My Two-for-Tuesday morning train reads:

• Rising Bond Yields Change the Calculus for Stocks: Whether markets get any reprieve from their recent selloff depends in part on what happens at the Fed meeting. (Wall Street Journal) see also Municipal Bonds Suddenly Look Cheap. Some Are Tax Traps. Investors are bailing out of municipal bond funds at a record pace, but bargain hunters should beware of some potential pitfalls. (Wall Street Journal)

• Interest Rates Are Up, So Why Are Bank Stocks Down? As inflation rises, bank deposits fall by nearly $370 billion in the second quarter—the largest decline in 20 years. (Chief Investment Officer)

• ‘Poison’ Ivy Zelman—the analyst who predicted the 2008 housing bust—sees U.S. home prices falling in both 2023 and 2024. Here’s how much: When Toll Brothers CEO Bob Toll tried to say the housing market had bottomed out in 2006, Zelman famously quipped back, “Which Kool-Aid are you drinking, because I want some.” Fast-forward to 2022, and Zelman once again has housing bulls sweating. (Fortune) see also Current State of the Housing Market: This is a market overview for mid-September (Calculated Risk)

• Some WFH Employees Have a Secret: They Now Live in Another Country: With growing pressure to return to the office, some employees are struggling to hide the fact that they now live abroad. “It’s quite hard to keep up the facade all the time,” one person said. (Vice)

• Scams are showing up at the top of online searches. Searchers, beware: That Google, Bing or DuckDuckGo ad might be ‘malvertising’ — phishing campaigns and malware hiding behind legit-looking links (Washington Post) see also If It Sounds Too Good To Be True: How would you like to buy a Rolex — brand new, with papers and box — for MSRP? That’s about 30-40% of what they are trading for online today. (The Big Picture)

• No, the U.S. didn’t outsource our carbon emissions to China Busting a common myth. (Noahpinion)

• How Patagonia’s ownership bombshell changes the game for American business: Forget woke capitalism or some tax scheme. Patagonia has moved the goalposts—again—on our expectations of what companies can do to fight climate change. (Fast Company) see also Earth is now our only shareholder. Yvon Chouinard: If we have any hope of a thriving planet—much less a business—it is going to take all of us doing what we can with the resources we have. This is what we can do. (Patagonia)

• I Went to Trash School: An education in “juice,” how to protect your shins, and keeping 12,000 daily tons of garbage at bay. (Curbed)

• Life on Mars? This Could Be the Place NASA’s Rover Helps Us Find It. Rocks collected by Perseverance are filled with organic molecules, and they formed in a lake that would have been habitable a few billion years ago. (New York Times) see also NASA’s Perseverance Rover Investigates Geologically Rich Mars Terrain: “This juxtaposition provides us with a rich understanding of the geologic history after the crater formed and a diverse sample suite. For example, we found a sandstone that carries grains and rock fragments created far from Jezero Crater – and a mudstone that includes intriguing organic compounds.” (NASA)

• Mar-a-Lago: the lax security of Trump’s alternative ‘White House’ – visualized The ex-president’s Florida estate has a history of security breaches, from US military plans viewed in front of paying guests to a makeshift ‘situation room.’ (The Guardian)

Be sure to check out our Masters in Business this week with Albert Wenger, Managing Partner at Union Square Ventures. He co-founded 5 companies; was President of del.icio.us thru the company’s sale to Yahoo; angel investor Etsy + Tumblr. Wenger is the author of World After Capital, describing the shift to a Knowledge Age + its implications for businesses & society.

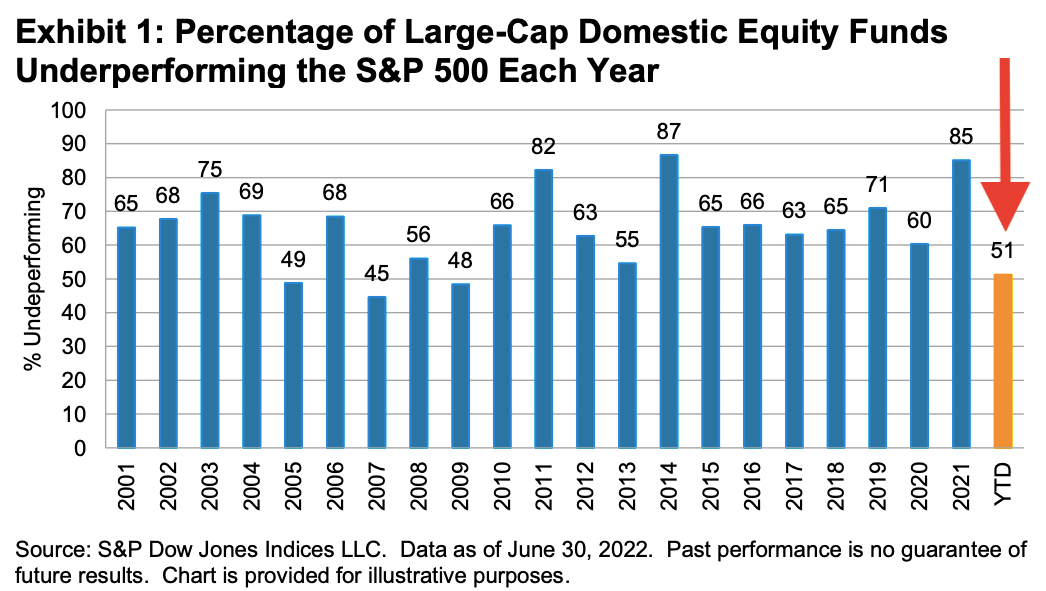

Most pros can’t beat the market: Only 3 of passed 20 years did a majority of pros best their benchmarks

Source: TKer