My Two-for-Tuesday morning train reads:

• Stocks Could Return About 10% in 2023—But First, They’re Going to Fall: After a selloff in the year’s first half, equities could rebound as investors anticipate a return to economic growth, market strategists say. (Barron’s) but see Forget Stock Predictions for Next Year. Focus on the Next Decade. Wall Street’s market forecasts for 2023 are worthless, our columnist says. But the long view is much clearer. (New York Times)

• Why This Housing Downturn Isn’t Like the Last One: A postcrisis mortgage-market makeover and an overhaul of the financial system make a repeat of 2008 unlikely (Wall Street Journal).

• How Long Will It Take Inflation to Hit the Fed’s 2% Target? If they are serious about that 2% inflation target, history says it might not be as easy as they think. Over the past 90+ years, the average inflation rate in the United States has been a little more than 3% per year, (Wealth of Common Sense) see also Why does good news about the economy sound bad to the Fed? So, if economic indicators are strong, why is the conventional wisdom that a recession is likely next year? (Grid)

• Institutional Failure: A Future of Finance Worldview: Part of the reason memes have a special place in my heart is that it seems like a daily occurrence that something dramatic, important, and problematic sits right in front of me and honestly, I’ve just sort of learned to live with it. Pandemic? Economics? Politics? Climate? AI? Clean Water? War in Ukraine? Violence? Civil rights? Rule of law? Whatever. (ETF Trends)

• Trading Games: This week the SEC filed suit against eight financial influencers from Atlas Trading, an online stock picking community, for manipulating their social media followers into buying and selling stocks for their own personal gain. The suit explains how their scheme worked. (Of Dollars And Data) see also When to sell big winners: Maximizing gains is fine, but minimizing regrets counts for a lot too. (The Big Picture)

• Employers Are Deflating Salaries in Job Listings to Keep Pay Down Some employers are posting artificially low salary ranges to keep wages from ballooning and to avoid alienating existing workers, but it could easily backfire. (Bloomberg)

• An EV Buying Guide for People Fed Up With Tesla’s Elon Musk: Luxury brands from Mercedes to Porsche have options that are superior to the EV trailblazer. (Pursuits) see also Elon’s stale playbook: At Tesla and SpaceX, Elon Musk was a jerk with a grand vision. At Twitter, he’s just a jerk. (Business Insider)

• Is the Country Getting…. Better? Things have been pretty weird in the USA over the past few years. Are things returning to normalcy? (Drezner’s World)

• January 6 Report Presents a Devastating Case Against Trump: He was the “central cause” of the riot and mounted multiple plots to overthrow democracy. (Mother Jones) ee also How Trump jettisoned restraints at Mar-a-Lago and prompted legal peril :The inside story of how Trump transplanted the chaos and norm flouting of his White House into his post-presidential life, leading to a criminal investigation into his handling of classified documents that presents potential legal peril. (Washington Post)

• The Genius of Lionel Messi Just Walking Around: The legendary striker can often be found off the ball, strolling and dawdling and looking mildly uninterested. Here’s what he’s actually doing. (New Yorker)

Be sure to check out our Masters in Business this week with Robert Koengisberger, founder and CIO of Gramercy Funds Management, which manages $5.2 billion in distressed Emerging Markets Debt. Gramercy’s chairman is (previous MiB guest) Mohamed A. El-Erian; the firm is a sponsor of the Greenwich Economic Forum.

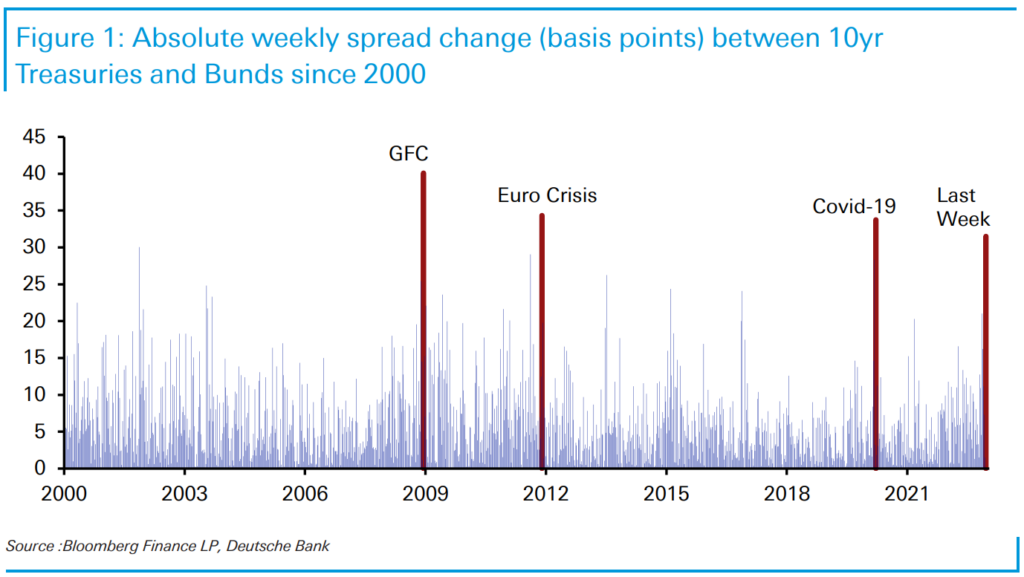

Last week was the 4th worst week of the century

Source: Jum Reid, Deutsche Bank

PUBLISHING NOTE: We will be taking time off — enjoy the holidays, we will see you next year!