Last Friday’s strong payroll data led to lots of chatter about the current labor situation. Often oversimplified and lacking in context, it has created a somewhat misleading picture.

I have a few thoughts I have been chewing over that will hopefully provide some of the missing context.

The labor market presents challenges for investors. Consider as an example the downside knee-jerk reaction to last week’s NFP only to see the markets close in the green by the end of the day. But it also matters to policymakers like the Fed; they are concerned that strong labor demand is a driver of upwards wage pressures.1 My views are it is complex and nuanced, in ways that perhaps the Fed might be overlooking.

There have been many longstanding trends leading to the current problems. I suspect the most underestimated aspect of the Labor puzzle is that the US is suffering a shortage of workers. (there is not a lot that raising rates will do to offset that.2 These are prior trends that accelerated during the pandemic.

Why does America have too few workers? Let’s consider:

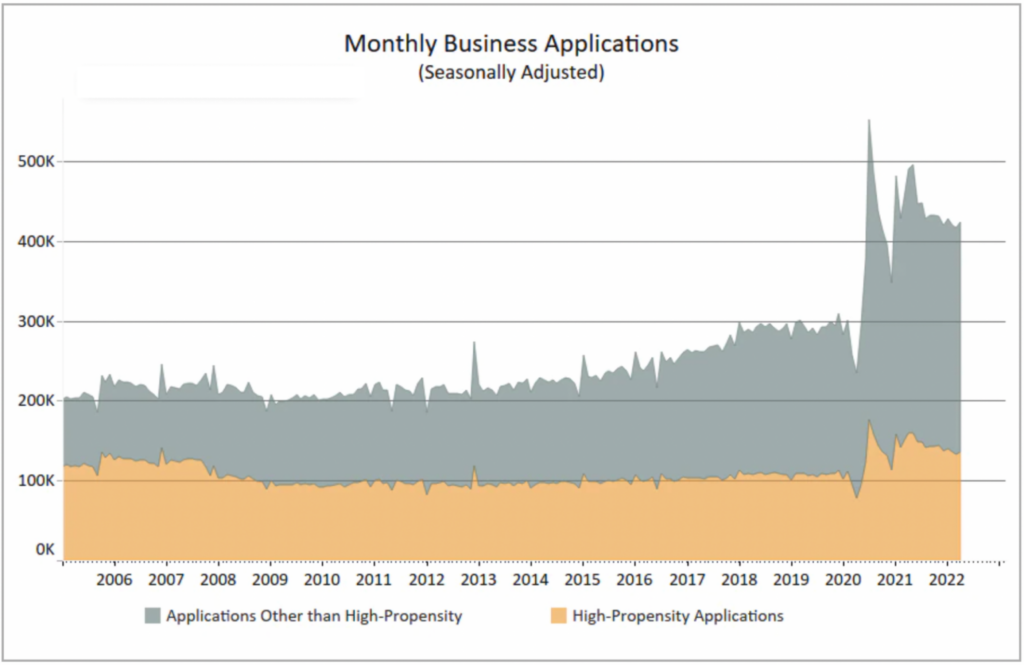

The Great Labor Reset: The past 3 years have seen record new business formation. There are various theories as to why this is, but I suspect it is simply lots of people buying into the American Capitalist dream of being their own boss. This is what happens when you lock people inside 18 months, and give them a few trillion dollars: A sizable percentage of them will upskill and launch their own shops. It is one of the more intriguing aspects of the past few years.

The Great Labor Reset: The past 3 years have seen record new business formation. There are various theories as to why this is, but I suspect it is simply lots of people buying into the American Capitalist dream of being their own boss. This is what happens when you lock people inside 18 months, and give them a few trillion dollars: A sizable percentage of them will upskill and launch their own shops. It is one of the more intriguing aspects of the past few years.

