My Two-for-Tuesday morning train WFH reads:

• Miami’s Love Affair With Crypto Is Souring as Bitcoin Faithful Flock to the City: On the eve of the annual bitcoin conference, the city and its mayor have mostly moved on from crypto. (Wall Street Journal) but see Crypto’s Most Influential Companies Often Follow Their Own Rules — Even After FTX’s Collapse: A review of practices at 60 of the sector’s most influential companies found many lack basic guardrails. (Bloomberg)

• The audacious plan to trigger Credit Suisse’s CDS: Can a bond that no longer exists trigger a default? This is the quasi-metaphysical question facing the panel of experts who have to determine whether Credit Suisse’s credit-default swap contracts will pay out. Call it Schrödinger’s swap. (Financial Times)

• All the arguments against EVs are wrong EVs are just going to win. Some on the political right are still suspicious that EVs are a government-subsidized scheme to reduce their standard of living, while some on the left worry that EVs will cause exploitation and environmental destruction and suburban sprawl. And pretty much everyone is asking whether the world has enough minerals to complete the transition. (Noahpinion) see also The New EV Gold-Rush: Automakers Scramble to Get Into Mining. A scarcity of EV battery materials pushes car companies and miners to work closer together; for both, there is a learning curve (Wall Street Journal)

• Coastal Cities Priced Out Low-Wage Workers. Now College Graduates Are Leaving, Too. Major coastal metros have been hubs of the kind of educated workers coveted most by high-powered employers and economic development officials. Economists have lamented the growing coastal concentration of their wealth. A politics of resentment in America has fed on it, too. These urban centers have become a class of their own — “superstar cities” — with outsized impact on the American economy fueled by the clustering of workers with degrees. (New York Times)

• Why Google is reinventing the internet search: Generative AI is here. Let’s hope we’re ready. (Vox) see also Do You Still Believe These 19 Ridiculous Tech Myths? Fact and fiction frequently collide when it comes to the technology we use in our daily lives. We set the record straight. (PC Magazine)

• This New Airline Is Raising the Bar, From First Class to Economy: Starlux has officially begun flying in the US. Here’s a look inside its fancy cabins (Bloomberg)

• Reckoning With Birth: What would happen if we took our natality as seriously as our mortality? (Commonweal) see also The Harms of Hospital Mergers and How to Stop Them: There is robust evidence that hospital mergers cause an array of problems, whether between direct competitors or not. “Well, the consolidation we predicted has happened: Last year saw 112 hospital mergers (up 18% from 2014). Now I think we were wrong to favor it.” (American Economic Liberties Project)

• The Art of the Doomer on worldviews and cognitive models: I’m really fascinated by doomerism – how loud and confidently people will talk about what presumably is the end of their world. I am not sure why there tends to be an undercurrent of “if things collapse, I will be okay because I have gold bars” because if things do end up falling apart, they tend to exist within a state of rubble rather than a state of utility, but alas. (Kyla)

• A California journalist documents the far-right takeover of her town: ‘We’re a test case’. Doni Chamberlain’s been a journalist in Shasta county for nearly 30 years. Now she’s targeted by the extremists who are looking to reshape the region (The Guardian) see also ‘We Just Want Someone Sane’: What Happens When a Small Town Goes MAGA. Washington County, Pennsylvania, was never known as Crazytown. Then election deniers decided to run for local office. (Bloomberg)

• How modern singing was invented: Modern singing – whether on the charts or Eurovision – is radically different to the kind familiar to our ancestors. (BBC)

Be sure to check out our Masters in Business interview this weekend with venture capitalist and seed investor Howard Lindzon. He is the founder and CIO of Social Leverage, where he makes early-stage investments. He founded Wall Strip (sold to CBS in 2007), co-founded StockTwits (which pioneered the ‘cashtag’ e.g., $AAPL), and was the first investor in Robin Hood. Social Leverage recently launched its 4th fund.

