My morning train WFH reads:

• The Active Management Delusion: Respect the Wisdom of the Crowd: “My basic point here is that neither the Financial Analysts as a whole nor the investment funds as a whole can expect to ‘beat the market,’ because in a significant sense they (or you) are the market . . . the greater the overall influence of Financial Analysts on investment and speculative decisions the less becomes the mathematical possibility of the overall results being better than the market’s.” (CFA Institute)

• Accessing Losses via Direct Indexing: Herein lies the huge advantage of direct indexing over owning ETFs and Mutual Funds: Accessing losers that would otherwise net out to zero. (TBP) see also Could Direct Indexing Lower Your Taxes? 8 factors to determine whether direct investing is right for you. (Morningstar)

• The Seven Virtues of Great Investors: Intelligence is “a trait more of the character than of the brain,” according to Benjamin Graham. It also is rooted in Curiosity, Skepticism, Independence, Humility, Discipline, Patience, and Courage. (Jason Zweig)

• ‘Pessimism of Disbelief,’ Illustrated: Sour sentiment and better-than-expected economic results are a normal bull market backdrop. (Fisher Investments)

• Manhattan’s Wealthy Homebuyers Lured Back by Luxury Price Cuts: Some of the first quarter’s biggest contracts came after significant seller discounts, which helped get the market moving. (Bloomberg)

• How Disney beat Gov. DeSantis: Ron DeSantis is now losing to both Donald Trump and Mickey Mouse. (Vox)

• Got Milk? Not This Generation. Alarmed by dwindling sales to Gen Z, the dairy industry is going all out to get younger Americans on the milk train. (New York Times)

• Among all of his mistakes, don’t forget Elon Musk is singlehandedly crushing a big chunk of Internet research for no good reason: Access to Twitter’s API has been mostly free to researchers for more than a decade. So how does $210,000 a month sound? (Nieman Lab)

• Turbotax is blitzing Congress for the right to tax YOU: Lobbying by the massively concentrated tax-prep industry – wildly profitable corporate giants like HR Block and Intuit, the parent company of Turbotax, who spent 20 years lobbying congress, spending millions to ensure that Americans would have to pay the Turbotax tax in order to pay their income tax. (Pluralistic) see also Over 60 million Americans have taxes so simple the IRS could do them automatically “Automatic returns” could vastly simplify tax season for millions of people. (Vox)

• How good, really, was Pablo Picasso? The exemplary modern artist died 50 years ago this month, and we’re still trying to clean up his mess. (Washington Post)

Be sure to check out our Masters in Business next week with Aswath Damodaran, Professor of Finance at New York University’s Stern School of Business. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. class nine times. His textbook “Investment Valuation” is the standard in the field. His next book comes out in December, and is titled The Corporate Lifecycle: Business, Investment, and Management Implications.

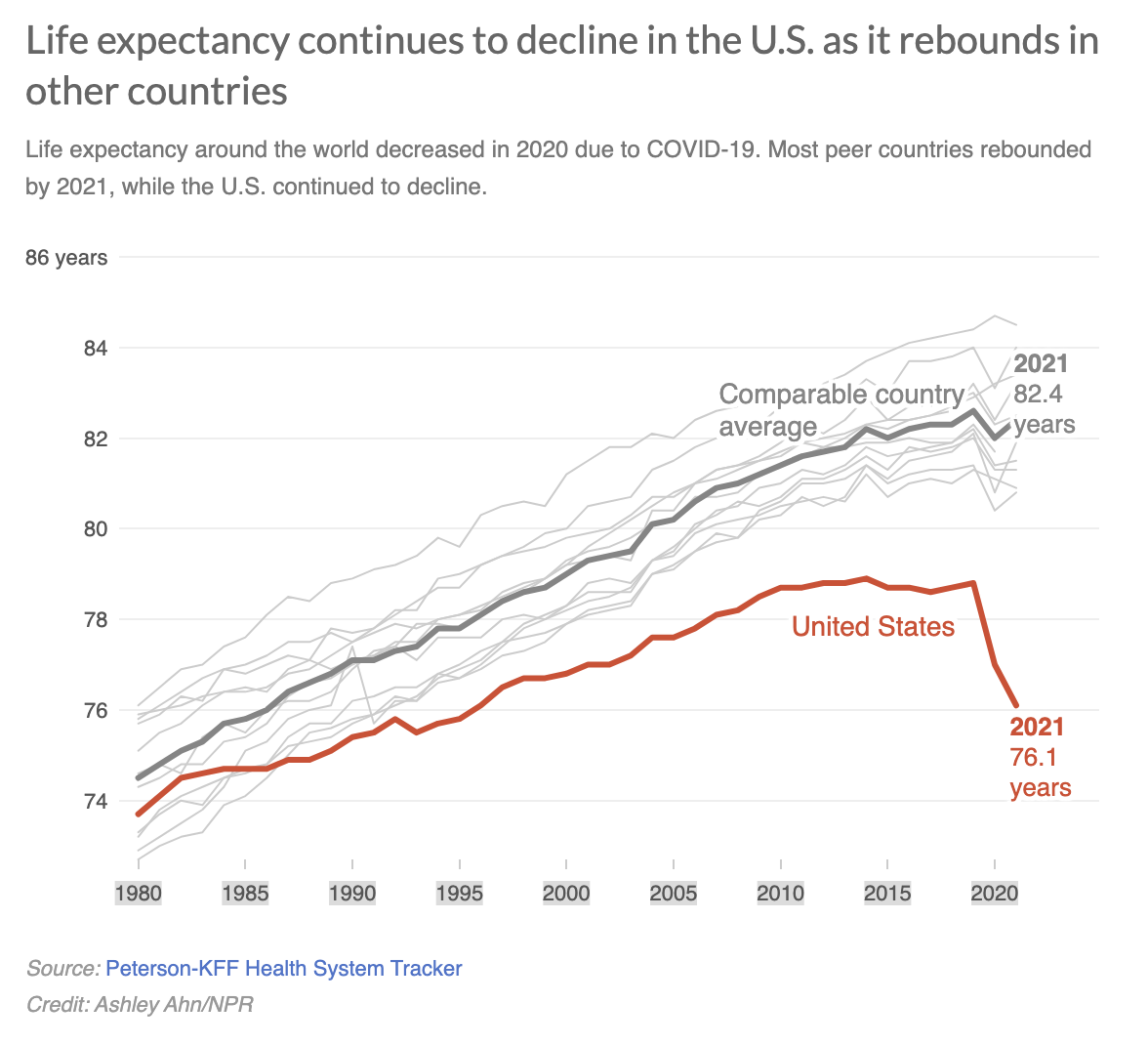

Life expectancy continues to decline in the U.S. as it rebounds in other countries

Source: NPR

Sign up for our reads-only mailing list here.