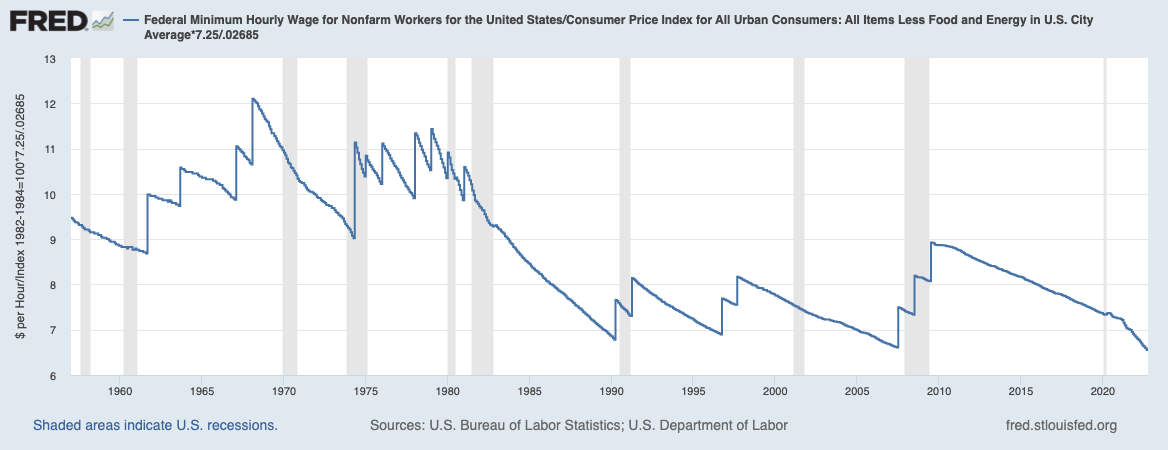

Lagging Wages: Among the bottom half of workers, wages have lagged just about everything: Inflation, productivity, stocks, executive comp, and median wages. At the entry-level or minimum pay scale, it’s even worse (see chart at top). Then came the reckoning: After a half-century of wages as a deflationary force, the Balance of Power shifted. What has been occurring since is mostly catch-up.

In many fields, it’s not so much that there aren’t enough workers, but rather, there aren’t enough workers at the prior low wages firms were offering. This has revealed challenges in specific business models, including fast food and discount retail.

Immigration: As we have discussed prior, legal immigration in the United States has been slowing for decades (see charts here). Immigration peaked in the 1990s, slowed in the 2000s, dove under President Trump in 2016, and continues at low levels under President Biden in 2021-22.

Immigration: As we have discussed prior, legal immigration in the United States has been slowing for decades (see charts here). Immigration peaked in the 1990s, slowed in the 2000s, dove under President Trump in 2016, and continues at low levels under President Biden in 2021-22.

If we were to return to the level of immigration that we saw in the 1990s, it would go a long way towards solving our labor shortage – about ~3,000,000 workers over the past 5 years (pre-pandemic).

Disability/Long Covid: The rise in disability claims stretches back three decades, then rose during the GFC, and accelerated during the pandemic. It’s a large number –about 32.7 million Americans — and nearly 1 in 4 people in the labor force.

There are a rising number of people suffering from “Long Covid” – by some estimates, it’s about 15 million people or more. Many of these people find they can no longer work in cognitively intensive jobs.

Note this is a different reading than NILF, which is a primarily male statistical quirk in the Labor Data regarding who is “Not in the Labor Force.” (We have discussed this previously3).

Covid Deaths: The United States has had nearly 100 million reported Covid cases and over a million deaths. Those are merely the reported numbers, they actual final numbers are likely higher.

So many people lost, it is an American tragedy. The mortality rate skews older as it does for many (most?) diseases. Beyond the personal losses are a substantial loss of employees. It is yet another reason why there are not enough workers

~~~

The bottom line remains that a robust economy, pent-up post pandemic demand and massive fiscal stimulus have combined with his shortage of workers to be supportive of ongoing job creation. I expect that to continue until the FOMC’s overly aggressive tightening regime begins to bite harder.

UPDATE : Janury 24 2023

Study: Long Covid Is Keeping Significant Numbers of People Out of Work

An analysis of workers’ compensation claims in New York found that 71 percent of claimants with long Covid needed continuing medical treatment or were unable to work for six months or more.

Previously:

Which is Worse: Inflation or Unemployment? (November 21, 2022)

The Great Resignation Is Long Over (July 27, 2022)

Generational Reset of Minimum Wage (November 30, 2021)

Who Is Quitting and Why? (November 19, 2021)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)

Real Wages (November 22, 2021)

The Great Reset (June 2, 2021)

Shifting Balance of Power? (April 16, 2021)

_________

1. It’s sad but amusing that traditional economists have spent decades ignoring the deflationary impact of lagging bottom half of the economic strata as a source of deflation (especially minimum wage). Ironically we get a reset and surge in wages and suddenly it’s the most important issue and we must do anything we can to stop inflation immediately even if that includes doubling the unemployment rate and causing a recession.

Look for a future post on The Fed versus The Poor.

2. At least, not without causing broad damage to the economy.

3. I have been discussing NILF as an aspect of the labor pool for more than a decade; See this, this, this, this, this, this, this, this, this, and this.