My end-of-week morning train WFH reads:

• For Diving FAANG Stocks, It’s the End of an Era: The five FAANG stocks are on track for their worst simultaneous losses ever, a far cry from their late-2021 highs. The stocks—Facebook parent Meta Platforms, Apple, Amazon, Netflix and Google parent Alphabet—have posted double-digit declines this year for the first time. The latest batch of earnings results has revealed their changing fortunes and, in some cases, dragged them lower for the year. (Wall Street Journal)

• Which Asset Class is More Attractive Right Now: Stocks or Bonds? Losing money stings but I prefer to look at bear markets as an opportunity. And with both stocks and bonds down big this year, there is no shortage of opportunities right now. (Wealth of Common Sense)

• Home prices are finally starting to fall—especially in California: Nobody is sure why home prices are falling faster west of the Rockies. (Full Stack Economics)

• What the Banks Stock Rally Says About Wall Street: A strong batch of earnings have propelled bank stocks in recent days, but investors remain more cautious on the outlook of Goldman Sachs and Morgan Stanley. (New York Times)

• Multi-strategy hedge funds are the new, superior fund-of-funds: One style to rule them all, and in the alpha bind them. (Financial Times)

• Britain’s Productivity Problem: “The British are among the worst idlers in the world,” they wrote. “We work among the lowest hours, we retire early and our productivity is poor. Whereas Indian children aspire to be doctors or businessmen, the British are more interested in football and pop music.” (NPR)

• The Fantasy of Instant Delivery Is Imploding: Gopuff was supposed to crack Silicon Valley’s longtime obsession with one-hour delivery. Instead, the startup valued at $15 billion risks becoming the next Kozmo.com-size flameout. (Businessweek)

• How Food Powers Your Body Metabolism, which unleashes the energy in what you eat, may be nature’s most electrifying invention. (New Yorker)

• Is a new anomaly affecting the entire Universe? Early relics and late-time objects give incompatible results for the expanding Universe. This independent anomaly intensifies the problem. (Big Think)

• 50 Years Ago, Stevie Wonder Heard the Future: On the anniversary of the landmark 1972 album “Talking Book,” musicians who made it and artists who cherish it share their stories. (New York Times)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

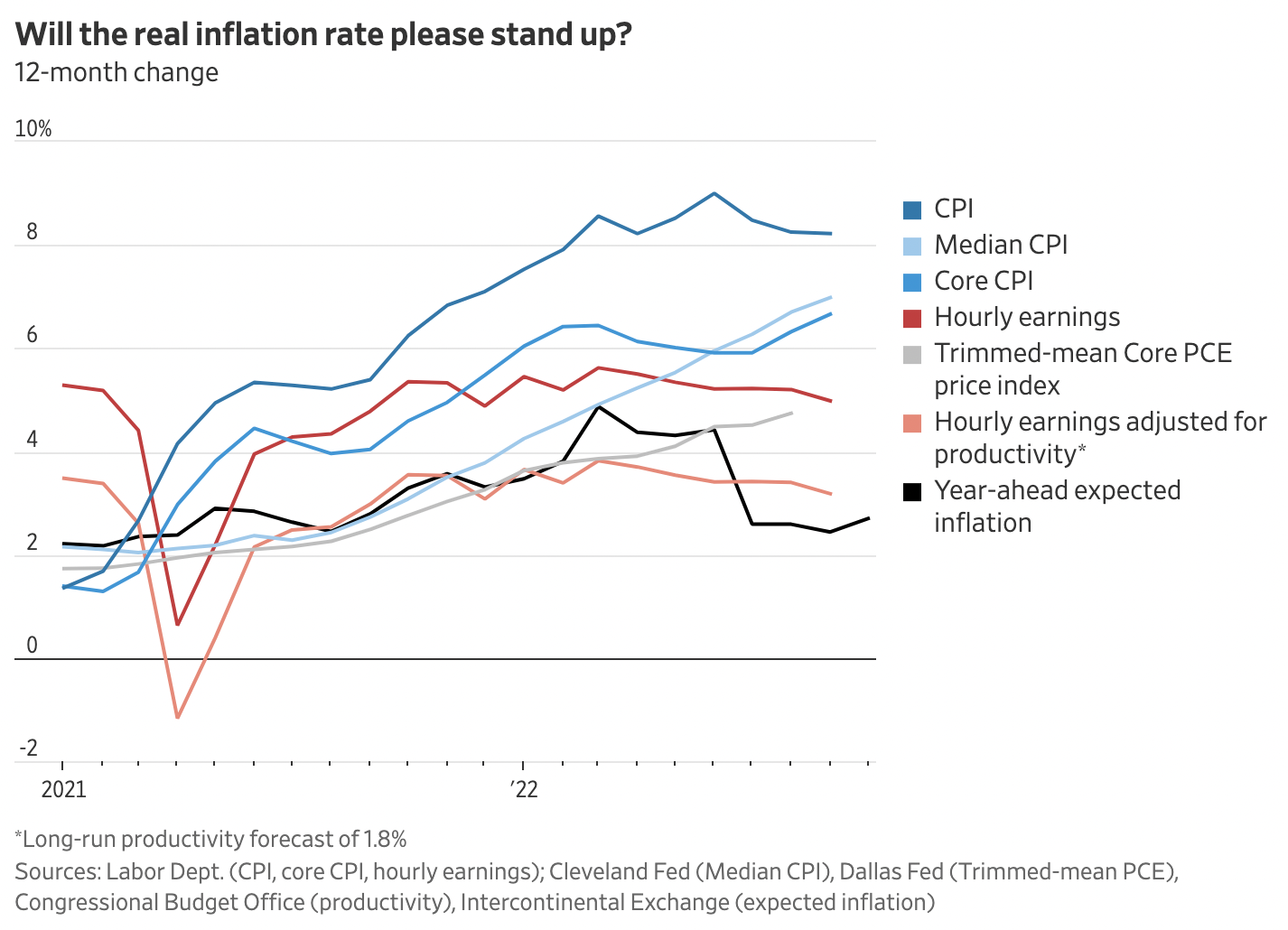

What’s the Inflation Rate? It’s a Surprisingly Hard Question to Answer

Source: Wall Street Journal

Sign up for our reads-only mailing list here.