My mid-week morning train reads:

• The Rise of FTX, and Sam Bankman-Fried, Was a Great Story. Its Implosion Is Even Better. About a year after the author Michael Lewis began to shadow Bankman-Fried, the founder of the crypto exchange FTX, Bankman-Fried was arrested. As the story evolved, Lewis has had a front-row seat to the drama. (New York Times)

• The Return to the Office Has Stalled: Offices remain half empty as companies settle into hybrid work plans. (Wall Street Journal) see also Is 50% the New (Metro) RTO? Europe‘s return to office rate 90+%, while RTO in the USA is just ~60%; Metro areas are doing even worse at 50%. (TBP)

• Paper Bears: If everything is so bad why are most people happy? I’m fine but everything else is terrible seems to be the default assumption for most people these days. The pandemic has obviously had an impact on how people generally feel about the state of the world and not in a good way. But it is weird that most people seem satisfied with their life in general but assume everyone else must be miserable. (Wealth of Common Sense)

• How Close is Tokenization for Mainstream Investors? Several money managers now offer tokenized funds to investors, while other firms are exploring ways to utilize tokenization for clients. (CIO)

• The Billion-Dollar Ponzi Scheme That Hooked Warren Buffett and the U.S. Treasury: How a small-town auto mechanic peddling a green-energy breakthrough pulled off a massive scam (The Atlantic)

• The case for financial literacy education: The damage wrought by a lack of financial literacy extends beyond the individual — to companies and even to the economy. “Influential policymakers and central bankers, including former Fed Chairman, Ben Bernanke, have spoken to the critical importance of financial literacy.” If only… (NPR)

• How Tokyo Became an Anti-Car Paradise: The world’s biggest, most functional city might also be the most pedestrian-friendly. That’s not a coincidence. (Heatmap)

• These Next-Generation Vaccines Could Upend Cancer Treatment As We Know It: Some of the tech used to make Covid-19 shots could help treat cancer and heart disease. (Inverse)

• The Era of Warriors Inevitability Is Over, But a New One Starts: Now Golden State’s dynastic run came to an end with a Game 6 loss to the Lakers, but don’t count out a rebound. (Sports Illustrated)

• What Little Richard Deserved: The new documentary “I Am Everything” explores the gulf between what Richard accomplished and what he got for it, and between who Richard was and who he let himself be. (New Yorker)

Be sure to check out our Masters in Business interview this weekend with venture capitalist and seed investor Howard Lindzon. He is the founder and CIO of Social Leverage, where he makes early-stage investments. He founded Wall Strip (sold to CBS in 2007), co-founded StockTwits (which pioneered the ‘cashtag’ e.g., $AAPL), and was the first investor in Robin Hood. Social Leverage recently launched its 4th fund.

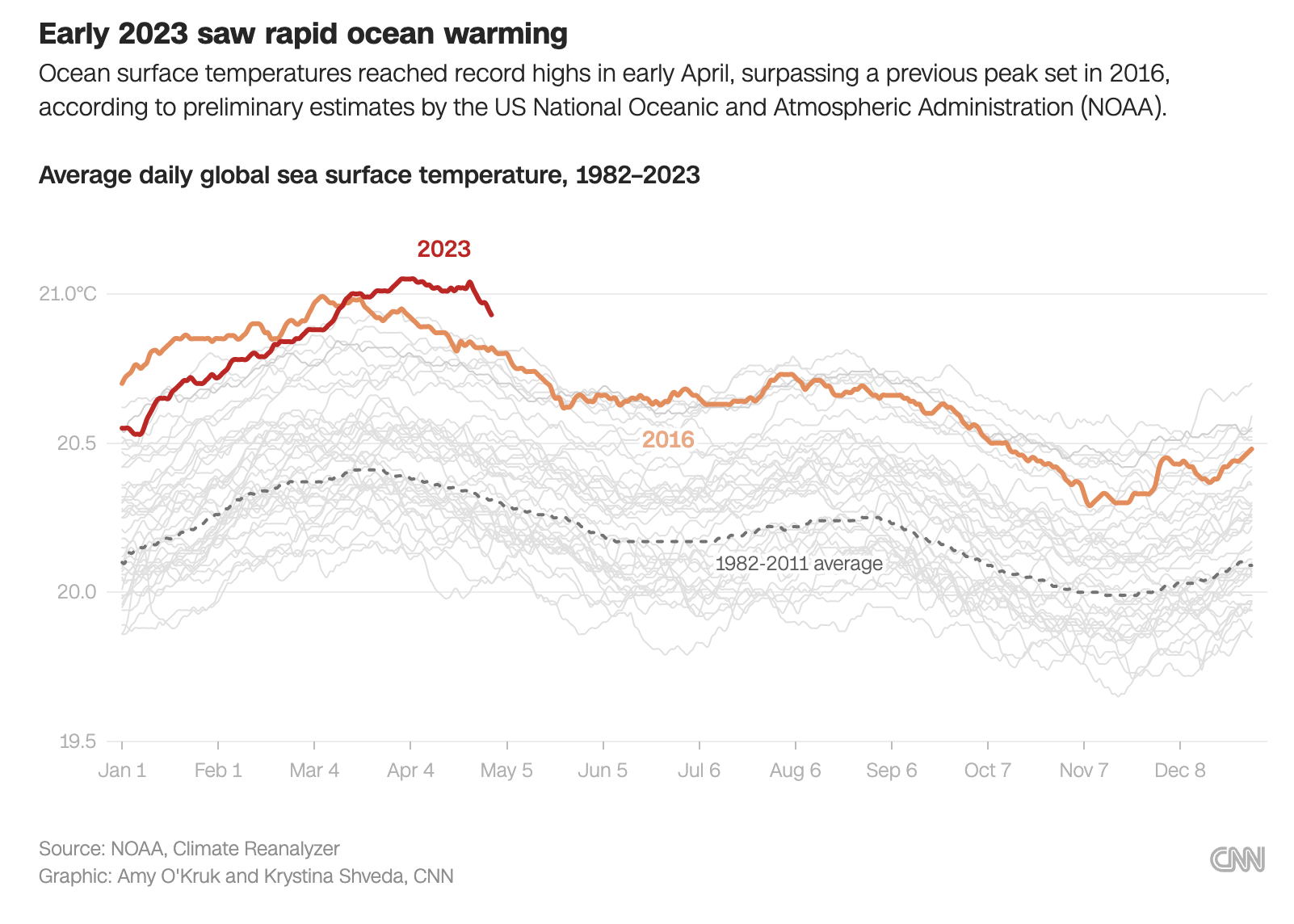

Ocean temperatures are off the charts right now, and scientists are alarmed

Source: CNN

Sign up for our reads-only mailing list here.