My back-to-work morning train WFH reads:

• When is a Bear Market Over? Like many things in the market, there aren’t any hard and fast rules for this kind of thing, especially in real-time. Let’s look at the 2008 scenario as an example. The S&P 500 topped out in early October 2007 and bottomed in March 2009. On a price-only basis, the index didn’t reach those 2007 highs again until March 2013: (Wealth of Common Sense)

• How Remote Work is Shifting Population Growth Across the U.S. New county level population growth data reveal that 2021 marked a clear break from past trends, not a continuation of them. The patterns of growth are consistent with remote work being an important driver of population loss in dense urban counties. Further, the shrinking gap between urban and suburban home prices suggests a significant portion of this urban exodus is permanent, not driven by temporary pandemic-related factors. (Economic Innovation Group)

• Is Private Credit a Bubble, or Just a Little Frothy? The asset class has exploded in popularity over the past two decades — but that doesn’t mean it’s about to blow up, argues our columnist. (Institutional Investor)

• The rise of the side startup: Remote workers are starting new businesses behind their bosses’ backs (Vox)

• Why Charging a Car Needs to Be as Easy as Filling Up With Gas: Long queues and buggy apps add to range anxiety for electric-car owners. (Bloomberg) see also Great American Road Trips Are Impossible for Most Electric Cars. Of the 11 most popular road trips as determined by AAA, four have stretches of at least 200 miles between public fast-charging stations. (Bloomberg)

• The search for an AC that doesn’t destroy the planet: The AC is about a century old. What comes next? (Recode)

• 100 Tips for a Better Life: You can improve your communication skills with practice much more effectively than you can improve your intelligence with practice. If you’re not that smart but can communicate ideas clearly, you have a great advantage over everybody who can’t communicate clearly. (LessWrong)

• How a Phoenix record store owner set the audiophile world on fire: MoFi claimed its expensive reissues were purely analog reproductions. It had been deceiving its customer base for years. (Washington Post)

• How American Spaceflight Entered Its Era of Compromise: Looking back at the shuttle program at 50. (Slate)

• How ‘Field of Dreams’ Turned Iowa Into Baseball’s Mecca: They’re building it. And they’re coming. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Ken Tropin, chairman and founder of Graham Capital Management, a multi-strategy quantitative hedge fund managing $17.2 billion. Previously, he was President and Chief Executive Officer of hedge fund John W. Henry & Company, working with such legendary traders as John Henry and Paul Tudor Jones.

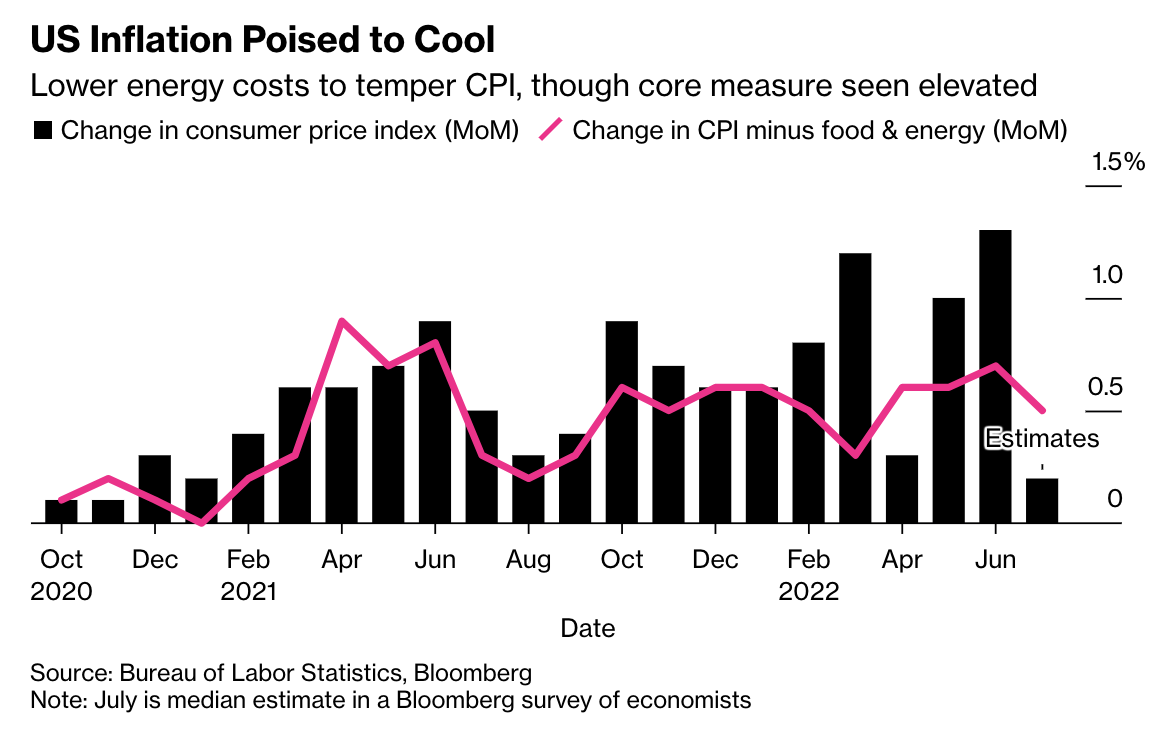

US Inflation Peak in Sight But Debate Rages Over What Comes Next

Source: Bloomberg

Sign up for our reads-only mailing list here.