My Two-for-Tuesday train reads:

• The fall of FTX shocked everyone. Except this guy. The world of cryptocurrency is rich with eccentric characters and anonymous Twitter personalities. So perhaps it shouldn’t be a surprise that one of the early figures who called attention to the problems with Sam Bankman-Fried’s cryptocurrency exchange, FTX, is a 30-year-old Michigan psychiatrist who investigates financial crimes as a hobby. (The Atlantic)

• You Bought a Hot Fund. Now It’s on Ice. Investors who piled into an unconventional Blackstone real-estate fund now can’t get more than a sliver of their money out (Wall Street Journal) see also SPACs Are Giving Up on Finding Deals: This week 18 blank-check companies are holding liquidation votes, while 25 are asking for extensions into 2023. (Institutional Investor)

• Some Bosses Embrace Work From Home to Keep Wages Down: With potential hires in short supply, companies increase their recruiting in areas where pay is lower. (Businessweek)

• Stiglitz: The Causes of and Responses to Today’s Inflation: Today’s inflation is largely driven by supply shocks and sectoral demand shifts, not by excess aggregate demand. Monetary policy, then, is too blunt an instrument because it will greatly reduce inflation only at the cost of unnecessarily high unemployment, with severe adverse distributive consequences. (Roosevelt Institute) see also Inflation Forecasts Were Wrong Last Year. Should We Believe Them Now? Economists misjudged how much staying power inflation would have. Next year could be better — but there’s ample room for humility. (New York Times)

