My mid-week morning train reads:

• Fed Is Losing Billions, Wiping Out Profits That Funded Spending: Central banks around the world paying more in interest Governments may need to make up holes at central banks The Marriner S. Eccles Federal Reserve building in Washington, DC. (Bloomberg)

• There is a rosy projection for the US economy. Americans may not have felt it: 2.9% GDP? Why so rosy despite all the bleak news? For one, a big chunk of GDP is comprised of consumer spending — and though we’re all complaining about inflation, rising prices haven’t actually stopped consumers from splurging just yet. Retail sales were up 8.2% in September from a year ago. (CNN) but see also NABE Survey: US Already in Recession or Will Be Soon: Almost two-thirds of respondents in a survey of business economists say the US is either already in a recession or has better-than-even odds it will be within the next year. (Bloomberg)

• Stocks Bottom First: Overweighting today’s news, for better and for worse, gets investors in trouble because today is already priced in. Stanley Druckenmiller recently relayed this message to an audience, saying: “Do not invest in the present. The present is not what moves stock prices.” (Irrelevant Investor)

• Builders Say They’re Ready for This Housing Slowdown. ‘I’ve Learned My Lesson.’ Meltdown of 2007-09 fostered less risky tactics; not as much debt. (Wall Street Journal)

• The Federal Reserve Owes the World a Mea Culpa: The US central bank can’t ease the international repercussions of its rapid monetary tightening, but it can and should own up to its mistakes. (Bloomberg)

• Economic Outlook: Rubber Bands on a Watermelon: With enough pressure, the watermelon *will* explode. (Kyla Scanlon)

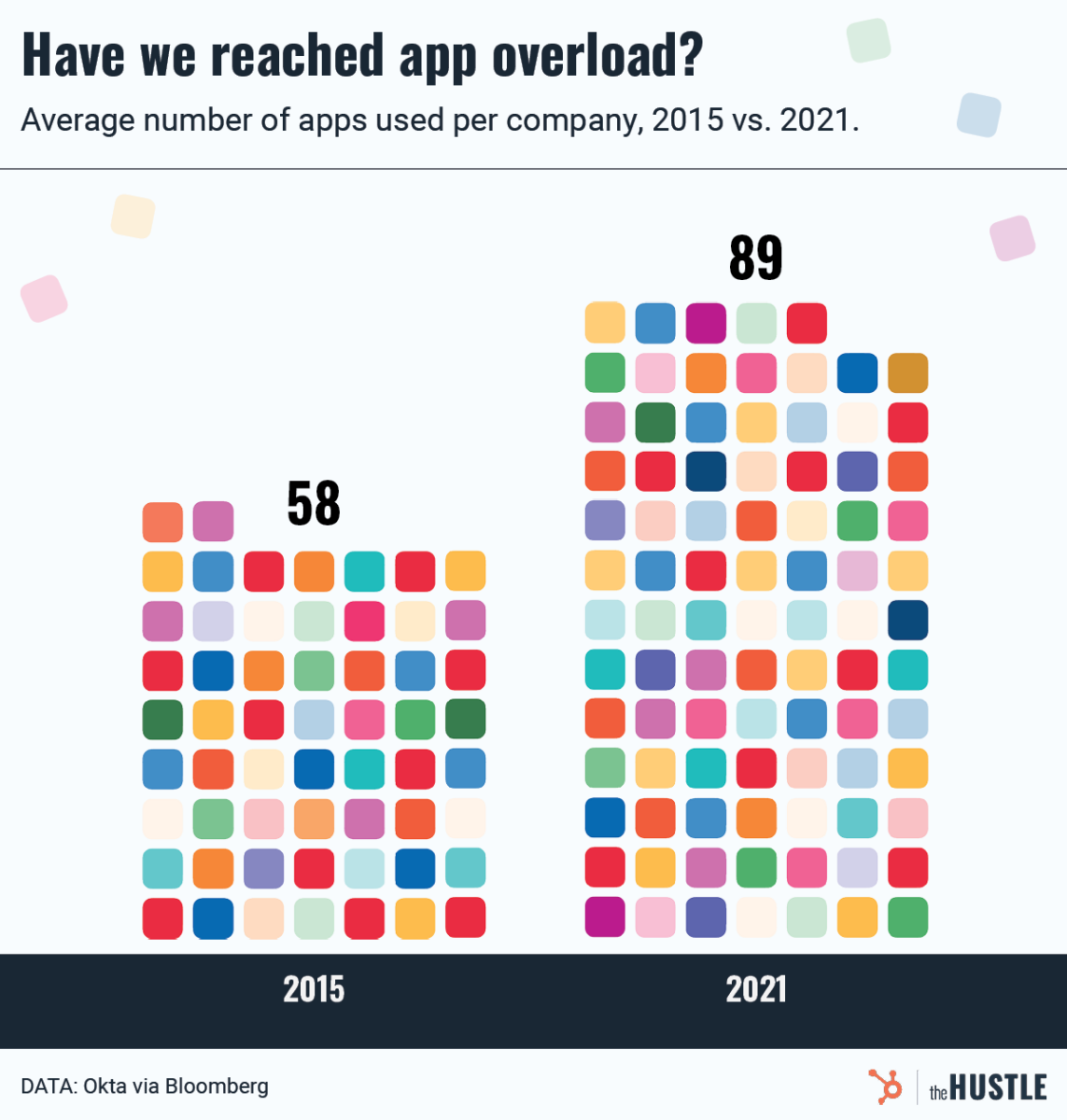

• Zoom, Teams, Slack Are Wreaking Havoc on Employee Productivity: Shifting between multiple apps to get stuff done drains workers’ time, efficiency and engagement. Can anything be done? (Bloomberg)

• Rising Shipping Costs Prompt Businesses to Get Creative With Deliveries: FedEx, UPS and U.S. Postal Service have increased shipping fees as their costs rise. (Wall Street Journal) see also Why the Price of Gas Has Such Power Over Us: “When prices go up, we have this feeling of oppression that we can’t do everything we want.” (Upshot)

• What broke Britain? The UK has seemed to be in constant crisis for a few years now. There’s one big reason why. There is one clear root cause of Britain’s woes: Brexit. The decision to leave unleashed serious economic aftershocks, which were impossible to ignore or paper over indefinitely. The result has been a chaotic, unsteady Britain, battling social malaise and political upheaval in the aftermath of the pandemic amid an inflation crisis sweeping the global economy. (Vox)

• Taylor Swift Has So Much New Music. How Will She Ever Perform It All? With her new album ‘Midnights,’ the pop superstar has four whole records she has never performed live, creating an unusual concert challenge. ‘She’s in a complete logistical nightmare.’ (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Marta Norton, Chief Investment Officer of Morningstar Investment Management. The firm manages directly or advises on $249.4B in client funds. She began her career as BLS economist, and before her current role, she was Head of U.S. Outcome-Based Strategies for Morningstar.

Apps are supposed to make life easier, but they’re stressing employees out

Source: The Hustle

Sign up for our reads-only mailing list here.