My mid-week morning train WFH reads:

• This Bear Market (Probably) Isn’t Over Yet Tuesday’s drop is less a blip than a harbinger of another rough patch (Wall Street Journal)

• Office Landlord Defaults Are Escalating as Lenders Brace for More Distress: Delinquency rate for office loans that back commercial-mortgage-backed securities remains low, but it is heading higher. (Wall Street Journal) see also REITs Can Hedge Inflation — But Not During a Market Crisis Allocators need a long-term time horizon if they want listed real estate to be an effective inflation hedge. (Institutional Investor)

• An Ongoing Stimulus in the Economy For Years to Come. It’s estimated 2/3 of those with mortgage debt are at 4% or lower. Those who locked in ultra-low mortgage rates are receiving an ongoing form of stimulus, giveng them more disposable income on a monthly basis that can be used for spending or saving elsewhere in their budget. (A Wealth of Common Sense)

• What Do US Growth Zones Have in Common? They Build Housing: Migration to the South and inland West has many causes, but the availability of new houses and apartments is the most important one. (Bloomberg)

• Leaked files reveal reputation-management firm’s deceptive tactics: A reputation-management company promises it can secretly remake anyone’s online image. But how do they do it? (Washington Post)

• They Lost Their Jobs, Then Went Viral on TikTok: Some workers are using the platform to share stories about job cuts, give advice and search for new roles. (New York Times)

• Smaller, safer, cheaper? Modular nuclear plants could reshape coal country: The Biden administration envisions dozens of ‘modular’ nuclear plants sprouting across the country. Why coal communities are so eager to be the staging ground for the risky endeavor. (Washington Post)

• How Barnes & Noble Came Back From Near Death: “How is it that bookstores do justify themselves in the age of Amazon? They do so by being places in which you discover books with an enjoyment, with a pleasure, with a serendipity that is simply impossible to replicate online. And to do that, you have to have a good bookstore.” (New York Times)

• How Supergenes Beat the Odds—and Fuel Evolution: Stretches of DNA that lock inherited traits together often accumulate harmful mutations. Recent work shows that their blend of genetic benefits and risks for species can be complex. (Quanta Magazine)

• Marvin Gaye’s iconic NBA All-Star Game national anthem: ‘He turned that thing into his own’ For one afternoon, America’s anointed theme song had a suede soul, velvety enough to be simultaneously sexy and spiritual. For one afternoon, patriotism masqueraded as a Motown kind of cool. The Forum in Inglewood, Calif., was graced by a superstar’s serenade, stirring together hope and love, resilience and confidence, into a concoction delightful enough to be served on the rocks. (The Athletic)

Be sure to check out our Masters in Business interview this weekend with Tim Buckley, CEO of the Vanguard Group, which manages $7.2 trillion in assets. He began his career at Vanguard 32 years ago as an assistant to Chairman John Bogle. He previously served roles as Chief Information Officer, as well as Chief Investment Officer.

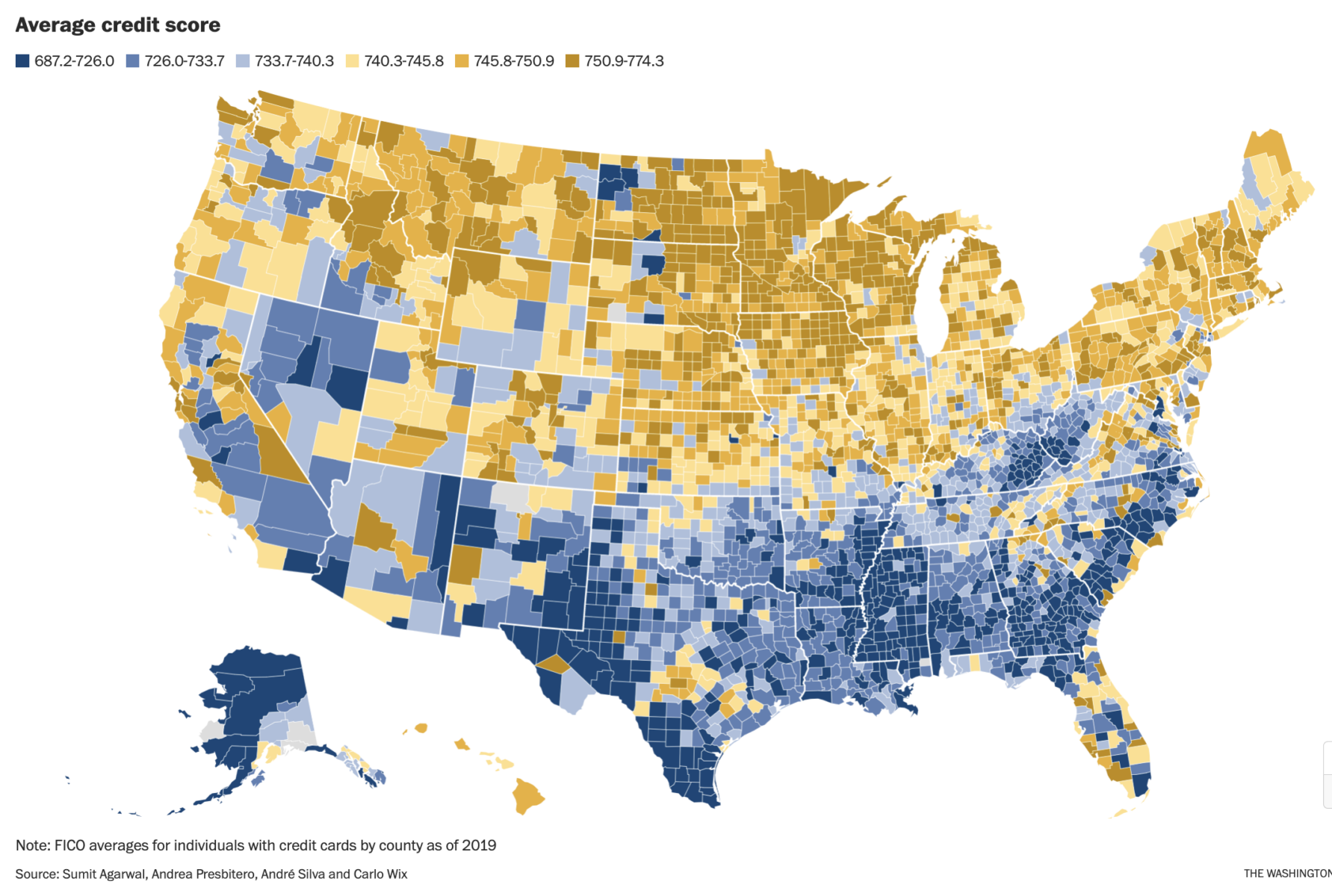

Why the South has such low credit scores

Source: Washington Post

Sign up for our reads-only mailing list here.