I have been a reader of Jamie Catherwood’s Investor Amnesia since it launched. It is always filled with interesting reminders from the past.

Investor Amnesia is a wonderful reminder that we tend to forget that which came before. Ray Dalio put it even more starkly, noting that nothing is truly unprecedented, and we tend to use that word to refer to those things we have not experienced in our lifetimes.

Towards that end, check out Catherwood’s latest project: The Ages Of Finance: A Timeline Of Markets. You can sort the long history of finance on a timeline, either by specific topics — Equities, Milestones & Innovations, Commodities, Debt, and Manias & Crashes — or by “All Market History.” It is yet another reminder of how rare truly novel events are, and how everything old becomes new again.

I’ve included some samples below, but you should go check out the Timeline in its entirety….

~~~

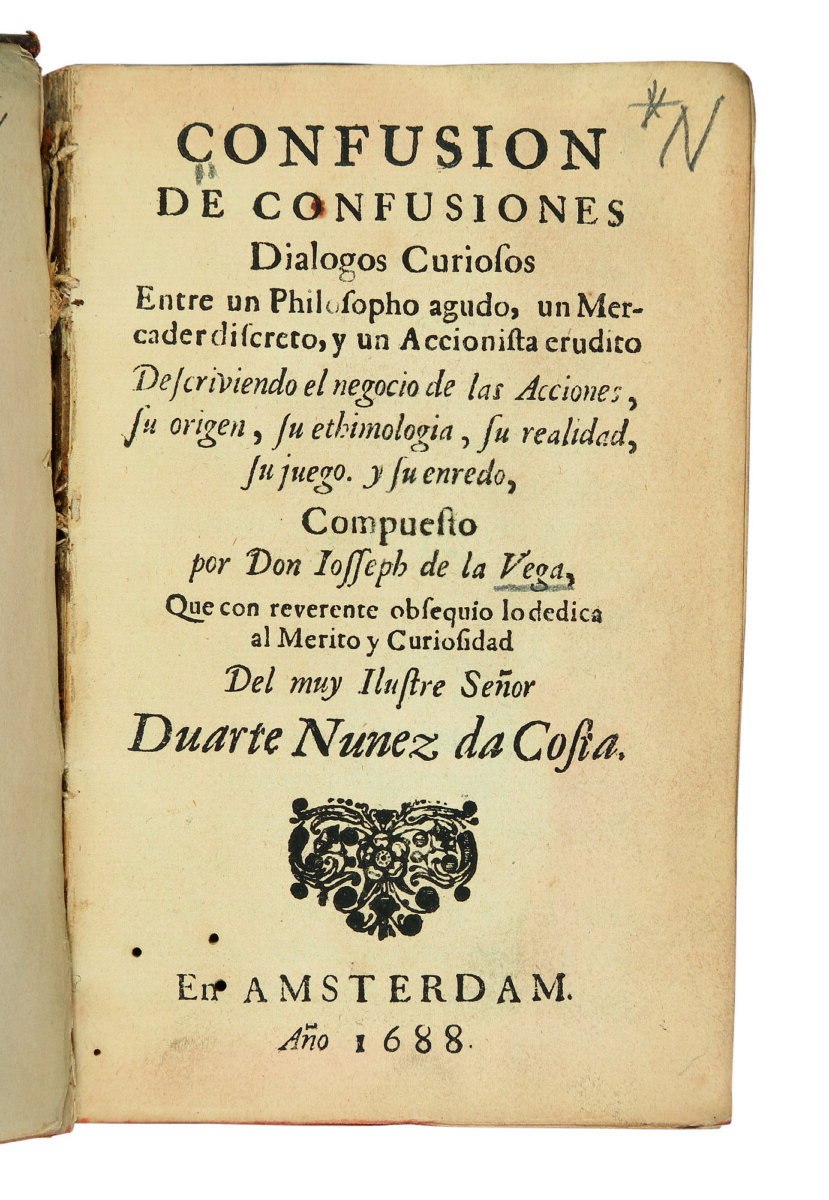

Joseph de la Vega wrote the first ever behavioral finance book in 17th century Holland. His book, Confusion de Confusiones, is a conversation between an Investor, Philosopher and Merchant in which the Investor explains how the stock market functions. This excerpt offers just one of the brilliant descriptions of markets:

“This business of mine [investing] is a mysterious affair, and that, even as it was the most fair and noble in all of Europe, so it was also the falsest and most infamous business in the world. The truth of this paradox becomes comprehensible, when one appreciates that this business has necessarily been converted into a game, and merchants [concerned in it] have become speculators…“

