For years, we have heard that “there is no alternative” – TINA – to equities, and that thanks to the Fed, “Cash is trash.”

No longer. The Federal Reserve, in its belated attempt to fight inflation, has cranked up rates to the point where today, there is an alternative to stocks: Bonds.

It’s been over two decades since the Fed first began panic cutting interest rates in response to such events as the 1998 Long Term Capital Management implosion, the 2000 dotcom crash (2001-03), the September 11th terrorist attacks in 2001, the great financial crisis in 2007-08, three 25 bps cuts in 2019 for reasons unknown, and the rate slash during the pandemic in 2020.

Despite what you may have heard, the Fed isn’t the only factor driving equity markets. However, they are significant — and rising rates this year have been a headwind for both equities and the economy.

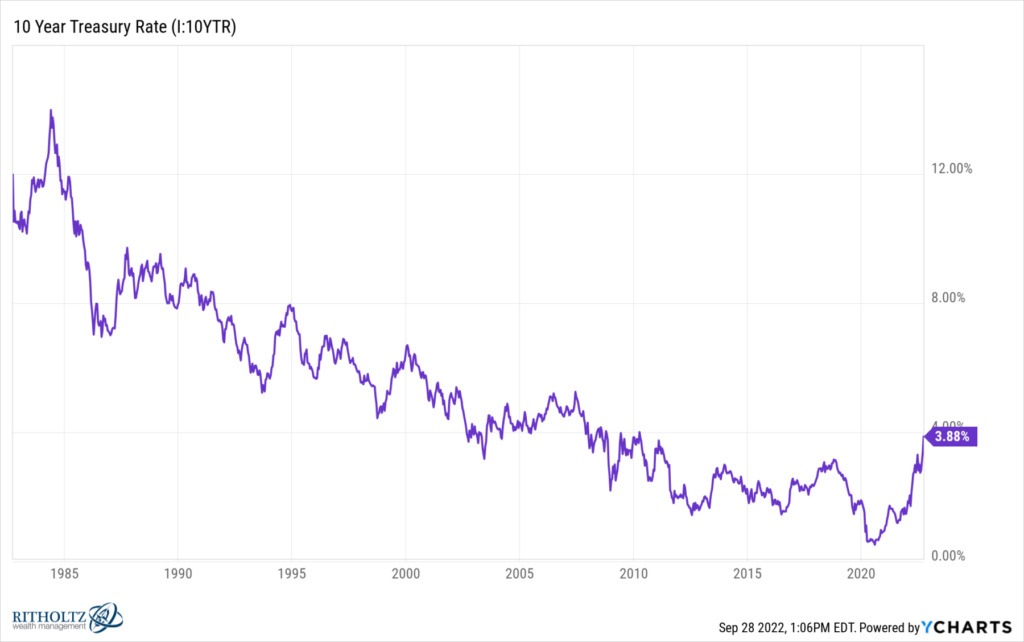

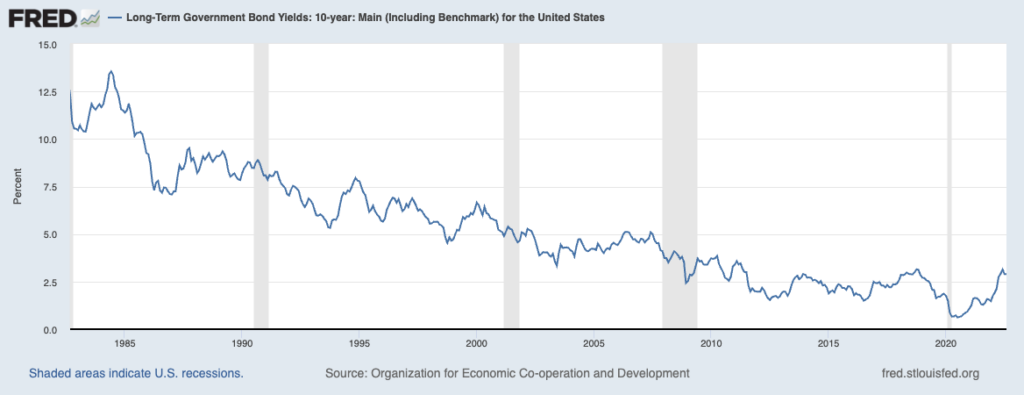

Market drawdowns occur on an all too regular (if not scheduled) basis. But the -23% of the SPX may not be the biggest story of 2022: The single most important change has been the end of the bond bull market that dates back to 1981. It is a one-in-a-generation, perhaps even once-in-a-lifetime event.

There is no small irony that the 4-decade long bond bull market was also kicked off by a Federal Reserve responding to inflation. Alas, today’s inflation is 1) not like that of the 1970s; 2) the economy is nothing like the 1980s double-dip recession; and 3) Jerome Powell is no Paul Volcker. 1 and 2 are good, I suspect 3 is problematic.

2022 may not be 1981-82, but for the first time in several years, bonds are attractive investment options. In addition to providing diversification versus equities, and some ballast to an allocation, you now get paid for owning them.

Consider:

The 10 Year Treasury Bond kissed a 4% yield yesterday and is now trading just under that:

Municipal Bonds are yielding between 3 and 5% – the taxable equivalent of 4.4 to 6% yield or better (according to Bankrate’s Tax Equivalent Yield Calculator)

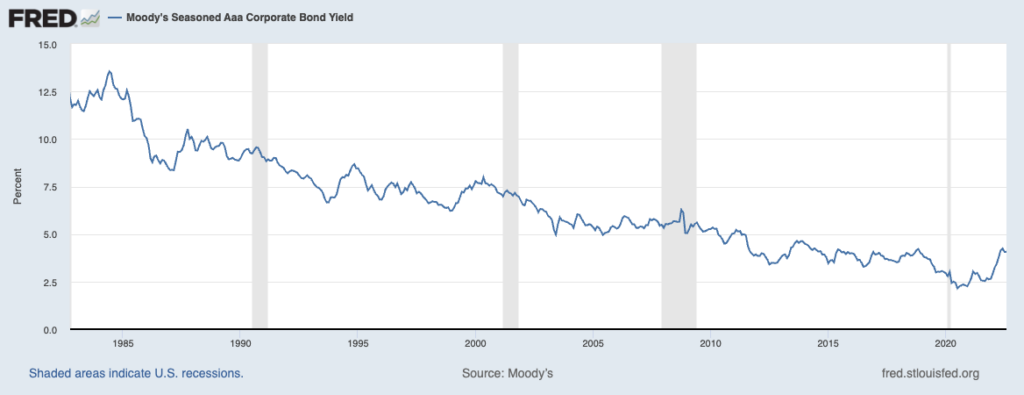

High-Grade Corporates are yielding over 4% (more if you go lower in quality (ill-advised) See the Moody’s Seasoned Aaa Corporate Bond Yield (AAA)

Of course, the downside to higher yields is that mortgage rates have all gone up: a 30-Year fixed mortgage spiked from under 3% to nearly 7%! Housing is typically the first place where higher rates bite into the economy.

~~~

More irony: Now that TINA is gone, and there is an alternative to equities, we will soon reach a point where stocks become very attractive. We are getting close to that moment.

See also:

Global Bonds Rally After 10-Year Treasury Yield Touches 4% (WSJ, September 28, 2022)

Expected Returns For Bonds Are Finally Attractive (A Wealth of Common Sense, September 27, 2022)