My Two-for-Tuesday morning train WFH reads:

• Why Is Inflation So Sticky? It Could Be Corporate Profits: Economists think some companies may have been raising prices faster than their costs have increased, making it harder for inflation to fall (Wall Street Journal)

• The FAAMGs are more than just five stocks: The thought of a few companies accounting for so much of the market is jarring, and it’s the kind of thing that you might consider a market vulnerability. Two quick things: First, there isn’t much evidence that shows a relationship between market concentration and forward market returns; Second, market concentration isn’t unusual. (TKer) see also Bets Offering 2,400% Payout on US Default Lure Growing Crowd: Volumes, spreads on US CDS are rising amid debt-cap showdown; Deeply discounted long bonds could supercharge swap payouts (Bloomberg)

• Why Banks Keep Failing: Three previously solid, medium-size banks suddenly faced annihilation. The blame lies with the system itself. (The Atlantic)

• The Glorious Return of a Humble Car Feature: Automakers are starting to admit that drivers hate touchscreens. Buttons are back! (Slate) see also A Tax Loophole Makes EV Leasing a No-Brainer in the US: An exemption in the Inflation Reduction Act is worth $7,500 to drivers who lease. (Businessweek)

• IKEA Redesigns Its Bestsellers, Starting With the Billy Bookcase: With inflation squeezing consumers and material and shipping prices up, the company took products back to the drawing board (Wall Street Journal)

• The New Social Network That Is Finally Threatening Elon Musk’s Twitter: Bluesky has instant buzz and great vibes. Is that enough? (Slate) see also What is Bluesky, and why is everyone on Twitter talking about it? The invite-only, decentralized new social network, explained. (Vox)

• A massive cavern beneath a West Antarctic glacier is teeming with life: Glaciologists bored 500 meters through the Kamb Ice Stream to access the cavern. (Science News)

• Independents Saw Urgency in Ousting Trump. Will They Feel the Same About Re-electing Biden? In Arizona, where independents are a crucial voting bloc, there might not be the same sense of urgency for a Biden-Trump rematch. And some voters might look elsewhere. (New York Times) see also Frum: The Coming Biden Blowout: Republicans thought about running without Trump in 2024—but lost their nerve. They’re heading for electoral disaster again. (The Atlantic)

• It’s Time to Take the Lakers Seriously (Again) Few believed Los Angeles could be a legit contender this season, even after its trade deadline makeover. But after upsetting the Grizzlies in the first round? It’s hard to deny that LeBron James and Co. have a real shot at another title. (The Ringer)

• How to Prepare and Eat The Little Mermaid Cast: “My preference would be to stuff Flounder’s insides with lemon, garlic, and as many fresh herbs as you can.” (Vulture)

Be sure to check out our Masters in Business next week with Ben Clymer, founder & chairman of Hodinkee, and Jeffery Fowler the firm’s CEO. Fowler and Clymer (dubbed the “High Priest of Horology“) discuss all things wristwatches and timepieces, including their experiences at the 2023 Watches & Wonders, why the marketplace has exploded over the past few years, and what are their favorite grail watches.

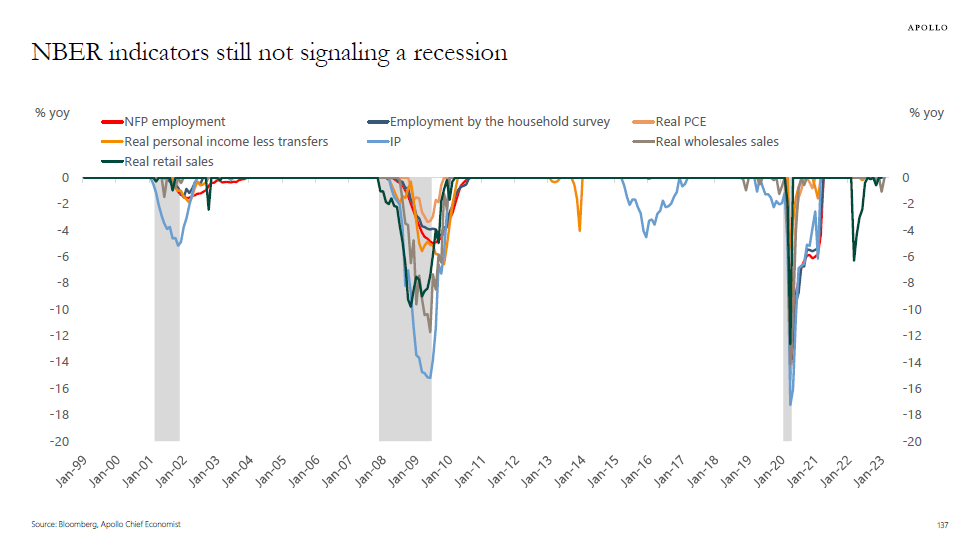

None of the indicators the NBER recession committee normally looks at suggest that we are in a recession.

Source: Torsten Slok, Apollo