My Two-for-Tuesday morning train WFH reads:

• When is a Bear Market Over? Like many things in the market, there aren’t any hard and fast rules for this kind of thing, especially in real-time. (A Wealth of Common Sense) see also Countertrend? Typically, secular bull and bear markets are best identified after the fact – something that allows precision but is useless for investors. In real-time, you have to make your assumptions and place your bets. (TBP)

• You can make any piece of data look bad if you try: Let’s review 9 unsettling market observations that miss the point. (TKer)

• How Inflation Can Be Both 0% and 8.5% at the Same Time Consumer prices didn’t rise in July. But that doesn’t necessarily mean they’re not rising. Is inflation now 0%? (Bloomberg) see also The Market’s Peak Inflation Story Fights the Fed There’s no sign the Fed will change its mind and agree that rates should come down again next year. (Wall Street Journal)

• Chinese Shun Debt and Pile Up Savings, Threatening Global Growth Engine Households downbeat about their prospects are retrenching, with consequences for local giants as well as multinationals. (Businessweek)

• The Place With the Most Lithium Is Blowing the Electric-Car Revolution: A California-sized piece of South America is stifling production of the metal at a time when battery makers desperately need it (Wall Street Journal) see also Why renewable subsidies are better than carbon taxes: Democrats got this one right, and economists were left in the dust (Noahpinion)

• The Secret Life of Leftovers. Cheese, curry, beer: We can thank our ancestors who put food scraps to creative use. What we’re leaving our children is garbage. (New Atlantis)

• Hidden inside the Inflation Reduction Act: $20 billion to help fix our farms Farming destroys the environment. Biden’s inflation bill could help blunt the impact. (Vox) see also How the Inflation Reduction Act might affect you — and change the U.S. The package, while smaller than Democrats’ initial ambitions, would transform huge sectors of the U.S. economy and affect millions of Americans (Washington Post)

• For Electric Vehicle Makers, Winners and Losers in Climate Bill: Carmakers may need several years to revamp their supply chains to meet new rules, but the legislation is still seen as a win for electric vehicles. (New York Times)

• The Summer of NIMBY in Silicon Valley’s Poshest Town: Moguls and investors from the tech industry, which endorses housing relief, banded together to object to a plan for multifamily homes near their estates in Atherton, Calif. (New York Times) see also VC Billionaire Marc Andreessen and Ultra-Wealthy Neighbors Thwart Housing in California Town: Andreessen has been a critic of anti-housing zoning in the past. (Bloomberg)

• The Yankees’ Dream Is a World Series. Their Nightmare Is Aaron Judge on the Mets. A star outfielder bets on himself and delivers the season of a lifetime. Someone’s going to pay. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Ken Tropin, chairman and founder of Graham Capital Management, a multi-strategy quantitative hedge fund managing $17.2 billion. Previously, he was President and Chief Executive Officer of hedge fund John W. Henry & Company, working with such legendary traders as John Henry and Paul Tudor Jones.

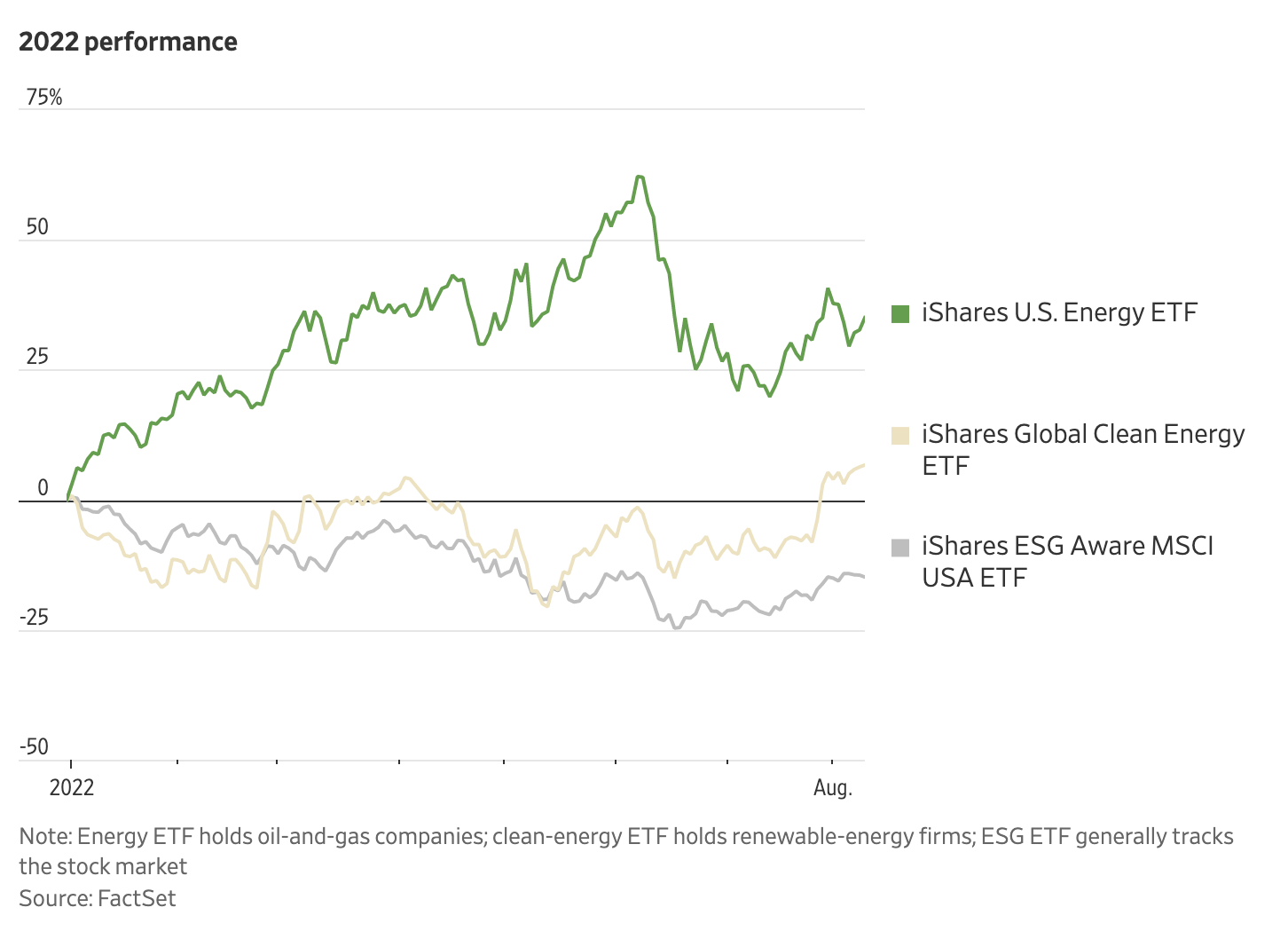

Wall Street, Like the Climate Bill, Bets on Both Green Energy and Fossil Fuels

Source: Wall Street Journal

Sign up for our reads-only mailing list here.