My back-to-work morning train reads:

• Why Are Markets So Calm? It’s Revenge of the Quant Funds: Firms that use computers to determine buy and sell signals have been loading up while other investors sit back. (Wall Street Journal)

• Crypto Is Staging a Major Rebound. How It Survived a $3 Trillion Crash. Bitcoin and other tokens have rebounded while big companies and funds continue to plow capital into cryptocurrencies. (Barron’s)

• Five Things That Could Knock Nvidia Down: Which is why now is a perfect time for us all to remind ourselves that stocks trading 170x earnings don’t normally reward the people who come in at these levels. And its an even better time to review some of the biggest risks to the story, because no matter where the price goes from here, sooner or later one of these things is more likely to happen than not. (TRB)

• Winklevoss Twins Attempt Pivot After Gemini Loses Money and Employees: Mounting market, legal and regulatory challenges in the US cloud the firm’s future as it seeks an overseas reset. (Bloomberg / Yahoo)

• Why Tipping Prompts Are Suddenly Everywhere: Shoppers encounter more requests for extra money from businesses they never expected. (Wall Street Journal) see also POS Tip Demands Are Driving Inflation Higher. Has the Bureau of Labor Statistics fully unpacked how to deal with this “innovation”? I am unsure how hip the FOMC or BLS is to this issue. But this much is clear: This tech-psych guilt trip has consumers spending more on services than they ordinarily would or should. (The Big Picture)

• The debt ceiling deal: What was the whole point? A manufactured crisis leads to an ineffectual “solution”. The recent fight over the debt ceiling seems more like a return to the pointless obstructionism and grandstanding that characterized politics in the 2010s. There was absolutely zero reason for the House GOP leadership to use the debt ceiling — they could have just forced a deal through the normal appropriations process. The net effect of using this tactic seems to have been to make the U.S. look like a dysfunctional clown show in front of our allies, at a time when we need to be projecting an image of dependability. (Noahpinion)

• The Unexpected Problem With EVs: They ‘Tire’ Quickly: Electric vehicles go through tires 30% faster than gas-powered vehicles, Bridgestone says, so it developed its first EV-specific replacement tire that protects range and improves durability. (PC Magazine)

• Is It Real or Imagined? How Your Brain Tells the Difference. New experiments show that the brain distinguishes between perceived and imagined mental images by checking whether they cross a “reality threshold.” (Quanta Magazine)

• Puritanism took over online fandom — and then came for the rest of the internet: Puriteens, anti-fans, and the culture war’s most bonkers battleground. (Vox)

• Football bonded them. Its violence tore them apart. They were roommates and teammates at Harvard, bound by their love of football and each other. Then the game — and the debate over its safety — took its toll. (Washington Post)

Be sure to check out our Masters in Business next week with John Hope Bryant, the founder and chief executive officer of Operation HOPE. The firm focuses on providing financial illiteracy as a way to address systemic issues for under-served individuals and small businesses. He is also the CEO of Bryant Group Ventures, and The Promise Homes Company. Bryant was named 2016 American Banker ‘Innovator of the Year,’ He has been an advisor to the last three sitting U.S. presidents.

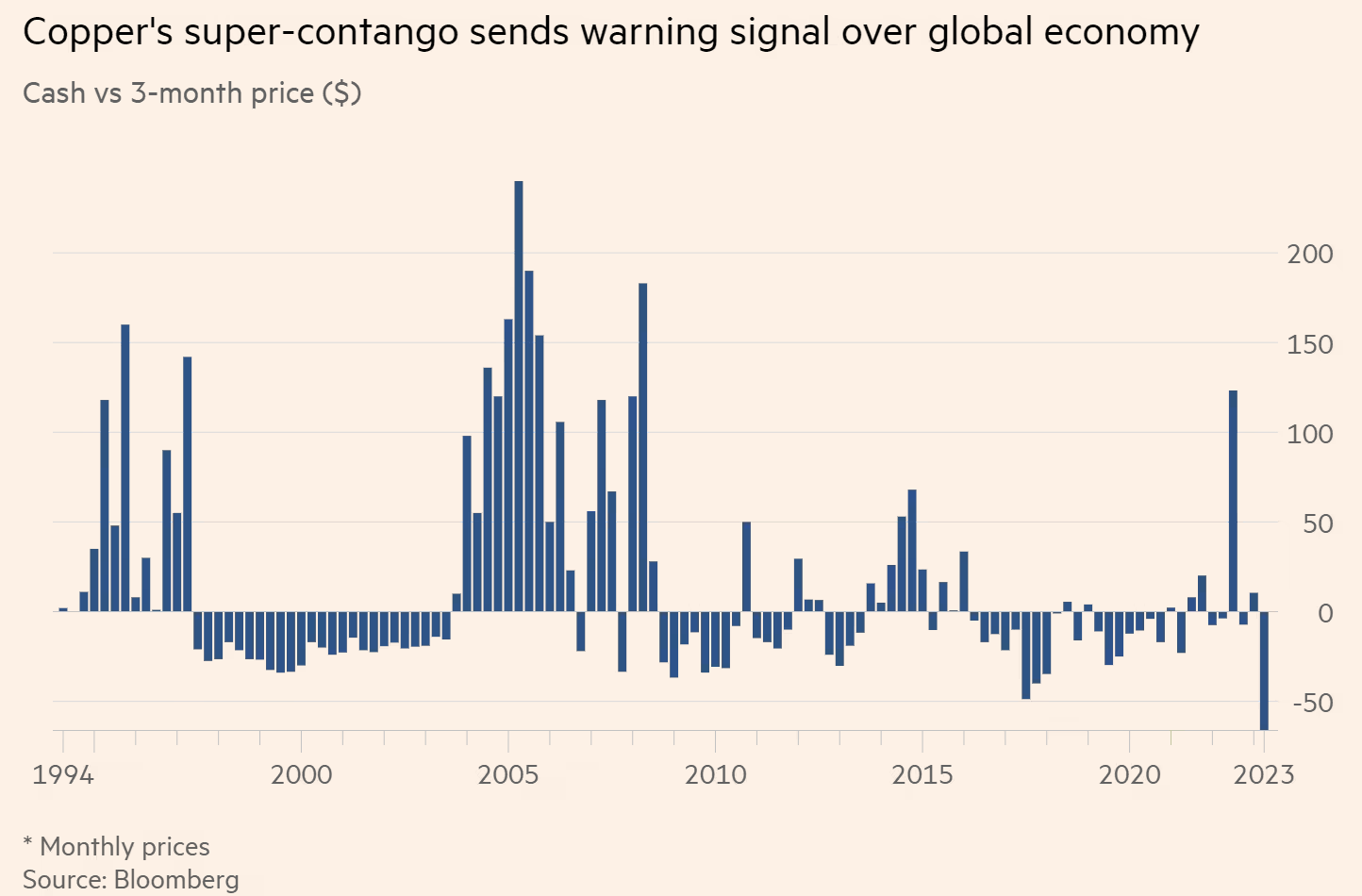

Copper price slides as global demand drops sharply

Source: Financial Times