My mid-week morning train reads:

• The Best Time to Buy Stocks: Some people simply cannot help themselves when it comes to buying after stocks go up and selling them after they go down. Let’s just hope all of the people who came charging into the stock market these past few years stick around. It would be a shame if a new group of investors entered because of a bull market and stopped investing because of a bear market. (A Wealth of Common Sense)

• Even Cathie Wood Can’t Spot the Next Bull Market: She built her reputation on picking tech trends. Now she is having to defend bailing out of Nvidia. (Bloomberg) see also Cathie Wood can’t fight the Fed: Ark Innovation ETF’s dependence on interest rate forecasts undermine stockpicking reputation. (Financial Times)

• How Moneyball Investing Ran Into a Data Squeeze Play: Quants can arbitrage away the advantages in factors and statistics almost as soon as they’re discovered. Look at the once-innovative Oakland A’s. (Bloomberg)

• U.S. Investors Want More Exposure to Japan. Here’s What They Should Know Beforehand. “At first, investing in Japan or predicting Japan is so difficult; it’s quite a unique market,” said Ryoji Musha. (Institutional Investor)

• Billionaires and the Evolution of Overconfidence: To understand billionaires, you need to understand horizontal inequality, illusory control, self-selection bias, quantified self-worth, and the evolution of overconfidence. (The Garden of Forking Paths)

• American Cities Are Starting to Thrive Again. Just Not Near Office Buildings. Neighborhoods are benefiting from remote work. (Wall Street Journal) see also Downtown LA Office Vacancy Sets Record, Causes Distress: Brookfield has defaulted on three towers, while other landlords have sold for a loss or face foreclosure. (Bloomberg)

• A.I.-Generated Content Discovered on News Sites, Content Farms and Product Reviews: The findings in two new reports raise fresh concerns over how artificial intelligence may transform the misinformation landscape online. (New York Times)

• The strange survival of Guinness World Records: For more than half a century, one organisation has been cataloguing all of life’s superlatives. But has it gone from being about the pursuit of knowledge to simply another big business? (The Guardian)

• ‘Trump Bucks’ promise wealth for MAGA loyalty. Some lose thousands. The products are advertised online as a kind of golden ticket that will help propel Trump’s 2024 bid and make the “real patriots” who support him rich when cashed in. (NBC News)

• Jazz Struggles on Streaming, But Vinyl Sales Give the Genre Hope: The genre accounts for less than 1% of music streams. Verve, Ella Fitzgerald’s old label, eyes new artists like Samara Joy to change that. (Businessweek)

Be sure to check out our Masters in Business next week with John Hope Bryant, the founder and chief executive officer of Operation HOPE. The firm focuses on providing financial illiteracy as a way to address systemic issues for under-served individuals and small businesses. He is also the CEO of Bryant Group Ventures, and The Promise Homes Company. Bryant was named 2016 American Banker ‘Innovator of the Year,’ He has been an advisor to the last three sitting U.S. presidents.

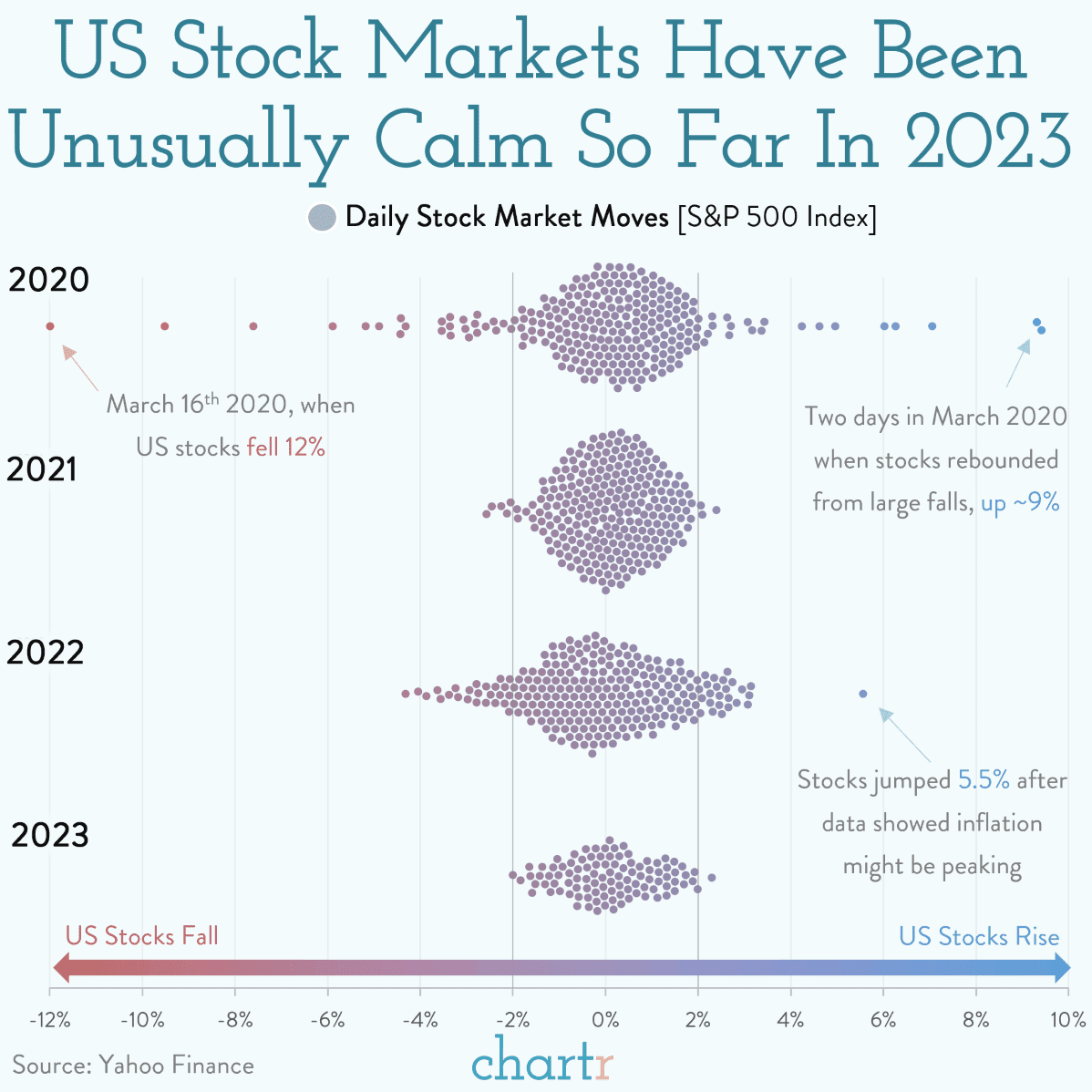

Stock markets are calm, despite the headlines

Source: Chartr

Sign up for our reads-only mailing list here.