~~~

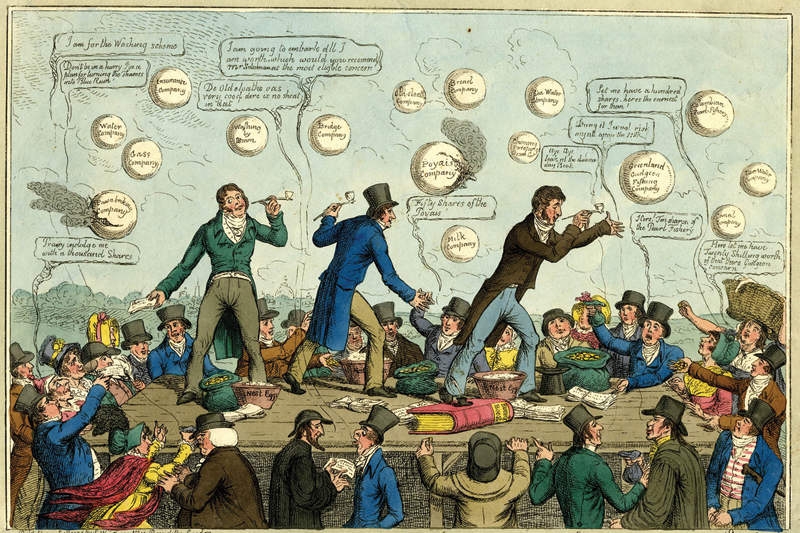

The Poyais Scam

Gregor MacGregor was deemed the ‘King of Con-Men’ by The Economist for pulling off the ‘greatest confidence trick of all time’. MacGregor earned this title by finding an uninhabited piece of land on the coast of Honduras, creating a fictitious country called Poyais, and selling over a billion dollars worth of ‘Poyais bonds’ in London by misleading investors with lies about how Poyais was a developed society. MacGregor claimed that Poyais was home to beautiful architecture, an opera house, parliamentary building, cathedral, and more. In reality, it was an uninhabited jungle. –Poyais Scam

~~~

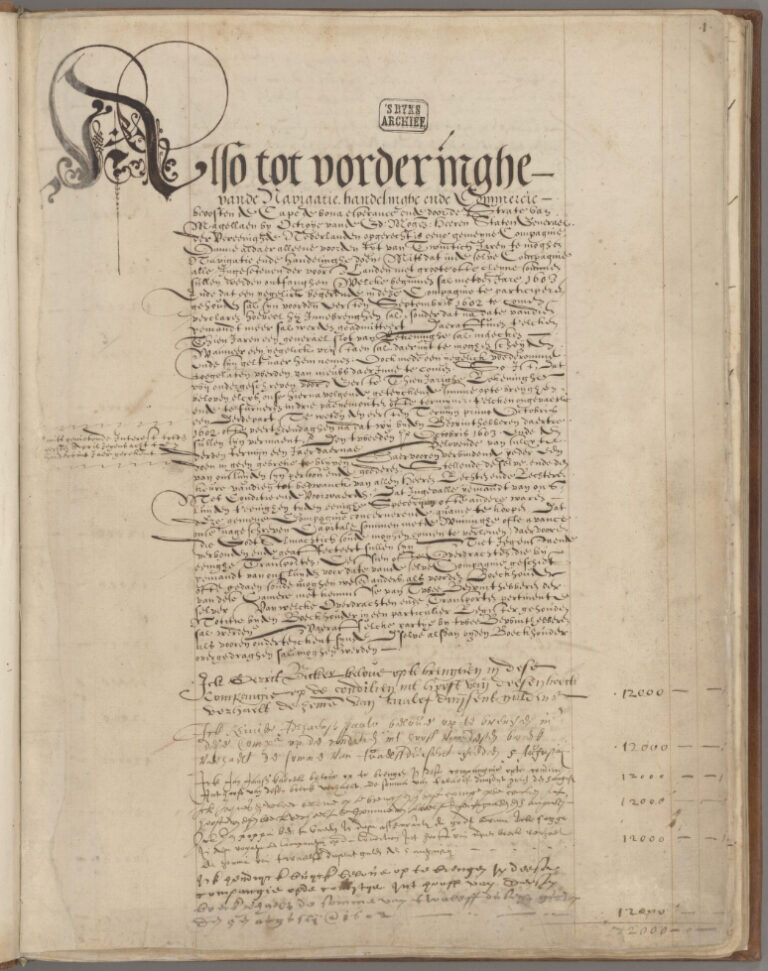

The First IPO

The Dutch East India Company formally announced its IPO in the corporation’s founding charter on March 20, 1602. The company invited all Dutchmen to invest when shares became available for purchase in August 1602. The general public’s ability to invest in this share offering was what made this first “IPO” so unique, as previously companies raised capital from small groups of wealthy investors. When the IPO subscription period ended on August 31, some 1,100 investors had purchased shares in the IPO. Read More: The World’s First IPO

~~~

The Panic Of 1882