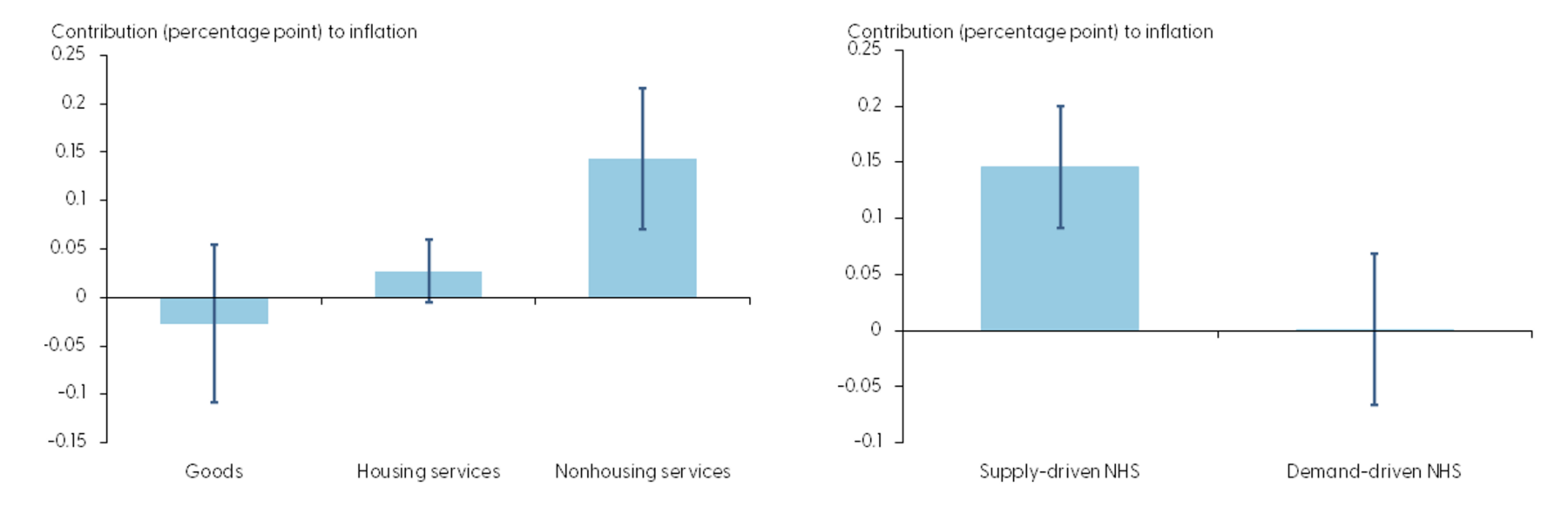

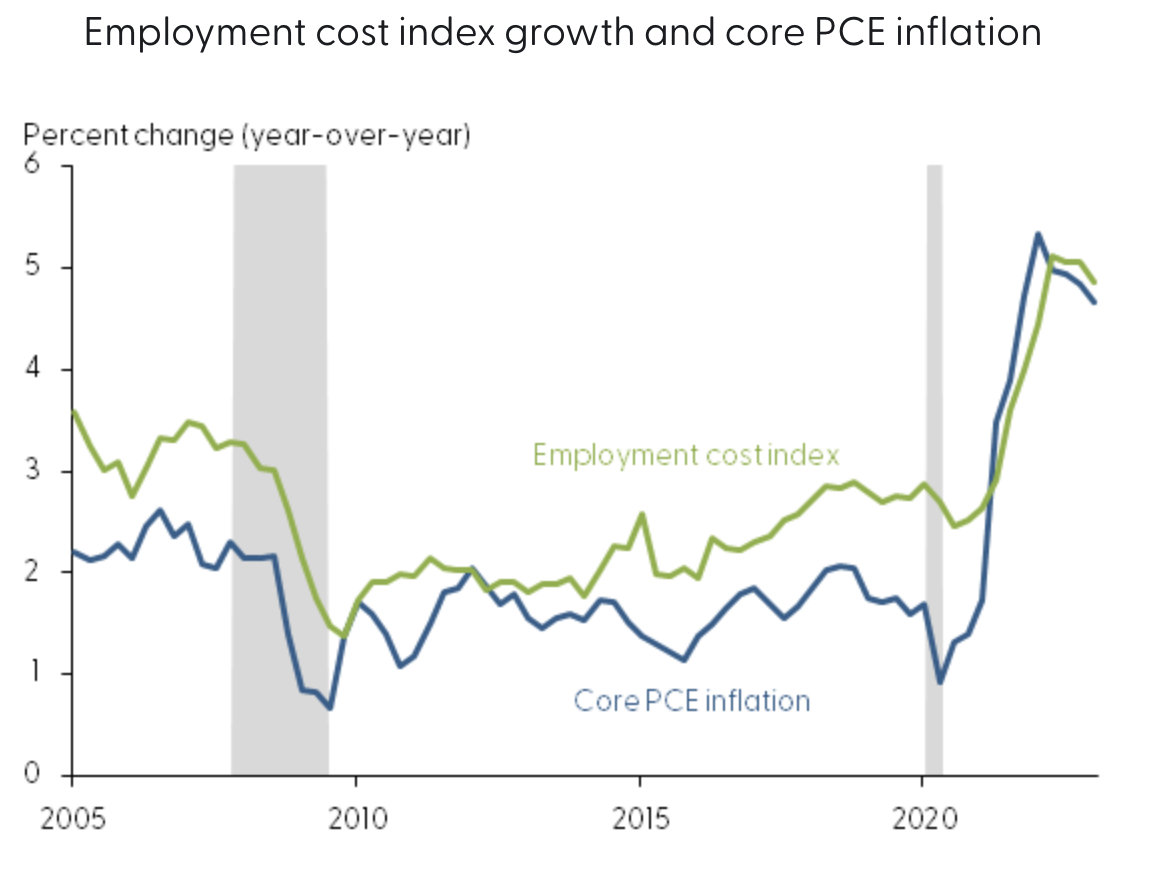

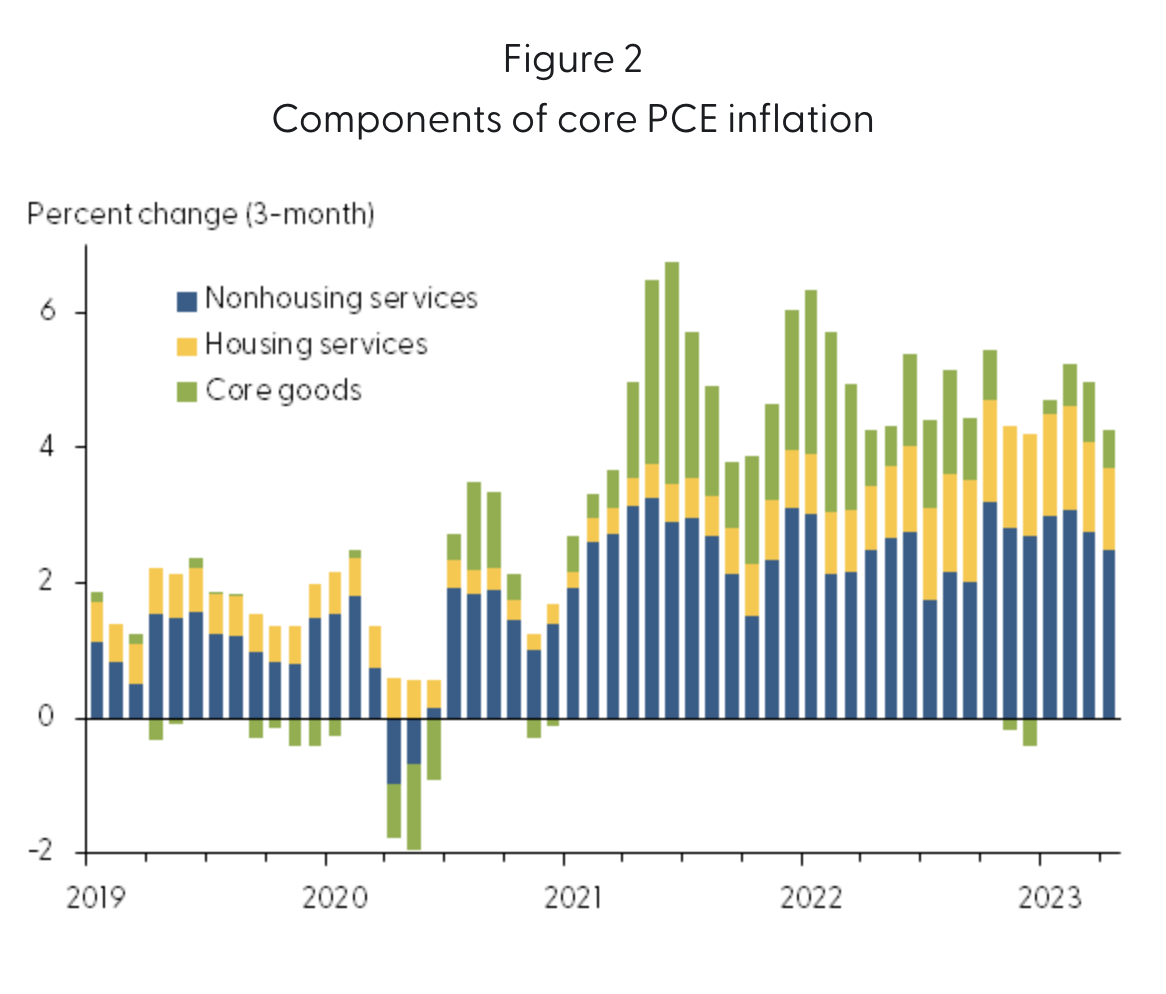

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings. Analysis shows that higher labor costs are passed along to customers in the form of higher nonhousing services prices, however the effect on overall inflation is very small. Labor-cost growth has no meaningful effect on goods or housing services inflation. Overall, labor-cost growth is responsible for only about 0.1 percentage point of recent core PCE inflation.” (emphasis added)

Fascinating research from the San Francisco Federal Reserve Bank, pondering the impact of wage gains on inflation.

Counterintuitively, they found that rising wages have a minimal impact on inflation. How little? The study found that a “1% point increase in labor costs causes only a 0.15% rise in core PCE inflation” over four years – an increase of less than 0.04% annually.