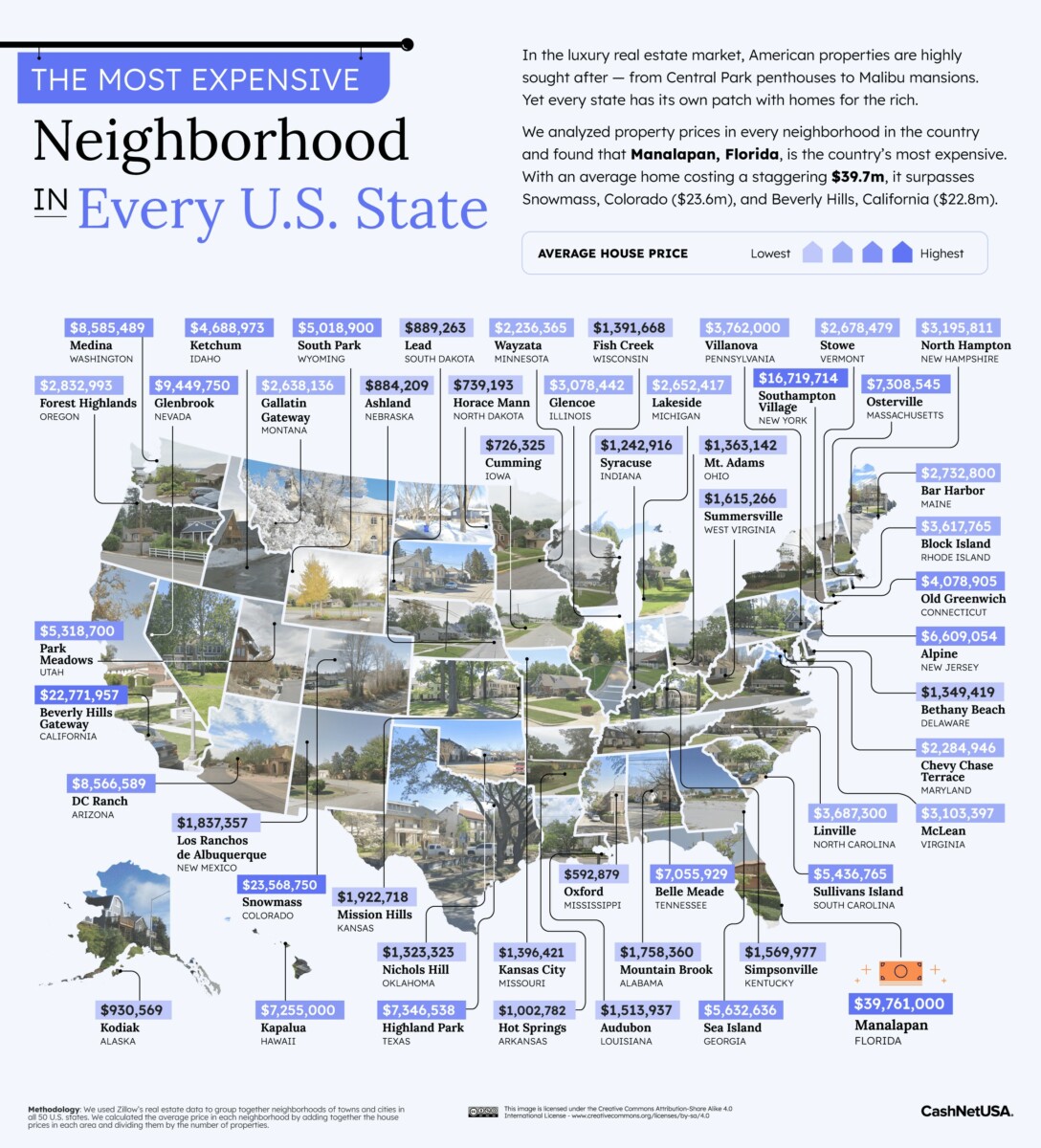

The Most Expensive Neighborhood in Each State, Mapped

Source: Mental Floss