My end-of-week morning train WFH reads:

• The stock market can be an emotional roller coaster. It shouldn’t be. There’s how you think about investment risk — and then how you feel about it. (Vox)

• Gen Z Knows What It Wants From Employers. And Employers Want Them. To tap into the creativity of younger workers, and to offset a labor shortage, companies are offering four-day weeks, club memberships and work-from-anywhere flexibility. (New York Times) see also You’re Back at the Office. Your Annoying Colleagues Are, Too. Employees are rediscovering the pet peeves that come with working inches apart from one another (Wall Street Journal)

• The people making millions off Listerine royalties A little-known provision in a 100-year-old contract opened up the door for private investors to mint money from mouthwash sales. (The Hustle)

• Bank of England Gives a Lesson in Honest Central Banking: Analytical directness and intellectual honesty from monetary policy makers are inspiring. (Bloomberg)

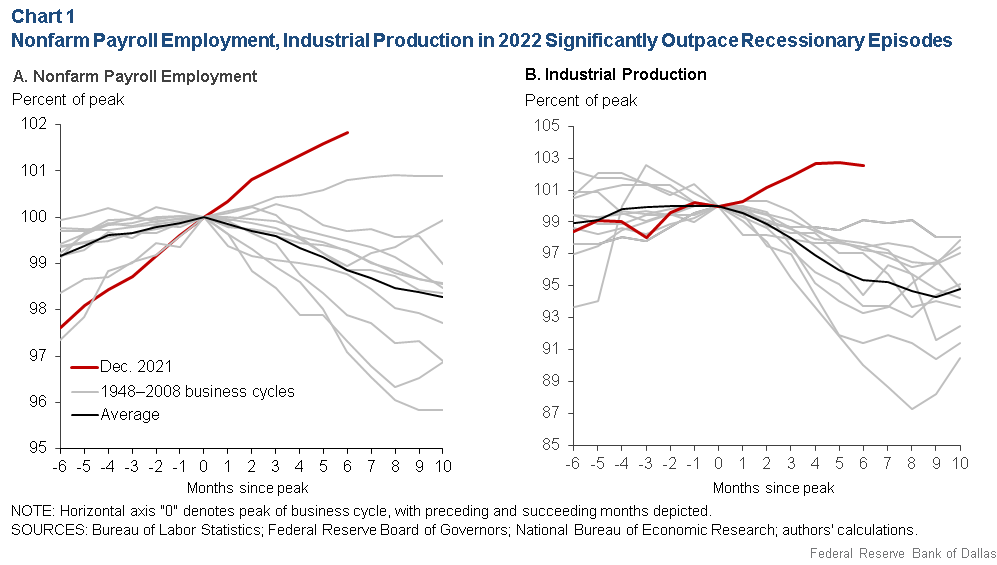

• Blame History for Making Recession Calls So Hard: The National Bureau of Economic Research has been putting dates on downturns since 1929 — well before there was such a thing as gross domestic product (Bloomberg) see also Does This Look Like a Recession To You? Things are very weird right now. Contradictions abound. All of the confusion results from turning the economy off and back on again. 2020 threw a wrench in everything. Everything. (Irrelevant Investor)

• The U.S. made a breakthrough battery discovery — then gave the technology to China Department of Energy officials declined NPR’s request for an interview to explain how the technology that cost U.S. taxpayers millions of dollars ended up in China. After NPR sent department officials written questions outlining the timeline of events, the federal agency terminated the license with the Chinese company, Dalian Rongke Power Co. Ltd. (NPR)

• The Making of a Conspiracy Theory: On the fabrication of well-poisoning accusations in medieval Europe. (Lapham’s Quarterly)

• Life Helps Make Almost Half of All Minerals on Earth: A new origins-based system for classifying minerals reveals the huge geochemical imprint that life has left on Earth. It could help us identify other worlds with life too. (Quanta Magazine)

• Londongrad is Falling Down: Inside London’s Struggle to Wean Itself From Russian Billions; Some say the uproar over sanctions unfairly targets elite U.K. citizens. Others are skeptical an oligarch diet can last. (Vanity Fair)

• Playing Carnegie Hall: On the science, or art, or mystery of acoustics. Are the acoustics of Carnegie Hall an accident? An example of serendipity? Or are they by design? The result of science? I know nothing about the subject—but I lean toward serendipity. Otherwise, why couldn’t other people, other halls, simply follow suit? (New Criterion)

Be sure to check out our Masters in Business interview this weekend with Anat Admati, Professor of Finance and Economics at Stanford University Graduate School of Business. She is also the director of the Corporations and Society Initiative, and a senior fellow at Stanford Institute for Economic Policy Research, She was named by Time Magazine as one of the 100 most influential people in the world, and is the co-author of The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It.

U.S. Likely Didn’t Slip into Recession in Early 2022 Despite Negative GDP Growth

Source: Federal Reserve Bank of Dallas

Sign up for our reads-only mailing list here.