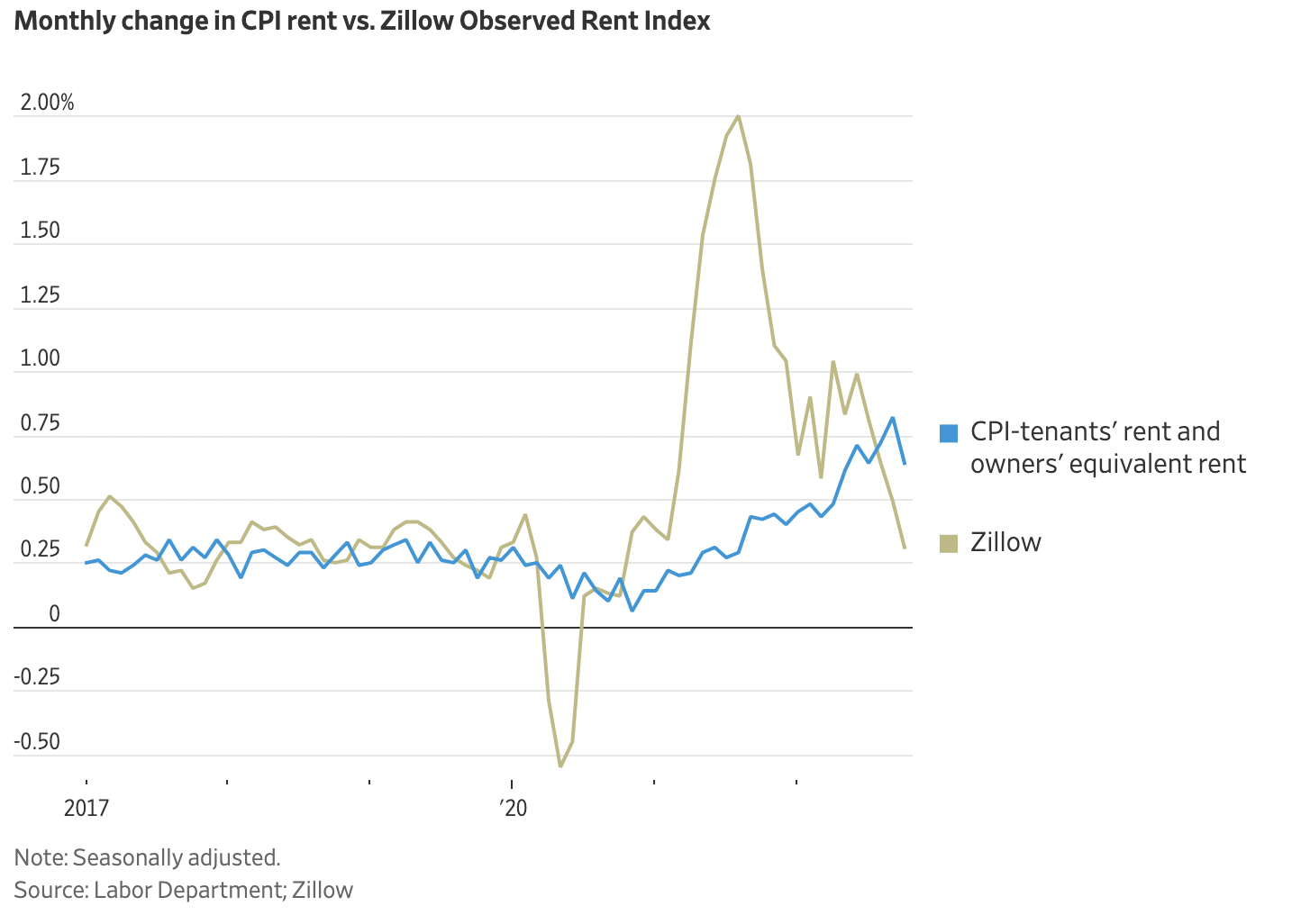

• How does the Consumer Price Index account for the cost of housing? Housing represents about a third of the value of the market basket of goods and services that the Bureau of Labor Statistics (BLS) uses to track inflation in the Consumer Price Index. A rise in the price of shelter, the BLS label for housing, contributed to the increase in inflation in early 2022. Measuring changes in shelter costs is more difficult than measuring changes in the prices of, say, apples or tires. How the BLS currently measures changes in the cost of housing for both renters and homeowners. (Brookings) see also How the Fed Causes (Model) Apartment Inflation: Home prices are rising, in part due to a lack of inventory but exacerbated a great deal by rapidly rising mortgage rates. Those rates are driven by the FOMC action. The combination operates to price potential buyers out of the market. But you gotta live somewhere, and so these buyers are forced to stay (or become) renters. There is a simple truism at the heart of sticky CPI inflation readings: Higher Fed Funds & Mortgage Rates = Rising OER & CPI. (The Big Picture)

• The Gamification of Everything Is No Fun: Adrian Hon’s book “You’ve Been Played” warns against the abuses of game logic in work and politics. (TNR)

• Taylor Swift and Ticketmaster Messed With the Wrong People: Data Analysts: I Knew You Were Trouble When I Logged In Taylor Swift fans are convinced a ticket sale screwed them over. Our data analysis suggests they’re right. (Slate) see also Karma Is a Second Chance at Taylor Swift Tickets Ticketmaster admits (sort of) that it screwed over loyal fans. (Slate)

• Australia’s first complete plesiosaur fossil discovered in outback Queensland: The complete head and body of an ancient marine reptile with “flippers like a turtle and long neck like a giraffe” has been uncovered in Queensland in what scientists say is a rare discovery. (ABC)

• Why Musk’s meltdown matters. Musk’s tweet was dangerous, ignorant, and insulting to Dr. Fauci and LGBTQ people. Should we care? Why should we pay attention to a man-child who seems to delight in provoking people who care about democracy, truth, and decency? (Robert B. Hubbell Today’s Edition Newsletter) see also How Elon botched his war on bots PLUS: Why it’s time to start leaving Twitter behind (Platformer)

• The Absurd Talent of Kylian Mbappé: The French star player has already proved that he’s one of the best in the history of the game. (The Atlantic)

Be sure to check out our Masters in Business next week with Kathleen McCarthy, Global Co-Head of Blackstone Real Estate. Blackstone is the world’s largest owner of commercial real estate globally with a $565 billion portfolio and $319 billion in investor capital.

Housing Costs, Inflation’s Biggest Component, Are Poised to Ease

Source: Wall Street Journal