My mid-week morning train reads:

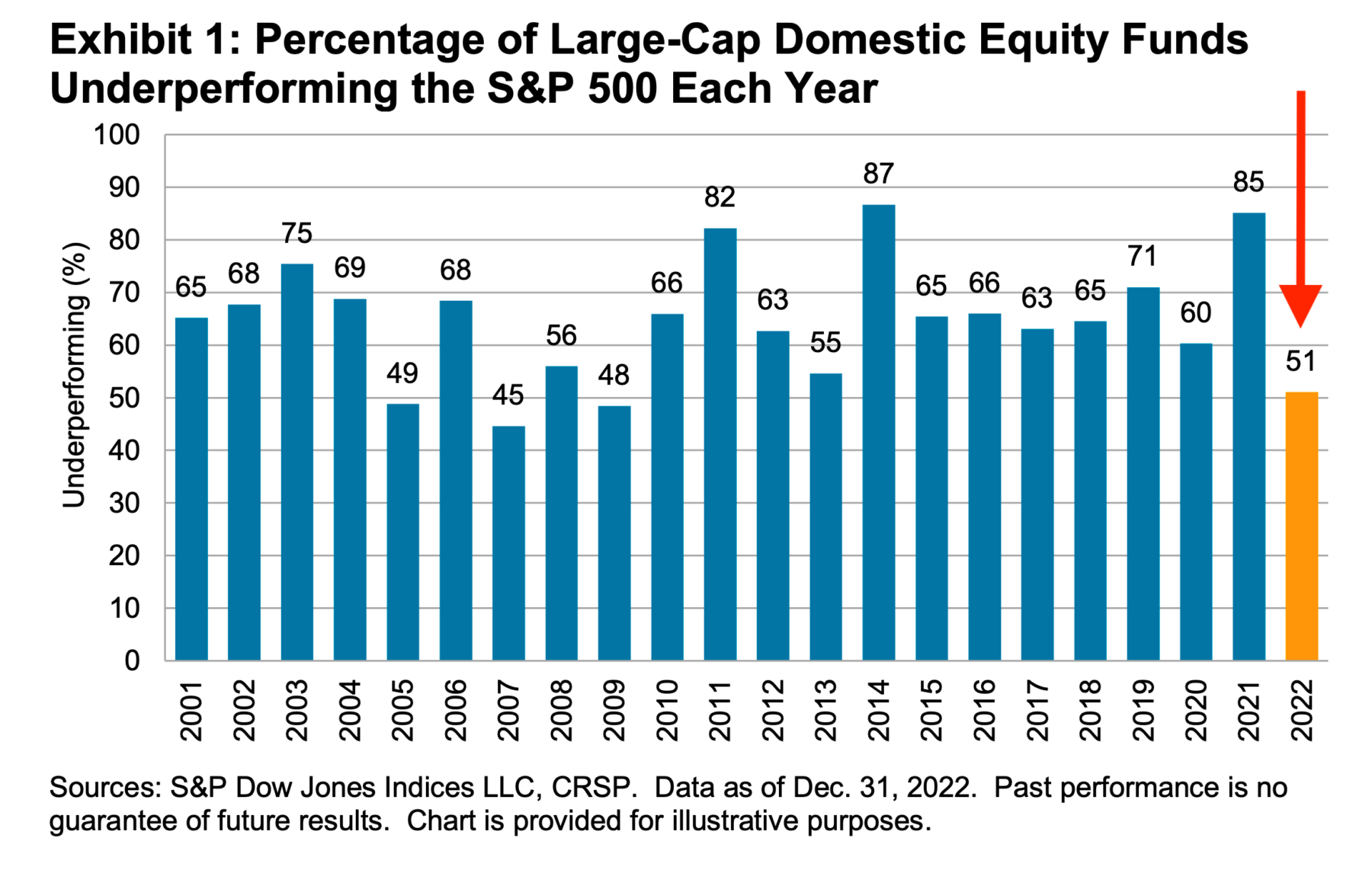

• The Rich List: The 22nd Annual Ranking of the Highest-Earning Hedge Fund Managers. Although the market rout caused a large portion of long-short and long-only managers to lose money last year — with many performing even worse than the S&P 500 index’s 19% decline — 2022 was a very good year for multistrategy, macro, trend-following, and fixed-income managers. (Institutional Investor)

• It Turns Out Money Does Buy Happiness, At Least Up to $500,000: Forget what you heard about there being no benefit once income reaches $75,000. (Bloomberg)

• A bull market is in full swing – and most of us are in denial: It’s part of a routine behavioral phenomenon I have long called the “Pessimism of Disbelief.” It forms bull markets’ very ramp upward – parallel to but different from the “wall of worry” that bull markets climb. (New York Post)

• Wall Street Concedes There Is Finally an Alternative to Stocks: TARA, TAPAS and TIARA are battling to replace TINA as traders’ favorite investing mantra. (Wall Street Journal)

• Twitter can’t protect you from trolls any more, insiders say: Twitter insiders have told the BBC that the company is no longer able to protect users from trolling, state-co-ordinated disinformation and child sexual exploitation, following lay-offs and changes under owner Elon Musk. (BBC) see also Musk’s Twitter is getting worse: Links aren’t working on Twitter due to an “internal change” that had “some unintended consequences.” (Vox)

• Blue Chip Classic Car Prices Soften at Amelia Island Auctions: While the sales volume was way up, due to more cars being on offer, many sold for underestimates or not at all. (Bloomberg)

• How to Take Back Control of What You Read on the Internet: Social-media algorithms show us what they want us to see, not what we want to see. But there is an alternative. (The Atlantic)

• The Build-Nothing Country Stasis has become America’s spoils system, and it can’t go on: The Build-Nothing Country: Stasis has become America’s spoils system, and it can’t go on. (Noahpinion)

• Why Are We Still Arguing About Masks? All this time later, their utility is in doubt. (The Atlantic)

• Do Americans Like Donald Trump, Nikki Haley or Ron DeSantis? Tracking the favorability ratings of declared — and potential — 2024 presidential candidates. (FiveThirtyEight)

Be sure to check out our Masters in Business interview this weekend with Dr. Maria Vassalou, chief investment officer of multi-asset solutions at Goldman Sachs Asset Management. She was a Professor of Finance at Columbia Business School where her academic research led her to establish many of the investment principles she employs today. At Columbia, she did consulting work for numerous institutions before joining Soros Capital Management and S.A.C. Capital Advisors.

Sign up for our reads-only mailing list here.