Merry Christmas, Happy New Year, and all the rest of the seasonal glad tidings for you and yours in 2023. Before we roll up our sleeves and start to engage in the serious business of managing risk in the capital markets, I wanted to share a story that is more in keeping with the spirits of the season.

I ran track in high school. My father’s advice when I joined the team was: Find the fastest guy on the team and keep up with him. My quarter-mile speed was okay, but as it turned out I could maintain that pace for extended distances. At meets, I ran the half-mile, the two-mile relay, and the three-mile solo. But I ran well enough to be competitive at the counties and states. Dad’s advice worked out well.

I went to grad school some years later, and the same advice was offered: Find the smartest person in your class and do your best to keep up with them. That person was Jeff Weitzman: Super Smart, funny, and lucky to be alive. (Jeff tells an amazing story as to that last point, best saved for another time).

We became fast friends and finished the 1L year ranked one and two (I was a few hundredths of a GPA point behind him). Dad’s advice was once again solid. We stayed in touch after school, only living a dozen blocks apart. Eventually, he got married and moved to the burbs. He had gone from working at a big law firm to a legal publishing house to what was essentially a law-related tech startup. When that firm got bought by Yahoo in the late 1990s, he relocated to Palo Alto.

I was thrilled for him. It’s great when good things happen to good people and Jeff was always one of the good guys. He had a technological underpinning to his worldview, and Silicon Valley was a good fit for him. He became a serial entrepreneur, successfully launching or working at numerous startups.

But I was genuinely taken aback by our classmates and colleagues. Whenever I discussed Jeff’s great turn of events, people were, let’s just say less than generous.

“Aren’t you angry about Jeff’s success?” (No)

“Jealous?” (No, but I envy him California’s weather).

“Don’t you wish you were doing that?” (No, Jeff had the tech chops, not me, my skillset was more logic, probability & philosophy).

“What about all of the money?” (I cannot imagine it in better hands than his).

On and on it went, with people in disbelief (and in one instance, genuinely dismayed) that I was actually happy for my friend’s success.

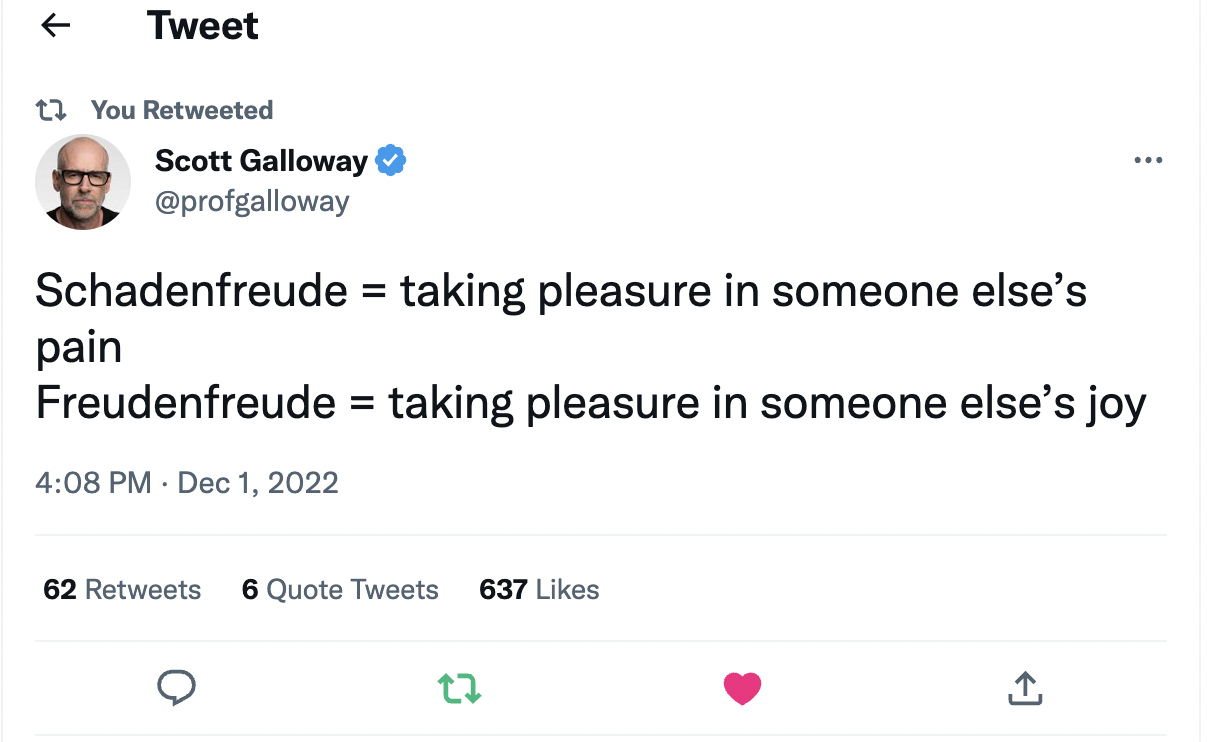

Which brings us to Prof Galloway’s Freudenfreude (although I prefer the made-up word Freudenschaude for reasons of inverted symmetry to the word we are all more familiar with).

As the new year begins, perhaps we would all be better off if we engaged in less Schadenfreude and more Freudenfreude. Let’s stop taking delight in other people’s misfortunes, and recognize that there but for the grace of God go I. Let’s recognize how rare and fragile success is, and revel in it – even if that means there is no increase in our bank accounts, our follower numbers, or our status among the neighbors.

We have all engaged in some aspect of Schadenfreude – look no further than the delight at Elon Musk’s disastrous 2022. While there has been frustration with Musk’s trolling, there has been way too much glee about his misfortunes among, well, practically everyone.

I know that most New Year’s resolutions are destined to fail, and yet, we still are compelled to try. Along those lines, for this year, I hope to see more Freudenfreude and less Schadenfreude…

Previously:

When to Sell Big Winners (December 20, 2017)