The weekend is here! Pour yourself a mug of Bean Box coffee, grab a seat by the fire, and get ready for our longer-form weekend reads:

• North Korea Wants Dollars. It’s a Sign of Trouble: Its trade with the outside world devastated, North Korea is scrambling for American dollars and other hard currency, not just to feed its people, but also to finance Mr. Kim’s military and economic ambitions. It is smuggling coal and stealing cryptocurrency. It is also trying to squeeze every bit of cash from the public, selling smartphones and other imported goods to the monied class, as well as collecting “loyalty” donations in exchange for political favors. (New York Times)

• This TikTok star makes up to $100,000 a month by asking the super-rich about their cars: When Macdonald began asking car owners what they did for a living, the Tucson native had just graduated from the University of Arizona with a finance degree and drove a 2011 Chevrolet Impala. He moved to Dallas, where he was training to become a financial consultant with Charles Schwab, earning an annual base salary of $45,000. He wasn’t much of a car guy but was impressed by the Ferraris he would see around his new city and wondered how their owners could afford such extravagance. (Los Angeles Times) see also So You Want to Be a TikTok Star: The social-media platform is transforming the music industry. Is that a good thing? (New Yorker)

• China’s Brute Force Economics: Waking Up from the Dream of a Level Playing Field: The time has come for the United States and its allies to abandon the notion that competing on a level playing field with China’s state-led economy is possible and confront the reality of what she calls the country’s “brute force economics.” China’s tactics are not merely an assortment of cutthroat moves made by individual actors. Rather, they are features of Beijing’s long-term strategy and are backed up by the full force of the country’s party-state system, creating a challenge that Washington cannot afford to ignore. (Texas National Security Review)

• How the Global Spyware Industry Spiraled Out of Control The market for commercial spyware — which allows governments to invade mobile phones and vacuum up data — is booming. Even the U.S. government is using it. (New York Times)

• The quiet disappearance of the safe deposit box: Once revered as the safest way to store physical valuables, safe deposit boxes are now being phased out by major banks. The move is already starting to backfire. (The Hustle)

• Life Is Hard. And That’s Good: When the going gets tough, the tough get philosophical. (Nautilus)

• Hello! You’ve Been Referred Here Because You’re Wrong About Twitter And Hunter Biden’s Laptop: You’ve said something quite wrong about Twitter and how it handled something to do with Hunter Biden’s laptop. If you’re being wrong about Twitter and the Hunter Biden laptop, there’s a decent chance that you’re also wrong about Section 230, so you might want to read that too! Also, these posts are using a format blatantly swiped from lawyer Ken “Popehat” White, who wrote one about the 1st Amendment. Honestly, you should probably read that one too, because there’s some overlap. (TechDirt)

• Why Is Marjorie Taylor Greene Like This? On the ground in the Georgia congresswoman’s alternate universe: Marjorie Taylor Greene arrived in Congress in January 2021, blond and crass and indelibly identified with conspiracy theories involving Jewish space lasers and Democratic pedophiles. She had barely settled into office before being stripped of her committee assignments; she has been called a “cancer” on the Republican Party by Senate Minority Leader Mitch McConnell; and she now has a loud voice in the GOP’s most consequential decisions on Capitol Hill because her party’s leaders know, and she knows they know, that she has become far too popular with their voters to risk upsetting her. (The Atlantic)

• Jeff Herrod feels forgotten: ‘No one acknowledges the work we did’ He’ll have dreams he’s still playing, still punishing whatever poor sap happened to line up across from him, and then he’ll wake up, seething and soaked in sweat, growling like a lion before the kill, pissed that it’s over and has been over for 25 years. All he’s left with is a body that’s falling apart and a mind that’s slipping away. (The Athletic)

• Planes, Trains and Automobiles at 35: An Oral History of One of the Most Beloved Road/Xmas Movies Ever Made: Starring Steve Martin and John Candy, the John Hughes road trip comedy had a nearly four-hour runtime at one point. Hear from cast, crew, and Hughes’ family about the classic. (Vanity Fair)

Be sure to check out our Masters in Business next week with Kathleen McCarthy, Global Co-Head of Blackstone Real Estate. Blackstone is the world’s largest owner of commercial real estate globally with a $565 billion portfolio and $319 billion in investor capital.

