There is some confusion about a) What a recession actually is, and b) Why it matters. Sometimes, ideas we think of as obvious get taken for granted, and simple matters become the subject of disagreement. When that occurs, we go back to first principles to explain what these issues mean and why they are significant.

Investors are concerned about Recessions because economic contractions shrink employment, lower consumer and business spending, reduce corporate revenue, and ultimately, impact profits negatively. The key for investors is that last item: Lower Earnings.

While there are numerous theories about stock market prices, they all seem to come down to some combination of two items: Profits and the market multiple assigned to them.

Earnings are reported quarterly, but that multiple is determined constantly by investor psychology. The Prices/Earnings ratio (P/E) fluctuates over time, so Price = Earnings X Multiple is not fixed. This is why recessions can be a double whammy: Earnings falling at the same time as psychology becoming more negative. The net result of both is to drive overall stock market prices lower.

~~~

This simple truism is why whether we are in a technical recession or not – and I think “not” – matters much less than whether economic activity is contracting — specifically, whether corporate and household spending is falling.

Let’s delve into the specifics:

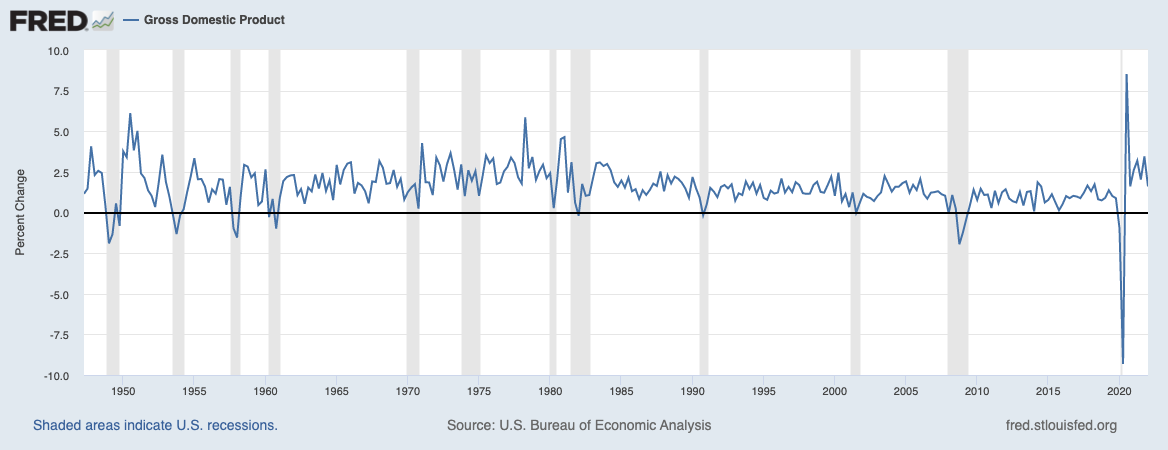

The start and end points of recessions are determined by the National Bureau of Economic Research (NBER),1 the official arbiters of such things in the U.S. Even if you use a rule of thumb such as two negative quarters of real GDP, what matters to investors are those key drivers: Earnings and market multiples. When the economy is expanding, but we get two negative GDP prints anyway, it’s not that important. In the present case, we have fluky movements in trade and inventories that are a quirk of measurements, not a reflection of an economic contraction affecting corporate revenues or profits. At least, that is what has been happening so far.

Hold aside the possibility of Q1 and Q2 being negative real GDP. Consider what the US economy has done over the first two quarters of 2022:

Jobs: Created 2.74 million new jobs;

Wages: Up 5.1% y/y for all workers, 6.4% for lower-wage workers

Consumer Spending: Increased y/y 4%

Corporate Profits: Profits have risen substantially in Q1 & Q2 10.6% from last year; 2022 forecasts expect companies in the S&P 500 to see full year profits grow by 10.6%.

Home Sales: The biggest negative in the economy is a red hot housing market is cooling off; sales of existing homes fell 3.4% in May, the fourth month in a row that sales have declined. Normally, we see sales increase from January lows to peak in July / August. The lack of inventory drove prices higher, but rising mortgage rates are now a drag.

A relatively healthy economy, with the problem being not declining economic activity, but inflation causing problematic price increases.

~~~

So if the economy is fine, why is the market down so much? One reason is mean reversion – the past two years have been far above average 8% market returns with 2020 at +21% and 2021 at +28%. The other reason being the end of very cheap credit and very low capital costs. This is likely to impact corporate profits eventually.

The Fed’s fight against Inflation gets much of the blame (or credit) for rising rates, but the Federal Reserve was long overdue to move off of its emergency footing and towards more historically normal rates. With the benefit of hindsight, Fed Chairman Jerome Powell now realizes this should have begun earlier in 2021. Regardless, with CPI inflation at 40-year highs, the Fed has its excuse to end both zero-interest policy rate (ZIRP) and quantitative easing (QE) policies.

The key question for investors is a potential policy error: Will the Fed get execute this plan just right? Can they cause a growth recession — cooling the economy enough to end inflation — but not cause a full recession? Or will they overtighten and cause an actual economic contraction?

My position is that we are likely past peak inflation, that much of the price increases we have seen are beyond the Fed’s control, and they no longer need to raise rates aggressively. Instead, they should be on a more gradual path towards normalization. The CPI report on June 13th might provide some clues if we are going to see a 50bps or 75 bps rate increase.

The answer to our title question is Earnings, since how the FOMC proceeds is likely to impact that, investors are left with three questions:

1. Will the FOMC recognize peak inflation and moderate its tightening cycle?

2. Will they go another 75 points again, risking full contractionary recession?

3. How much of this is already priced into equity markets?

We get our next inflation hint when the Consumer Price Index is released Wednesday, July 13; the next FOMC meeting is July 27 + 28.

Previously:

Revisiting Peak Inflation (June 29, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Too Many Bears (May 3, 2022)

One-Sided Markets (September 29, 2021)

See also:

The Biggest Argument in Finance Right Now (Wealth of Common Sense, July 9, 2022)

_______

1. The National Bureau of Economic Research’s definition of a recession is “A significant decline in economic activity that is spread across the economy and that lasts more than a few months.”