My mid-week morning train WFH reads:

• The Stock Market Isn’t as Calm as It Seems: Traders are scooping up bets on volatility surging at a record clip. (Wall Street Journal)

• Tech’s Toughest Cuts Could Draw New Talent to Asset Management: Asset managers are eyeing thousands of workers laid off by the tech industry as asset management firms build out their own capabilities. (Chief Investment Officer)

• The Uneven Effect of Remote Work, in One List: This ranking of jobs by percentage of remote work also helps explain why the pandemic has left more scars in certain areas. (Upshot)

• Eat Your Heart Out, Tesla. Mercedes-Benz May Have the Fastest EV Yet. The Yasa motors could be a major technological breakthrough, though they’re based on principles laid down by Michael Faraday in 1821. Axial-flux motors are used in CD drives but not currently in electric cars other than the Ferrari SF90 Stradale. The motors, notably thinner than the standard radial-flux motors, promise higher torque and power density, with less weight and volume. A 250-horsepower motor could weigh only 52 pounds. The motors could be placed in the car’s wheel hubs—a goal for many automakers that has so far proven elusive in production. (Barron’s)

• The ‘Extend and Pretend’ Real Estate Strategy Is Running Out of Time: Higher interest rates and soaring vacancies have brought the commercial property industry to the brink. (Businessweek) but see New York Landlord Vornado Bets $1 Billion That More Commuters Will Return: Real-estate investor builds around Penn Station in the hope that workers will travel to the transit hub if the journey is easy. (Wall Street Journal)

• Reddit’s Chief Says He Wants It to ‘Grow Up.’ Will Its Community Let It? As the social media site matures, its users and moderators have made their displeasure about corporate changes known, putting the company into a bind. (New York Times)

• Everyone Says Social Media Is Bad for Teens. Proving It Is Another Thing. Parents, scientists and the surgeon general are worried. But there isn’t even a shared definition of what social media is. (New York Times)

• It’s almost like the House GOP never cared about deficits after all: Unlike most kinds of government spending, each dollar spent on the IRS leads to much more than a dollar flowing back into government coffers, especially when the IRS would use that funding to collect unpaid taxes. Which this spending would: The GOP-proposed cuts specifically target IRS enforcement efforts. The Treasury Department projects that this latest GOP proposal to siphon resources away from IRS enforcement would result in an $8.6 billion loss of revenue, by limiting the agency’s ability to audit high-income and corporate tax dodgers. (Washington Post)

• How Pacman Jones, NFL poster boy for bad behavior, stepped in for fallen teammate’s family: After the strip clubs and the suspensions, after the man who drafted him sixth overall called him “nothing but a disaster off the field,” after two NFL teams gave up on him, the CFL decided he wasn’t worth the headache and he flunked what he figured was his last chance at pro football, Adam “Pacman” Jones stood inside the tunnel at Paul Brown Stadium in Cincinnati, overweight and out of shape, his hamstrings screaming, his career in peril, and cried… (The Athletic)

• Harrison Ford Is 80. He’s Proof: Silver-Haired Stars Are the New Box-Office Gold. Ford, Tom Cruise, Denzel Washington and other actors of a certain age are coming soon to a theater near you—again. They’re putting a new spin on the term ‘old Hollywood.’ (Wall Street Journal)

Be sure to check out our Masters in Business this week with Peter Borish, founding partner at Tudor Investments, where he was Director of Research for 10 years working directly with Paul Tudor Jones. He has also been Chairman and CEO of Computer Trading Corp, and Chief Strategist for quant fund at Quad Group. Borish is also a founding trustee of the Robin Hood Foundation, formed with Paul Tudor Jones in 1988.

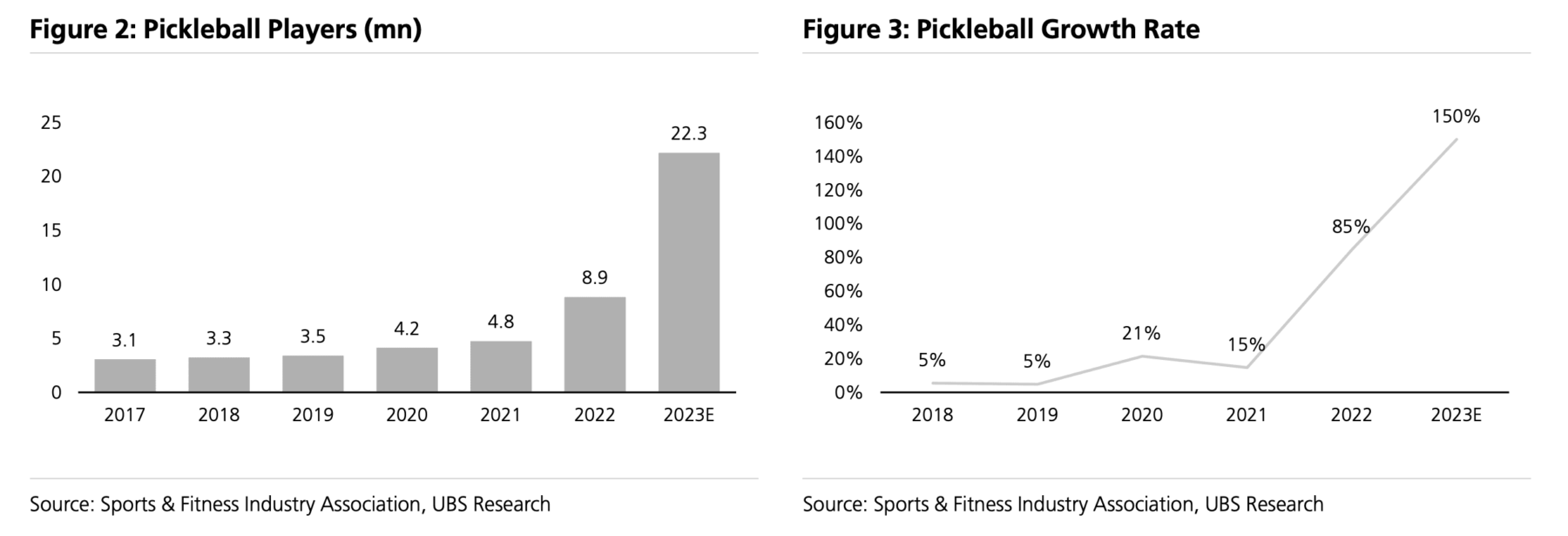

“We Estimate $250-500 mn in Medical Costs Attributable to Pickleball in 2023”

Source: @SamRo

Sign up for our reads-only mailing list here.