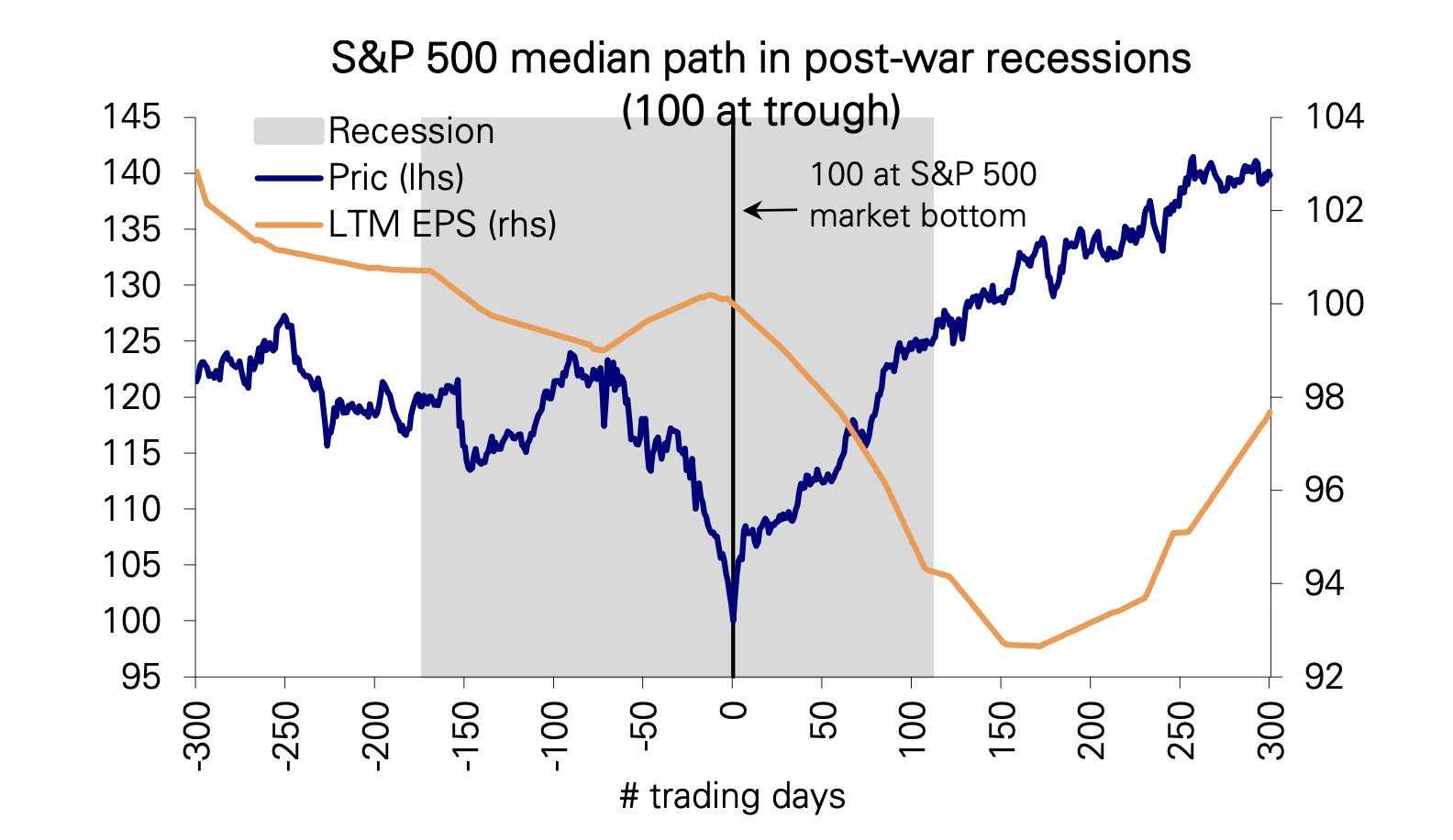

“While equity prices typically bottom half-way through a recession, earnings typically bottom only after the recession has ended.” – Deutsche Bank

Source: @SamRo

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.