state now ranks behind only Texas in energy production. (Businessweek)

• Spies’ night eyes: Once-restricted tech is helping spot Russian troops, Chinese missile sites and raging wildfires Satellites equipped with regular cameras can’t snap shots of most of the planet most of the time: ~70% of the globe is shrouded in clouds, and at any given time about half of the planet also happens to be dark. That’s where a newer kind of satellite comes in. Instead of using cameras to detect visible light, they rely on a technology called synthetic aperture radar (SAR) that beams microwaves at Earth. These microwaves shoot through clouds and don’t know the difference between day and night. (Grid)

• Don’t Let the Pandemic Make You Hate Microbes: These organisms digest our food; maintain the pH of microenvironments such as saliva, bile, gastric acid, and tear ducts; and remove dead cells so live ones can take their place. They colonize our skin, hair, and armpits, and coat our every single nook and cranny inside and out. The presence of a healthy array of microbiota is imperative for maintaining nearly every physiologic process and for thwarting growth of the pathogens that make us sick. (Slate)

• What People Misunderstand About Red-Pilling: I’ve been doing fieldwork in far-right online communities since 2016. I hang out on white supremacist Telegram channels, comb through QAnon threads on 8kun (formerly known as 8chan), and watch TikToks that claim COVID-19 is a globalist plot. Like most people who work with far-right content, I find it emotionally draining and unpleasant. But I’m also convinced that the mainstream acceptability of extremely racist and conspiratorial beliefs is a threat to American democracy. (Slate)

• ‘Pickleball Is the Wild, Wild West’: Inside the Fight Over the Fastest-Growing Sport in America There are: Too many leagues. Too many federations. Battling billionaires. Bad behavior. And the growth of a booming sport is on the line. (Sports Illustrated)

Be sure to check out our Masters in Business interview this weekend with Gerard K. O’Reilly, Co-Chief Executive Officer and Chief Investment Officer of Dimensional Fund Advisors, which manages $650 billion in client assets. Previously, he was Head of Research at DFA, managing the firm’s rigorous approach to interpreting, testing, and applying research in portfolios.

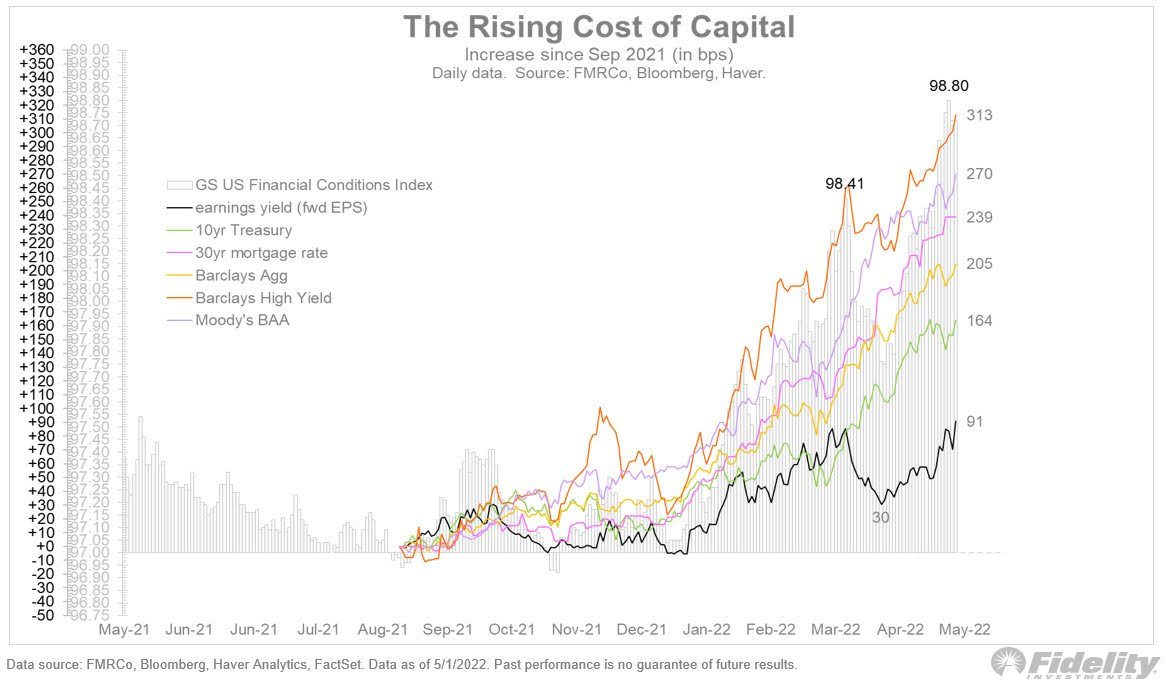

When the Fed wants to slow demand by raising the cost of capital, no market is immune

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.