In response to employee shortages and hiring difficulties, 25 states in America ended enhanced unemployment insurance payments early.

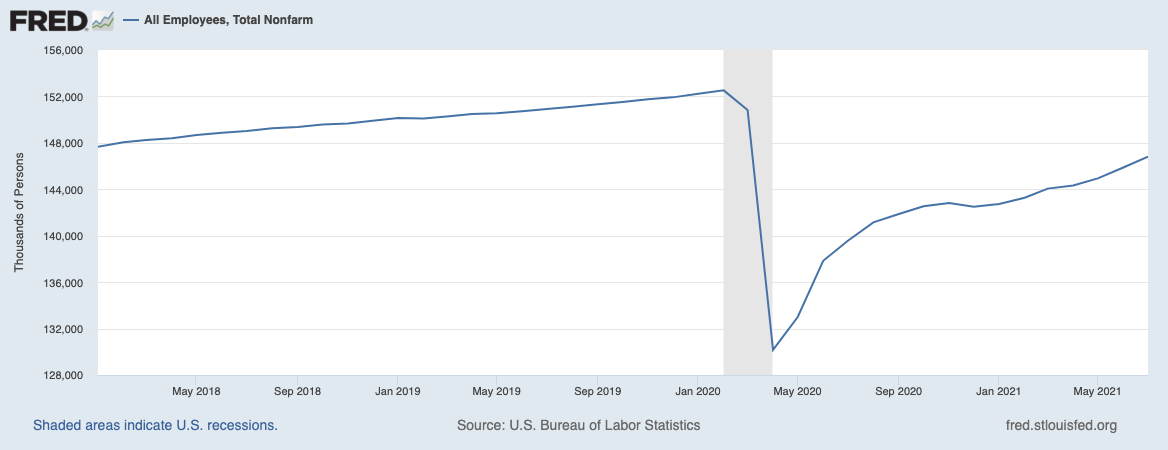

The thinking: If we curtail generous unemployment benefits of the CARES act, these people would then go back to their former low-paying and/or unsatisfying jobs. The US still has 5.7 million fewer employed than before the pandemic.

Today, the Wall Street Journal reported that “Nonfarm payrolls rose 1.33% in July from April in the 25 states that ended the benefits [early] and 1.37% in the other 25 states and the District of Columbia [that did not].”

In other words, the promised benefit of ending UI benefits early was not evident in the data.

This should come as no surprise: As we have detailed here, those pushing for early benefit termination 1) used an outdated, misguided model of lower-wage workers; 2) ignored data about the state of the labor market; 3) assumed a positive impact on labor shortages that was highly unlikely.

Start with a lack of available child care and concerns about Covid so often cited by economists. That only gets you part of the way to why those ending UI had little or no impact. There are myriad underlying reasons driving this phenomenon — and if you understand these, you will understand a lot more about what is going on today.

It is also why I am so constructive: My view of the expansion is the economy is mid-cycle, not late-cycle/Fed dependant; this implies the market has further — perhaps much further — to run. Let’s look at the data that is informing my perspective

Consider those changing careers: As noted in Elvis (Your Waiter) Has Left the Building, “Waitstaff, bartenders, hotel maids, busboys, dishwashers (and others) used the year of lockdown to level up, gain new skills, find not new jobs, but new careers. They have exited difficult, thankless, dead-end jobs for a chance at the American Dream.”

Any hypothesis is just an empty theory without the data to back it up. There are two key data points that support this idea:

1) New business formation has been substantial; in 2020 it was near record-breaking pace.

2) The Quits Rate is not only above pre-pandemic levels, it reached an all-time high at 2.7%.

We’ve never had more gainfully employed people quitting their jobs to do something else, and we never have had more people starting up new businesses than ever before. The balance of power between employers and employees is shifting. As noted here in June, “Job openings at record highs, Quit rates at record highs, new business formation at records highs . . . why, it’s almost as if these things are related!”

What are the new gigs that have people refusing to go back to their old jobs? We have seen an explosion in:

-Mobile apps

-FinTech & finance

-DeFi, Crypto/Blockchain

-Content creators, influencers, and new media

-Non-traditional assets

-Creator/Etsy retail

-Online services

-Angel round funding of countless tech start ups

And so much more.

There is a Tsunami of available capital washing over the land. It is not just the$ 4 trillion in the various CARES Acts’ monies, but an endless sea of seed dollars and angel funds and venture capital and private equity and investor dollars ready to be put to work. If you have a smart idea and a half-decent team, lack of capital should not be your impediment.

And while that much cash will always lead to pockets of froth, that should not paint your view of the entire market. If someone wants to pay $12 million dollars for an NFT of a rock, and someone else wants to pay the same for a 60-year old Ferrari, those are one-offs, not necessarily reflective of broader deeper more liquid markets.

The genius of the gig economy is not a million serfs driving cars for someone else, but that apps like Uber and Task Rabbit opened so many people’s eyes to starting their own business versus working a menial job for low pay and zero satisfaction. Why hate a low-paying job when you can take a risk with launching your own firm? If it doesn’t work out, you end up in similar places financially, only one gives you valuable experience and much more satisfaction and control.

Sometimes the world is a confusing mixture of crosscurrents, unseen causations, coincidences, and randomness. These are the times when nothing seems to make much sense, you cannot figure out what is going on, and are forced to grope about blindly.

2021 was not one of those times.

Select the correct data set to review and you can discern the world quite clearly: You see other people’s biases and motivations, you understand the causal relationships occurring, and even though it may lead you to an outlier conclusion, you can have sufficient confidence in your own methodology to comfortably embrace being outside of the mainstream.

To get this right, all you need to do was look at the data without outmoded, ideological, and yes, racist views of the bottom quartile of the labor market.

Source:

States That Cut Unemployment Benefits Saw Limited Impact on Job Growth

by Sarah Chaney Cambon and Danny Dougherty

WSJ, Sept. 1, 2021

https://on.wsj.com/2YfHXhc

Previously:

Wages in America

Elvis (Your Waiter) Has Left the Building (July 9, 2021)

Table Stakes (June 10, 2021)

What Makes Teen Employment Data So Interesting… (June 9, 2021)

Finding it Hard to Hire? Try Raising Your Wages (May 6, 2021)