My mid-week morning train WFH reads:

• Will The U.S. Economy Pull Off a ‘Soft Landing’? In the ’70s and ’80s, we thought that you needed to raise unemployment to fight inflation. Next, we thought that cooling down inflation would require higher unemployment. In the early ’70s, economists thought that price controls could slow inflation. …and were surprised when unemployment stayed low. In the late ’80s, we thought that a good inflation target was 4 percent. Then we decided that a better target would be 2 percent.. (New York Times)

• JPMorgan’s US debt default Q&A: JPMorgan late on Friday published a fantastic Q&A that explores most of the technical issues surrounding a possible US default. While the bank’s analysts stress that they “fully expect a timely resolution of the debt ceiling constraints”, it noted that clients naturally had a lot of questions. (Financial Times) see also Even Flirting With U.S. Default Takes Economic: Toll Financial markets are still betting that Congress and the White House will strike a deal. But the uncertainty alone is having consequences. (New York Times)

• How Did Hyundai Get So Cool? Korean carmaker known for budget brands becomes EV innovator; sets sights on Tesla. (Wall Street Journal)

• Decoupling is just going to happen: Chinese policy and geopolitical risk are doing a lot of the work here. (Noahpinion)

• Why Are Economists Still Uncertain About the Effects of Monetary Policy? Despite decades of research, there remains substantial uncertainty about the quantitative effects of monetary policy. Different models produce conflicting predictions, and these predictions lack precision. This article discusses some reasons for these issues. In addition to the relative lack of data, the structure of the economy has continued to evolve, posing challenges for empirical macroeconomic analysis more generally. Economists have been confronting these challenges by developing tools to jointly consider a range of models and continuing to seek new sources of data. (Federal Reserve Bank of Richmond)

• Foresight: The mental talent that shaped the world: When humanity acquired the ability to imagine the future, it changed the trajectory of our species. But in the age of the Anthropocene, we need to harness this mental skill now more than ever, say the scientists Thomas Suddendorf, Jon Redshaw and Adam Bulley. (BBC)

• How Will We Know When Self-Driving Cars Are Safe? When They Can Handle the World’s Worst Drivers: Call it the Mad Max driving test, a gantlet only a Hollywood director—or a mild-mannered engineer—could dream up. (Wall Street Journal)

• ‘The exact opposite of Donald Trump’: Republican senator Tim Scott’s vision for America: Can the politician’s Reaganesque optimism and rightwing principles convince the GOP to pick its first Black presidential candidate? (The Guardian)

• What Do a Falling Apple and an Orbiting Moon Have in Common? Isaac Newton connected the two motions in a way that revolutionized physics and made space travel possible. (Wired)

• Killers of the Flower Moon review – Scorsese’s magnificent period epic is an instant American classic: Leonardo DiCaprio and Robert De Niro star in a sinuous, pitch-black tragedy about how the west was really won. (The Guardian)

Be sure to check out our Masters in Business next week with Robyn Grew, Incoming CEO of Man Group, (and current President). Man Group is the largest publicly traded hedge fund in the world, whose history dates back 230 years to 1783. Previously, she held senior positions at Barclays Capital, Lehman Brothers, and LIFFE.

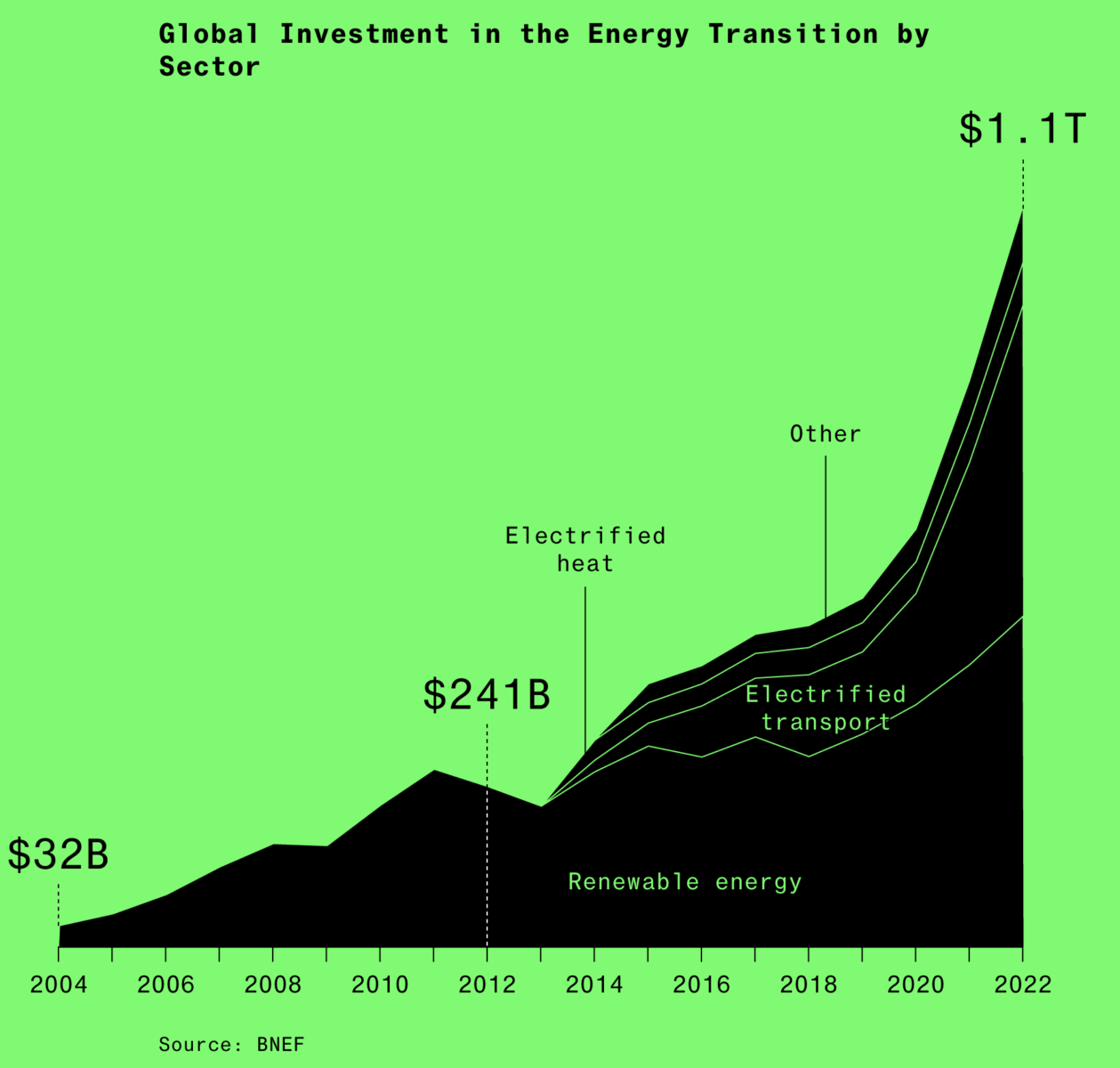

How the World Is Spending $1.1 Trillion on Climate Technology

Source: Bloomberg

Sign up for our reads-only mailing list here.