My back to work morning train WFH reads:

• Awaiting the cure for high prices: They often say that the cure for high prices is high prices. The idea is that when the price for something goes up by too much, fewer people will be willing or able to pay for it. And so demand comes down, and in turn the price comes down. But while inflation has indeed been running hot, the problem — ironically — is that consumers and businesses are in unusually strong financial positions. And while this may prevent any economic slowdown from becoming economic calamity, it’s also a curse in that it has enabled consumers and businesses to pay the higher prices. (TKer)

• Got Losses on Stocks, Bonds or Crypto? Let Uncle Sam Share Your Pain It’s been a brutal year for markets. The good news: Selling your losers can pay off at tax time. Here’s what to know about tax-loss harvesting. (Wall Street Journal) see also Abandon Stocks for Bonds? If Only Life Were So Simple. Investors who shunned bonds for years need to reassess their objections, even if there is no magic fix to the difficulties of inflation. (Wall Street Journal)

• Leaders Imagining Markets in 2052: We asked top executives at Goldman Sachs, Citigroup, Bridgewater to tell us which innovations will make a difference in the next 30 years. (Markets)

• It’s Time to Get Biofuels Out of Your Gas Tank Blending mandates were supposed to help tackle emissions. In practice, plant-derived alternatives are starting to become an impediment. (Bloomberg)

• 3M’s ‘Forever Chemicals’ Crisis Has Come to Europe The fight over a tunnel project in Antwerp has revealed extraordinary levels of toxins in the water, soil, and people near the company’s factory. This time there could be criminal charges. (Businessweek)

• ‘After lockdown, things exploded’ – how TikTok triggered a books revolution: Have teenagers taken control of publishing? With some authors notching up a billion views, we look at how TikTok is electrifying the world of books – creating bestsellers, reviving classics and rescuing neglected genres (The Guardian)

• This Nerve Influences Nearly Every Internal Organ. Can It Improve Our Mental State, Too? On social media, exercises that aim to “tone” one of our body’s longest nerves have been touted as a cure-all for anxiety and other psychological ailments. Here’s what the research says. (New York Times)

• The Pedestrian Outlaws Who Are Tired of Waiting for Cities to Slow Down Cars Members of the Crosswalk Collective have been painting crosswalks at intersections in residential neighborhoods around Los Angeles. Each new crosswalk represents a small point of contention in the battle between automobiles and human beings on foot, in a place where the city hasn’t taken action and so those human beings must. They are handmade, DIY infrastructure-as-protest. I love them. (Slate)

• Mike Pence Is an American Hero: Democrats should honor the Republican who’s trying to end Trumpism. (The Atlantic)

• Palais Intrigue: A dispatch from Cannes 2022: Cannes is built on tuxedo people. The festival is not so much about the films as it is about glamour and, even more importantly, access to it. The hierarchy of access extends to press badges, which run from pink to blue to yellow in order of importance; party invites; interview availability; a near-feudal ticketing system; and almost every other facet of the festival. But foremost, the hierarchy is this: there are those at Cannes and those who are not, and this is what allows the festival to function. (The Baffler)

Be sure to check out our Masters in Business this week with Mark Mobius of Mobius Capital. Known as the “The Godfather of Emerging Markets,” he was tapped by Sir John Templeton in 1987 to run Templeton Emerging Markets, one of the first EM funds in the world. Over the next 30 years, he visited 112 countries, invested in 5,000+ companies, and traveled 1,000,000+ miles. This helped to grow the Templeton Emerging Markets Group from $100 million in six markets to over $40 billion in 70 countries.

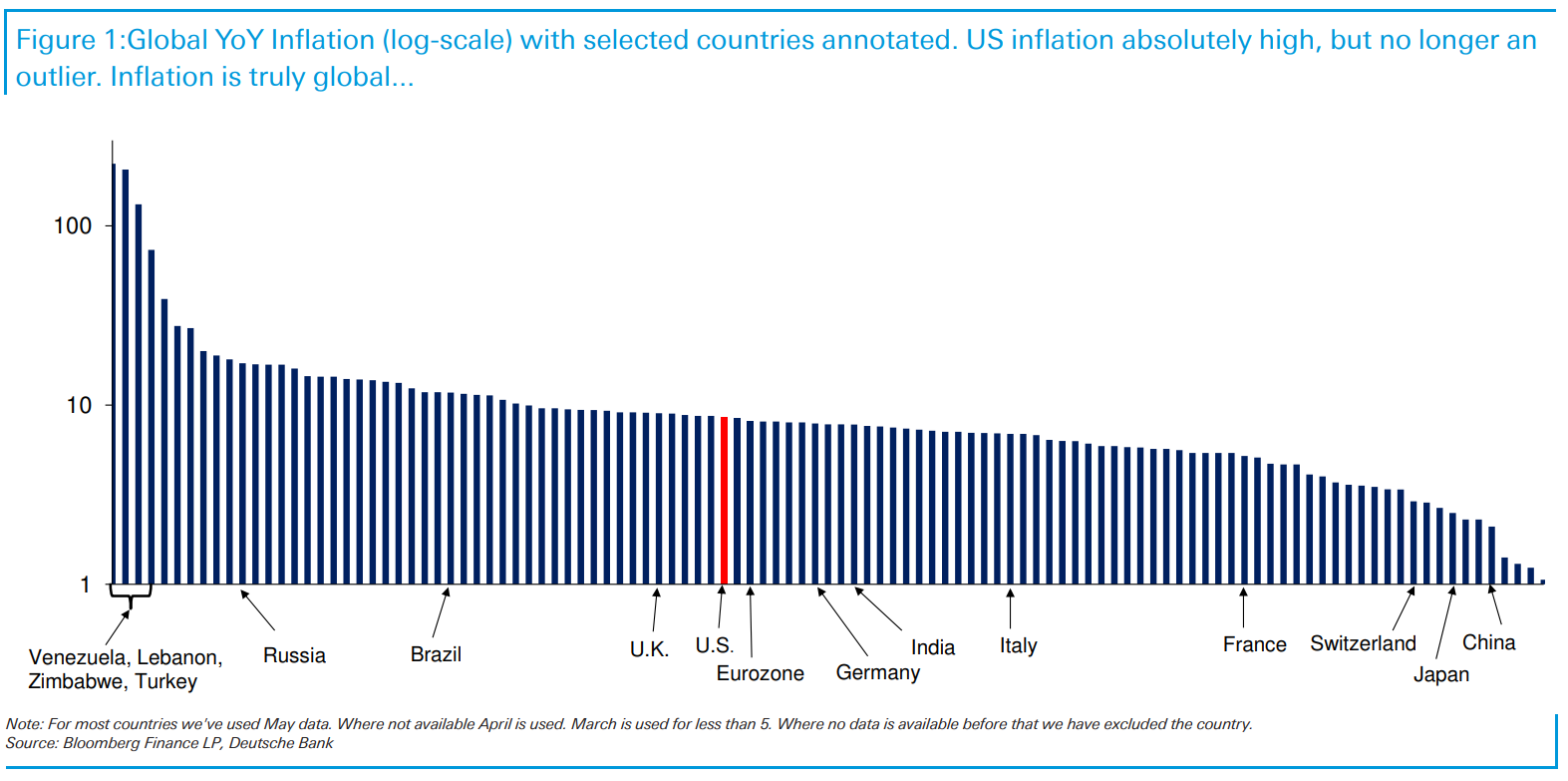

US inflation is now middle of the pack, 48th of 111 countries covering the most up-to-date data available

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.