There are several factors that explain this: First is productivity and efficiency gains; rising productivity is a large part of the reason why service-sector profits have been expanding over the past few decades. Second, In many services businesses wages are but one component of many that affect producer prices. Last, there are times when companies would rather retain market share, and occasionally allow higher wages to eat into margins.

I would add a caveat about the unique impact of the pandemic: The shift to goods over services during the lockdowns – an enormous 20% surge – along with the massive fiscal stimulus of the three CARES Acts was also a driver of higher prices. Add to the mix shortages caused by broken supply chains. The sudden influx of cash to households combined with lots of pent-up demand created an inflation spike.

This is important because Federal Reserve Chairman Jerome Powell – incorrectly in my and others’ views – has stated his concerns over rising wages as a driver of inflation. The Fed Chair stated it “may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.”

The focus on rising wages has led to some policy decisions that have had all sorts of unintended consequences. Perhaps that’s why so few Fed economists boast about stagnant wages over the past 3decades contributing to deflation.

Regardless, credit Adam Hale Shapiro, a senior economist in the Economic Research Department of the Federal Reserve Bank of San Francisco, for calling out that his boss is wrong about this issue…

Source:

How Much Do Labor Costs Drive Inflation? (PDF)

Adam Hale Shapiro

FRBSF Economic Letter, May 30, 2023

See also:

Peter Coy: The Minimum Wage Is Pretty Minimal (March 31, 2023)

Previously:

Generational Reset of Minimum Wage (November 30, 2021)

Cutting Unemployment Benefits Does Not Increase Employment (September 1, 2021)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)

America’s Corporate Welfare Queens (BloombergNovember 13, 2013)